Answered step by step

Verified Expert Solution

Question

1 Approved Answer

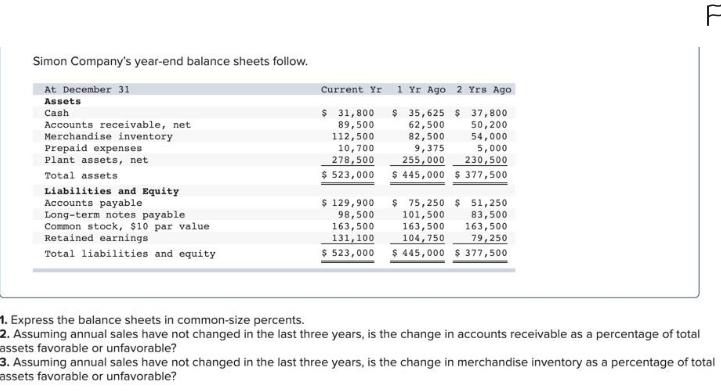

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities

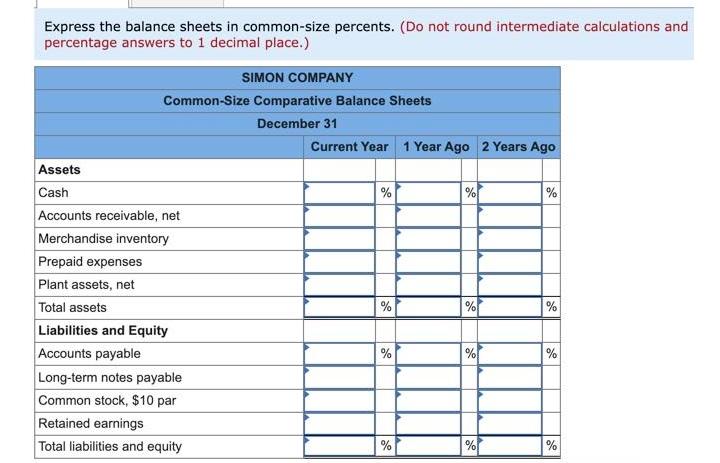

Simon Company's year-end balance sheets follow. At December 31 Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Liabilities and Equity Accounts payable Long-term notes payable Common stock, $10 par value Retained earnings Total liabilities and equity Current Yr $ 31,800 89,500 112,500 10,700 278,500 $ 523,000 $ 129,900 98,500 1 Yr Ago 2 Yrs Ago $ 35,625 $ 37,800 62,500 50,200 82,500 54,000 9,375 255,000 $ 445,000 $377,500 5,000 230,500 $ 75,250 $ 51,250 101,500 83,500 163,500 131,100 163,500 104,750 163,500 79,250 $ 523,000 $ 445,000 $ 377,500 1. Express the balance sheets in common-size percents. 2. Assuming annual sales have not changed in the last three years, is the change in accounts receivable as a percentage of total assets favorable or unfavorable? F 3. Assuming annual sales have not changed in the last three years, is the change in merchandise inventory as a percentage of total assets favorable or unfavorable? Express the balance sheets in common-size percents. (Do not round intermediate calculations and percentage answers to 1 decimal place.) Assets Cash Accounts receivable, net Merchandise inventory Prepaid expenses Plant assets, net Total assets Common-Size Comparative Balance Sheets December 31 Liabilities and Equity Accounts payable SIMON COMPANY Long-term notes payable Common stock, $10 par Retained earnings Total liabilities and equity Current Year 1 Year Ago 2 Years Ago % % % % % % % % % %

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

The detailed ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started