Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A)Determine the expected value of the net present value for the standard-size restaurants. Use the data in Figure 2. Remember to state your final answer

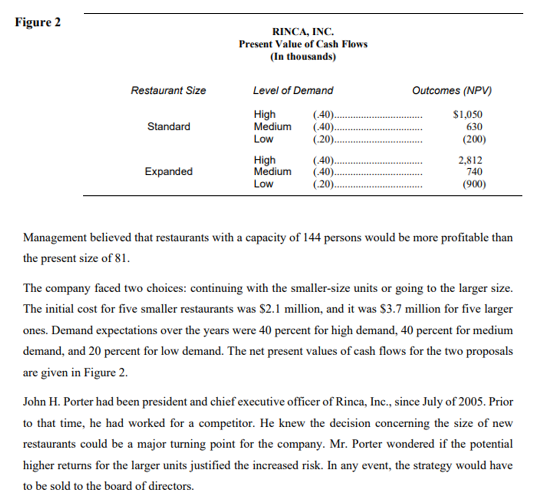

A)Determine the expected value of the net present value for the standard-size restaurants. Use the data in Figure 2. Remember to state your final answer in thousands.

B)Follow the same procedure for the expanded-size restaurants to arrive at the expected value of the net present value.

Figure 2 Restaurant Size Standard Expanded RINCA, INC. Present Value of Cash Flows (In thousands) Level of Demand High Medium Low High Medium Low (40).. (-40). (20). (40).. (40).. (-20). Outcomes (NPV) $1,050 630 (200) 2,812 740 (900) Management believed that restaurants with a capacity of 144 persons would be more profitable than the present size of 81. The company faced two choices: continuing with the smaller-size units or going to the larger size. The initial cost for five smaller restaurants was $2.1 million, and it was $3.7 million for five larger ones. Demand expectations over the years were 40 percent for high demand, 40 percent for medium demand, and 20 percent for low demand. The net present values of cash flows for the two proposals are given in Figure 2. John H. Porter had been president and chief executive officer of Rinca, Inc., since July of 2005. Prior to that time, he had worked for a competitor. He knew the decision concerning the size of new restaurants could be a major turning point for the company. Mr. Porter wondered if the potential higher returns for the larger units justified the increased risk. In any event, the strategy would have to be sold to the board of directorsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started