Question

ADDITIONAL INFORMATION: The fair value/book value differential from Pop's two purchases of Son was goodwill. Pop Corporation sold inventory items to Son during 2016

ADDITIONAL INFORMATION:

The fair value/book value differential from Pop's two purchases of Son was goodwill. Pop Corporation sold inventory items to Son during 2016 for $60,000, at a gross profit of $10,000. During 2017, Pop's sales to Son were $48,000, at a gross profit of $8,000. Half of the 2016 intercompany sales were inventoried by Son at year-end 2016, and three-fourths of the 2017 sales remained unsold by Son at year-end 2017. Son owes Pop $25,000 from 2017 purchases. At year-end 2016, Son purchased land from Pop for $20,000. The cost of this land to Pop was $12,000. Pop sold machinery with a book value of $40,000 to Son for $80,000 on July 8, 2017.

The machinery had a five-year useful life at that time. Son uses straight-line depreciation without considering salvage value on the machinery. Pop uses a one-line consolidation in accounting for Son. Both Pop and Son Corporations declared dividends for 2017 in equal amounts in June and December.

Required Prepare a workpaper to consolidate the financial statements of Pop Corporation and Subsidiary for the year ended December 31, 2017.

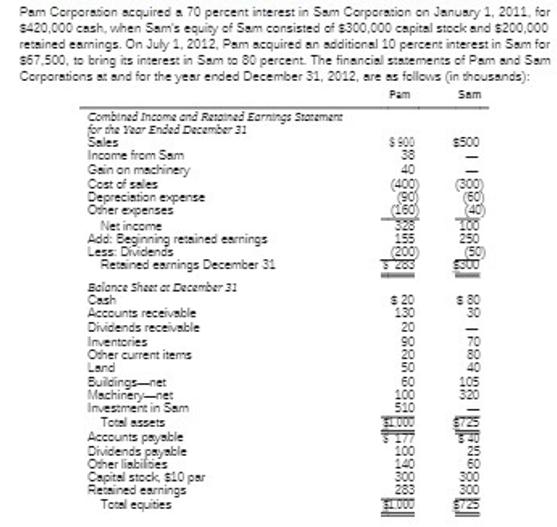

Pam Corporation acquired a 70 percent interest in Sam Corporation on January 1, 2011, for $420,000 cash, when Sam's equity of Sam consisted of $300,000 capital stock and $200,000 retained earnings. On July 1, 2012, Pam acquired an additional 10 percent interest in Sam for $67,500, to bring its interest in Sam to 80 percent. The financial statements of Pam and Sam Corporations at and for the year ended December 31, 2012, are as follows (in thousands): Pam Combined Income and Retained Earnings Statement for the Year Ended December 31 Sales Income from Sam Gain on machinery Cost of sales Depreciation expense Other expenses Net income Add: Beginning retained earnings Less: Dividends Retained earnings December 31 Balance Sheet at December 31 Cash Accounts receivable Dividends receivable Inventories Other current items Land Buildings-net Machinery-net Investment in Sam Total assets Accounts payable Dividends payable Other liabilites Capital stock, $10 par Retained earnings Total equities $900 38 (400) (90) (160) 328 $ 20 130 20 90 20 50 60 100 510 31000 S177 100 140 300 283 Sam 811880888 88123958 *888 $500 (50) 300

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears you have provided detailed transactional information between Pop Corporation and Son a subsidiary in which Pop has a controlling interest To prepare a consolidation workpaper for the financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started