Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Adidis Limited bought a squash centre, consisting of six courts, in a southern suburb of Polokwane at a price of R900 000. The deal

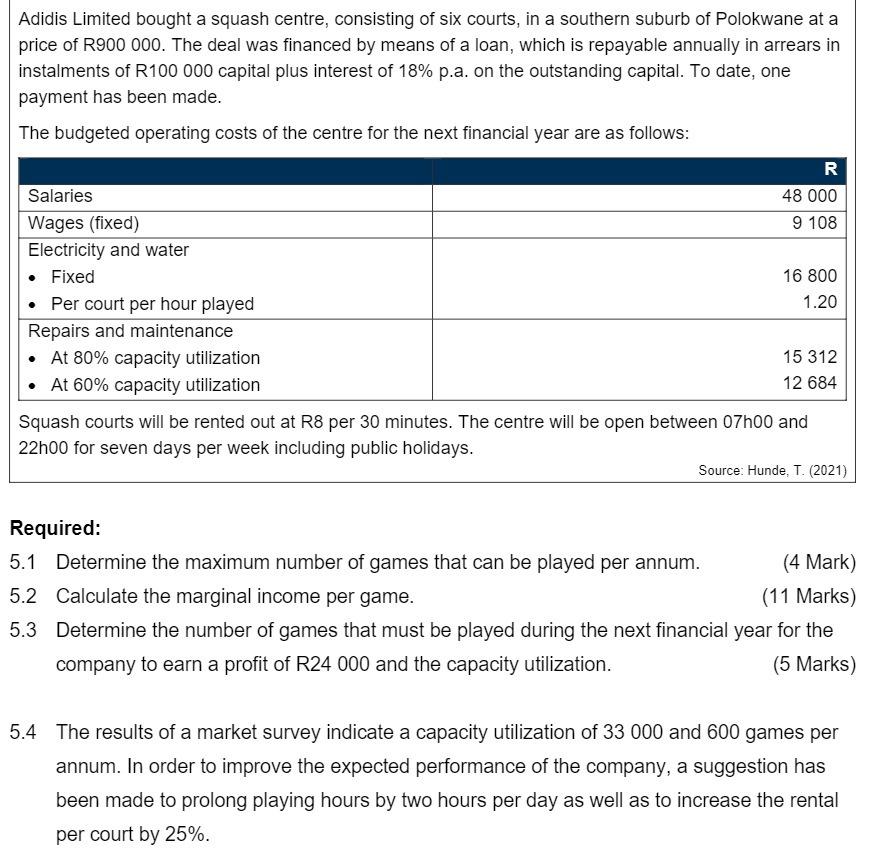

Adidis Limited bought a squash centre, consisting of six courts, in a southern suburb of Polokwane at a price of R900 000. The deal was financed by means of a loan, which is repayable annually in arrears in instalments of R100 000 capital plus interest of 18% p.a. on the outstanding capital. To date, one payment has been made. The budgeted operating costs of the centre for the next financial year are as follows: Salaries Wages (fixed) Electricity and water Fixed Per court per hour played Repairs and maintenance At 80% capacity utilization At 60% capacity utilization R 48 000 9 108 16 800 1.20 15 312 12 684 Squash courts will be rented out at R8 per 30 minutes. The centre will be open between 07h00 and 22h00 for seven days per week including public holidays. Source: Hunde, T. (2021) Required: (4 Mark) 5.1 Determine the maximum number of games that can be played per annum. 5.2 Calculate the marginal income per game. (11 Marks) 5.3 Determine the number of games that must be played during the next financial year for the company to earn a profit of R24 000 and the capacity utilization. (5 Marks) 5.4 The results of a market survey indicate a capacity utilization of 33 000 and 600 games per annum. In order to improve the expected performance of the company, a suggestion has been made to prolong playing hours by two hours per day as well as to increase the rental per court by 25%.

Step by Step Solution

★★★★★

3.49 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

51 Maximum number of games per annum Centre is open 7 days a week from 0700 to 2200 15 hours of open...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started