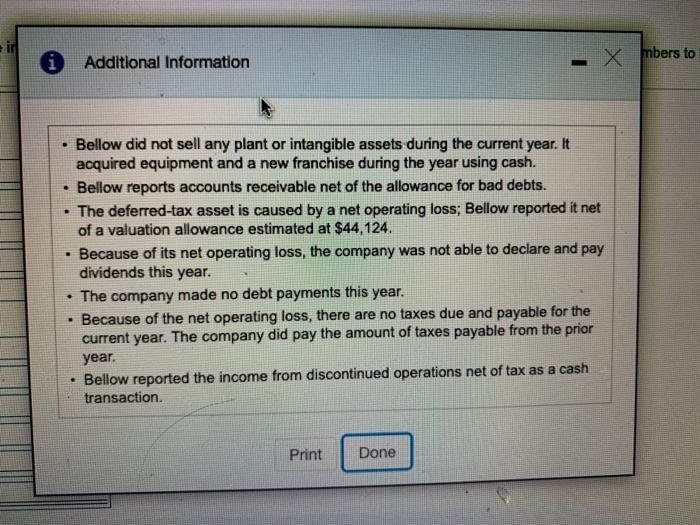

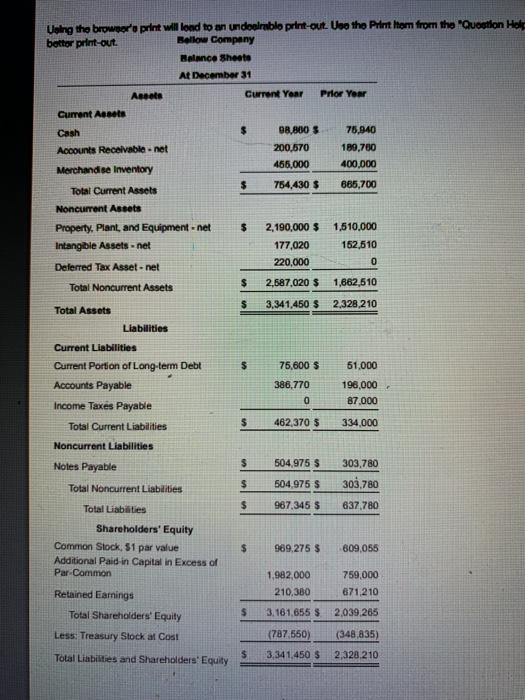

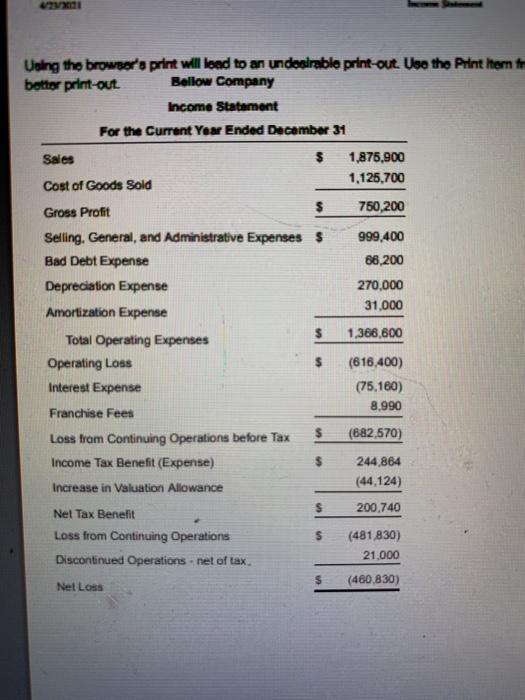

Additional Information - X mbers to . . . Bellow did not sell any plant or intangible assets during the current year. It acquired equipment and a new franchise during the year using cash. Bellow reports accounts receivable net of the allowance for bad debts. The deferred-tax asset is caused by a net operating loss; Bellow reported it net of a valuation allowance estimated at $44,124. Because of its net operating loss, the company was not able to declare and pay dividends this year. The company made no debt payments this year. Because of the net operating loss, there are no taxes due and payable for the current year. The company did pay the amount of taxes payable from the prior year. Bellow reported the income from discontinued operations net of tax as a cash transaction. . Print Done Using the broworo print will lead to an underblo print out. Use the Print Hor from the Question Holy bottor print out Bellow Company Balance Sheeto Af December 31 Assets Current Year Prior Year Current Assets Cash $ 08.8005 75,940 Accounts Receivable.net 200,570 189,700 465,000 Merchandise Inventory 400,000 $ 754.430 $ 685,700 Total Current Assets Noncurrent Assets Property, Plant, and Equipment.net $ 2,190,000 $ 1,510,000 Intangible Assets-net 177,020 162,510 220,000 0 Deferred Tax Asset-net Total Noncurrent Assets $ 2,687.020 $ 1,662,510 $ Total Assets 3,341,450 $ 2,328,210 Liabilities Current Liabilities Current Portion of Long-term Debt 3 75,600 S 61,000 Accounts Payable 386,770 196,000 0 Income Taxes Payable 87.000 Total Current Liabilities $ 462,370 5 334,000 Noncurrent Liabilities $ 504,975 $ 303,780 Notes Payable Total Noncurrent Liabilities $ 504,975 S 303,780 $ 987,345 5 637,780 Total Liabilities Shareholders' Equity Common Stock, 51 par value Additional Paid in Capital in Excess of Par Common $ 969,275 $ 609,055 Retained Earnings Total Shareholders' Equity 1,982,000 759,000 210,380 671.210 3.181,655 $ 2,039,265 $ Less Treasury Stock at Cost (348,835) (787550) 3,341,450 $ Total Liabilities and Shareholders' Equity $ 2,328 210 Using the browser's print will lead to an undesirable print-out. Use the Print Stern for botter print out Bellow Company Income Statement For the Current Year Ended December 31 Sales $ 1,875,900 1,125,700 Cost of Goods Sold $ Gross Profit 750,200 Selling. General, and Administrative Expenses $ Bad Debt Expense Depreciation Expense Amortization Expense 999,400 68,200 270,000 31.000 1,386,600 (616,400) (75,160) 8,990 Total Operating Expenses Operating Loss Interest Expense Franchise Fees Loss from Continuing Operations before Tax Income Tax Benefit (Expense) Increase in Valuation Allowance (682.570) 244 864 (44,124) $ 200.740 Nel Tax Benefit s Loss from Continuing Operations Discontinued Operations - net of tax (481 830) 21.000 (460,830) Net Loss Additional Information - X mbers to . . . Bellow did not sell any plant or intangible assets during the current year. It acquired equipment and a new franchise during the year using cash. Bellow reports accounts receivable net of the allowance for bad debts. The deferred-tax asset is caused by a net operating loss; Bellow reported it net of a valuation allowance estimated at $44,124. Because of its net operating loss, the company was not able to declare and pay dividends this year. The company made no debt payments this year. Because of the net operating loss, there are no taxes due and payable for the current year. The company did pay the amount of taxes payable from the prior year. Bellow reported the income from discontinued operations net of tax as a cash transaction. . Print Done Using the broworo print will lead to an underblo print out. Use the Print Hor from the Question Holy bottor print out Bellow Company Balance Sheeto Af December 31 Assets Current Year Prior Year Current Assets Cash $ 08.8005 75,940 Accounts Receivable.net 200,570 189,700 465,000 Merchandise Inventory 400,000 $ 754.430 $ 685,700 Total Current Assets Noncurrent Assets Property, Plant, and Equipment.net $ 2,190,000 $ 1,510,000 Intangible Assets-net 177,020 162,510 220,000 0 Deferred Tax Asset-net Total Noncurrent Assets $ 2,687.020 $ 1,662,510 $ Total Assets 3,341,450 $ 2,328,210 Liabilities Current Liabilities Current Portion of Long-term Debt 3 75,600 S 61,000 Accounts Payable 386,770 196,000 0 Income Taxes Payable 87.000 Total Current Liabilities $ 462,370 5 334,000 Noncurrent Liabilities $ 504,975 $ 303,780 Notes Payable Total Noncurrent Liabilities $ 504,975 S 303,780 $ 987,345 5 637,780 Total Liabilities Shareholders' Equity Common Stock, 51 par value Additional Paid in Capital in Excess of Par Common $ 969,275 $ 609,055 Retained Earnings Total Shareholders' Equity 1,982,000 759,000 210,380 671.210 3.181,655 $ 2,039,265 $ Less Treasury Stock at Cost (348,835) (787550) 3,341,450 $ Total Liabilities and Shareholders' Equity $ 2,328 210 Using the browser's print will lead to an undesirable print-out. Use the Print Stern for botter print out Bellow Company Income Statement For the Current Year Ended December 31 Sales $ 1,875,900 1,125,700 Cost of Goods Sold $ Gross Profit 750,200 Selling. General, and Administrative Expenses $ Bad Debt Expense Depreciation Expense Amortization Expense 999,400 68,200 270,000 31.000 1,386,600 (616,400) (75,160) 8,990 Total Operating Expenses Operating Loss Interest Expense Franchise Fees Loss from Continuing Operations before Tax Income Tax Benefit (Expense) Increase in Valuation Allowance (682.570) 244 864 (44,124) $ 200.740 Nel Tax Benefit s Loss from Continuing Operations Discontinued Operations - net of tax (481 830) 21.000 (460,830) Net Loss