Answered step by step

Verified Expert Solution

Question

1 Approved Answer

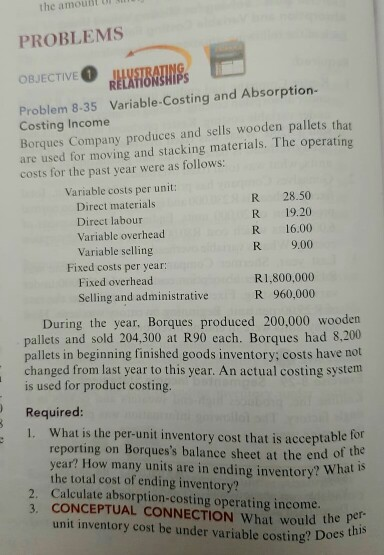

Additional information is that fixed manufacturing is based on producing 250000 units overheads the amount U PROBLEMS OBJECTIVEO JUMATATAND Problem 8-35 Variable-Costing and Absorption- Costing

Additional information is that fixed manufacturing is based on producing 250000 units overheads

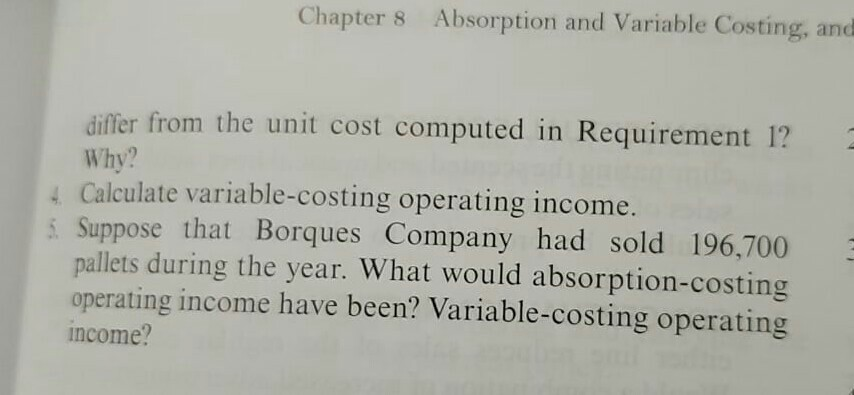

the amount U PROBLEMS OBJECTIVEO JUMATATAND Problem 8-35 Variable-Costing and Absorption- Costing Income Borques Company produces and sells wooden pallets that are used for moving and stacking materials. The operating costs for the past year were as follows: Variable costs per unit: Direct materials R 28.50 Direct labour R 19.20 Variable overhead R 16.00 Variable selling R9.00 Fixed costs per year: Fixed overhead R1,800,000 Selling and administrative R 960,000 During the year. Borques produced 200,000 wooden pallets and sold 204,300 at R90 each. Borques had 8,200 pallets in beginning finished goods inventory, costs have not changed from last year to this year. An actual costing system is used for product costing. Required: 1. What is the per-unit inventory cost that is acceptable for reporting on Borques's balance sheet at the end of the year? How many units are in ending inventory? What the total cost of ending inventory? 2. Calculate absorption-costing operating income, 3. CONCEPTUAL CONNECTION What would the py unit inventory cost be under variable costing? Does osting? Does this Chapter 8 Absorption and Variable Costing, and differ from the unit cost computed in Requirement 1? Why? Calculate variable-costing operating income. 6. Suppose that Borques Company had sold 196,700 pallets during the year. What would absorption-costing operating income have been? Variable-costing operating incomeStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started