Question

Additional information Physical stock-take on 28 February 2020 revealed the following Inventories on hand; Trading inventory R228 250, and Consumable inventory: packing material R3 600

Additional information Physical stock-take on 28 February 2020 revealed the following Inventories on hand; Trading inventory R228 250, and Consumable inventory: packing material R3 600 A new tenant rented a portion of the premises from 1 March 2019. According to the rental agreement the rent for the period 1 March 2019 to 31 March 2020 was R1 500 per month. Rent is usually received in advance ie. rent is received in the month before it is due. For example; the April 2019 rent was received during March 2019. Commission income of R10 800, earned in February 2020, has not yet been received nor recorded. Electricity and water of R1 600 for February 2020 has not been paid and is not yet included in the above records. The long term loan from Peoples Bank was obtained on 1 September 2016 at an interest rate of 11,5% per year. The loan was payable in four (4) equal annual instalments. The first instalment was paid on 31 August 2019. The second instalment is payable on 31 August 2020. Interest is paid during March each year. A debtor who owes Joes General Dealers R12 680 cannot be traced. His account must be written-off as irrecoverable. The insurance account balance of R25 725 covers the period 1 March 2019 to 30 April 2020. The monthly insurance premium remained unchanged during this period. Provide for depreciation for the year as follows: Vehicles at 10% per year on straight line method, and Equipment at 14% on the diminishing balance method. There were no purchases or sales of the above items during the current financial year.

Required: Use the above information to prepare the statement of profit and loss and other comprehensive income for Joes General Dealers for the year ended 28 February 2020. Your answer must comply with International Financial Reporting Standards that are appropriate to this type of business. Round off all amounts to the nearest rand. All calculations must be shown.

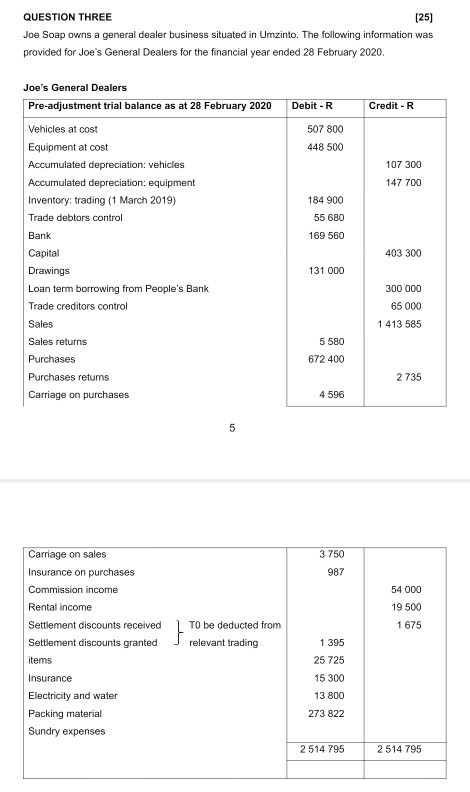

QUESTION THREE [25] Joe Soap owns a general dealer business situated in Umzinto. The following information was provided for Joe's General Dealers for the financial year ended 28 February 2020. Debit - R Credit - R 507 800 448 500 107 300 147 700 184 900 55 680 169 560 Joe's General Dealers Pre-adjustment trial balance as at 28 February 2020 Vehicles at cost Equipment at cost Accumulated depreciation: vehicles Accumulated depreciation equipment Inventory: trading (1 March 2019) Trade debtors control Bank Capital Drawings Loan term borrowing from People's Bank Trade creditors control Sales Sales returns Purchases Purchases returns Carriage on purchases 403 300 131 000 300 000 65 000 1 413 585 5 580 672 400 2 735 4 596 5 3 750 987 54 000 19 500 1 675 Carriage on sales Insurance on purchases Commission income Rental income Settlement discounts received Settlement discounts granted items Insurance Electricity and water Packing material Sundry expenses } TO be deducted from relevant trading 1 395 25 725 15 300 13 800 273 822 2 514 795 2 514 795Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started