Answered step by step

Verified Expert Solution

Question

1 Approved Answer

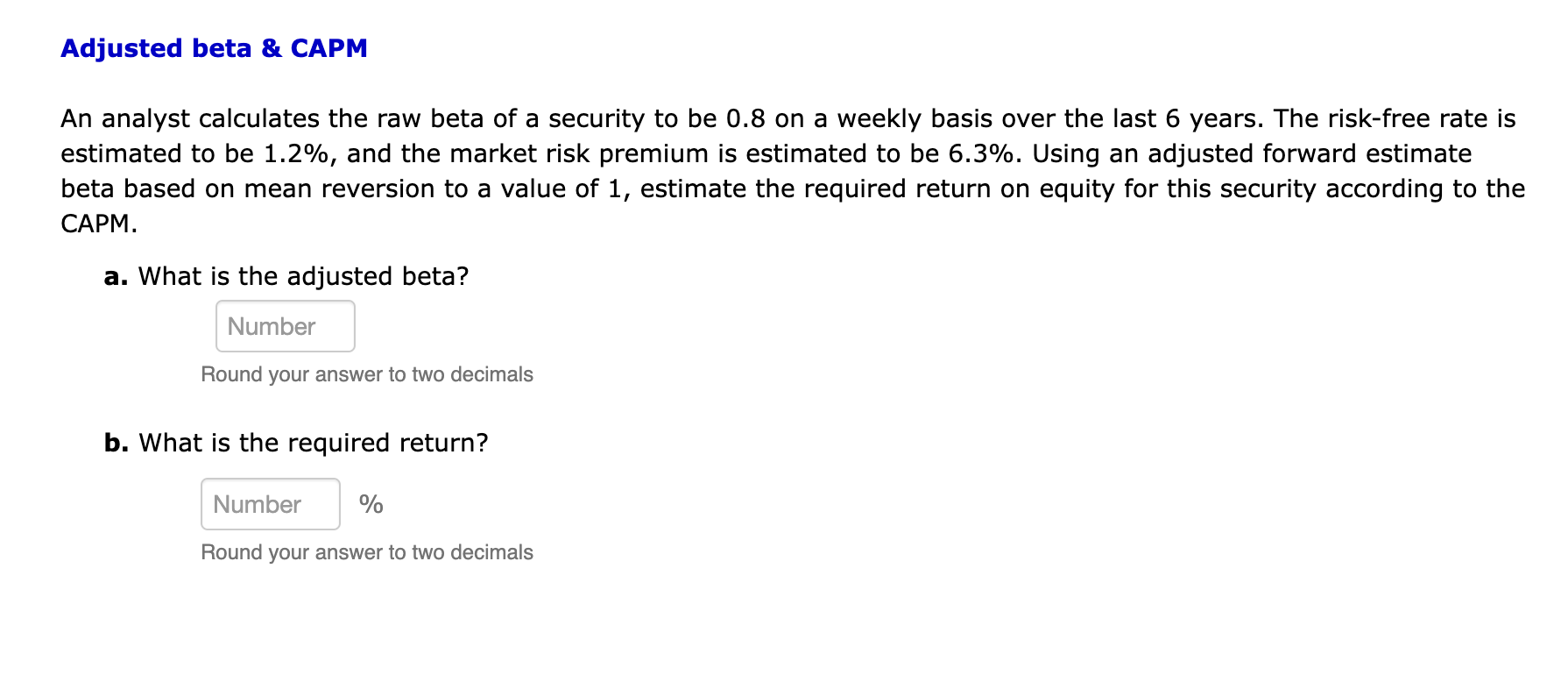

Adjusted beta & CAPM An analyst calculates the raw beta of a security to be 0.8 on a weekly basis over the last 6

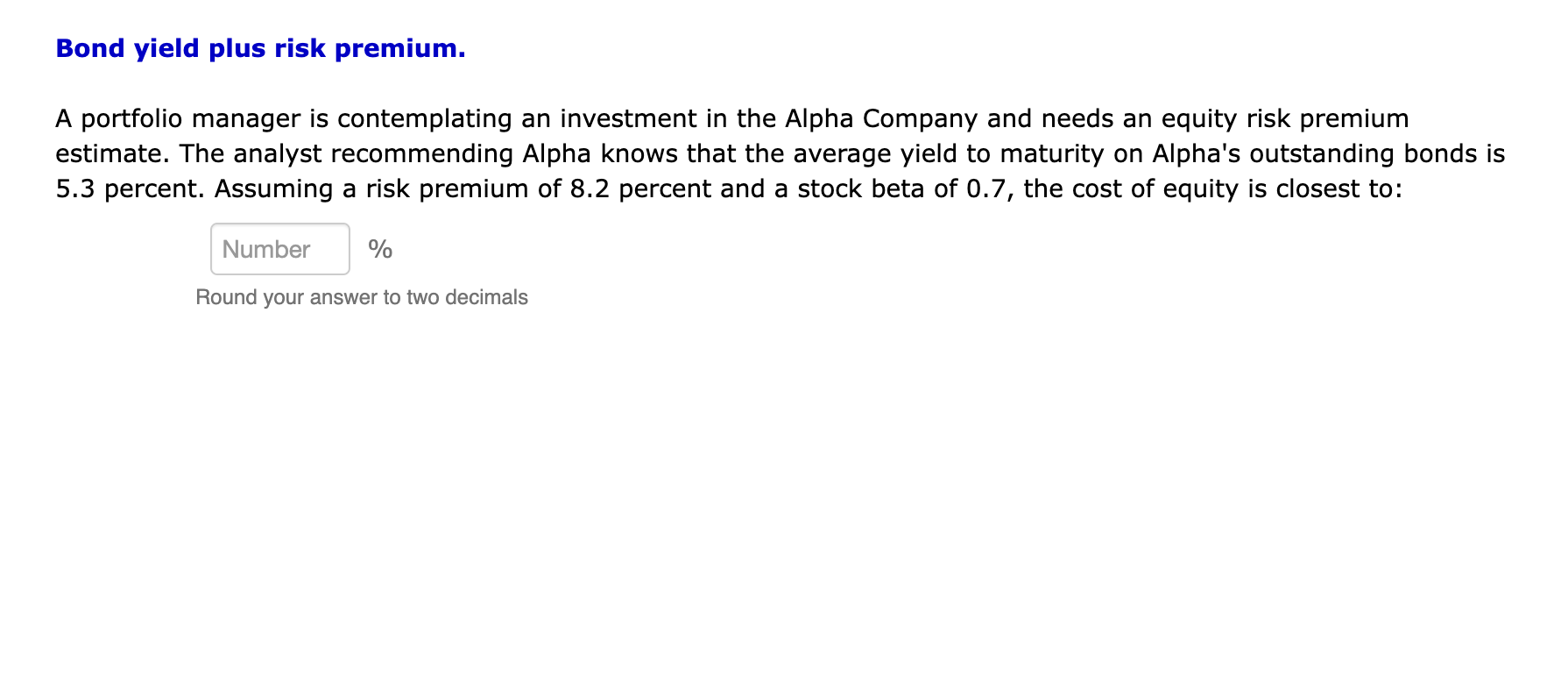

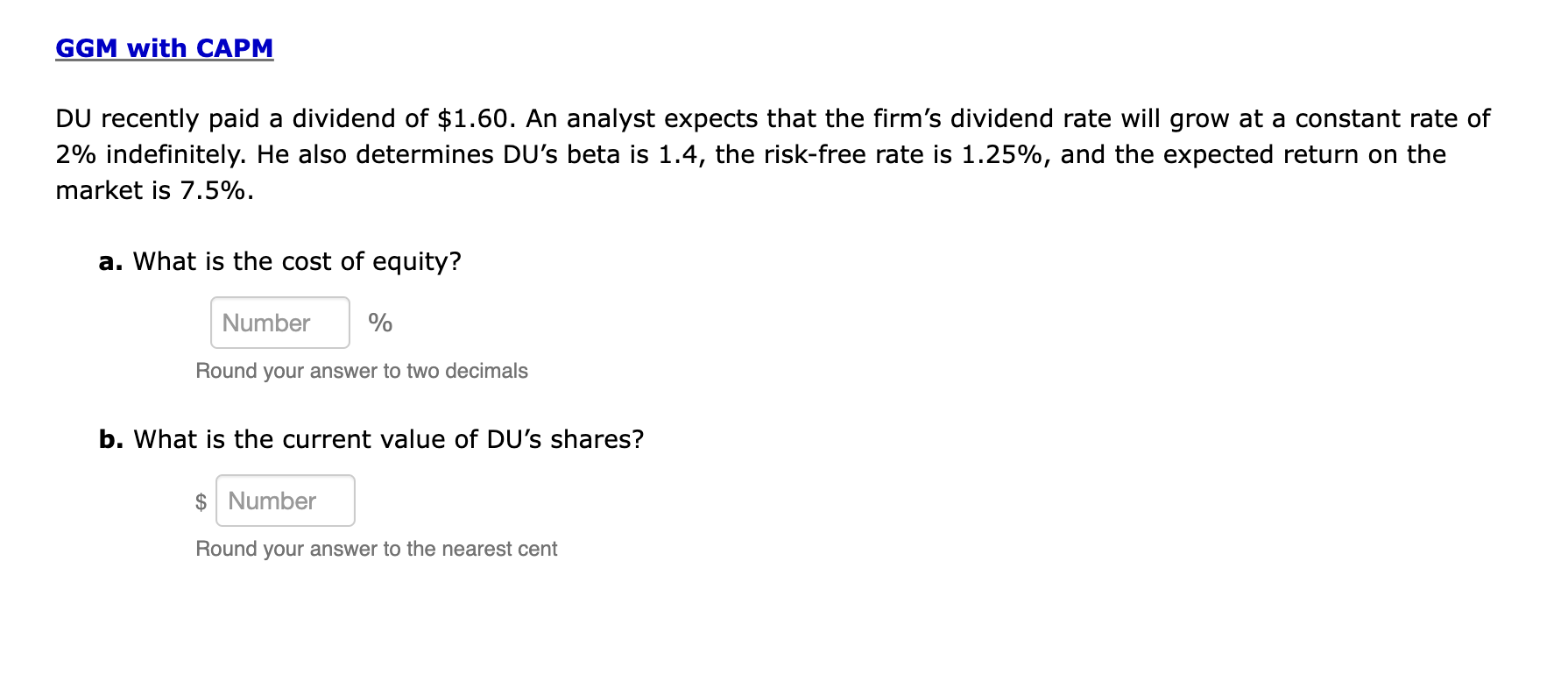

Adjusted beta & CAPM An analyst calculates the raw beta of a security to be 0.8 on a weekly basis over the last 6 years. The risk-free rate is estimated to be 1.2%, and the market risk premium is estimated to be 6.3%. Using an adjusted forward estimate beta based on mean reversion to a value of 1, estimate the required return on equity for this security according to the CAPM. a. What is the adjusted beta? Number Round your answer to two decimals b. What is the required return? Number % Round your answer to two decimals Bond yield plus risk premium. A portfolio manager is contemplating an investment in the Alpha Company and needs an equity risk premium estimate. The analyst recommending Alpha knows that the average yield to maturity on Alpha's outstanding bonds is 5.3 percent. Assuming a risk premium of 8.2 percent and a stock beta of 0.7, the cost of equity is closest to: Number % Round your answer to two decimals GGM with CAPM DU recently paid a dividend of $1.60. An analyst expects that the firm's dividend rate will grow at a constant rate of 2% indefinitely. He also determines DU's beta is 1.4, the risk-free rate is 1.25%, and the expected return on the market is 7.5%. a. What is the cost of equity? Number % Round your answer to two decimals b. What is the current value of DU's shares? $ Number Round your answer to the nearest cent

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started