Answered step by step

Verified Expert Solution

Question

1 Approved Answer

a.Define what is meant by a pure discount bond. (2 marks) b. An Investment Advisor is valuing Pick and Pay by discounting the cash flows

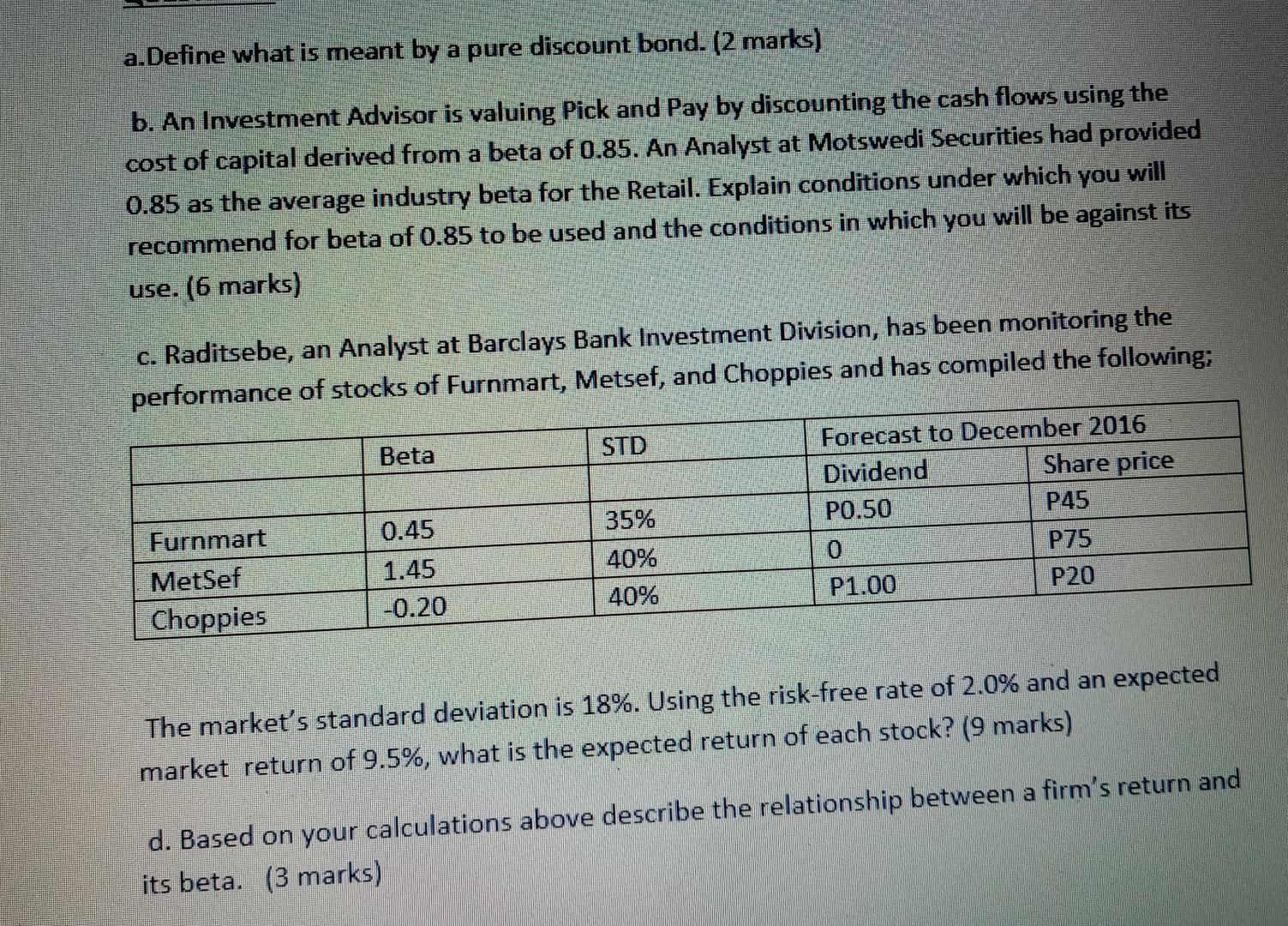

a.Define what is meant by a pure discount bond. (2 marks) b. An Investment Advisor is valuing Pick and Pay by discounting the cash flows using the cost of capital derived from a beta of 0.85. An Analyst at Motswedi Securities had provided 0.85 as the average industry beta for the Retail. Explain conditions under which you will recommend for beta of 0.85 to be used and the conditions in which you will be against its use. (6 marks) c. Raditsebe, an Analyst at Barclays Bank Investment Division, has been monitoring the performance of stocks of Furnmart, Metsef, and Choppies and has compiled the following; STD Beta Furnmart MetSef Choppies Forecast to December 2016 Dividend Share price P0.50 P45 0 P75 P1.00 P20 35% 40% 40% 0.45 1.45 -0.20 The market's standard deviation is 18%. Using the risk-free rate of 2.0% and an expected market return of 9.5%, what is the expected return of each stock? (9 marks) d. Based on your calculations above describe the relationship between a firm's return and its beta. (3 marks) a.Define what is meant by a pure discount bond. (2 marks) b. An Investment Advisor is valuing Pick and Pay by discounting the cash flows using the cost of capital derived from a beta of 0.85. An Analyst at Motswedi Securities had provided 0.85 as the average industry beta for the Retail. Explain conditions under which you will recommend for beta of 0.85 to be used and the conditions in which you will be against its use. (6 marks) c. Raditsebe, an Analyst at Barclays Bank Investment Division, has been monitoring the performance of stocks of Furnmart, Metsef, and Choppies and has compiled the following; STD Beta Furnmart MetSef Choppies Forecast to December 2016 Dividend Share price P0.50 P45 0 P75 P1.00 P20 35% 40% 40% 0.45 1.45 -0.20 The market's standard deviation is 18%. Using the risk-free rate of 2.0% and an expected market return of 9.5%, what is the expected return of each stock? (9 marks) d. Based on your calculations above describe the relationship between a firm's return and its beta

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started