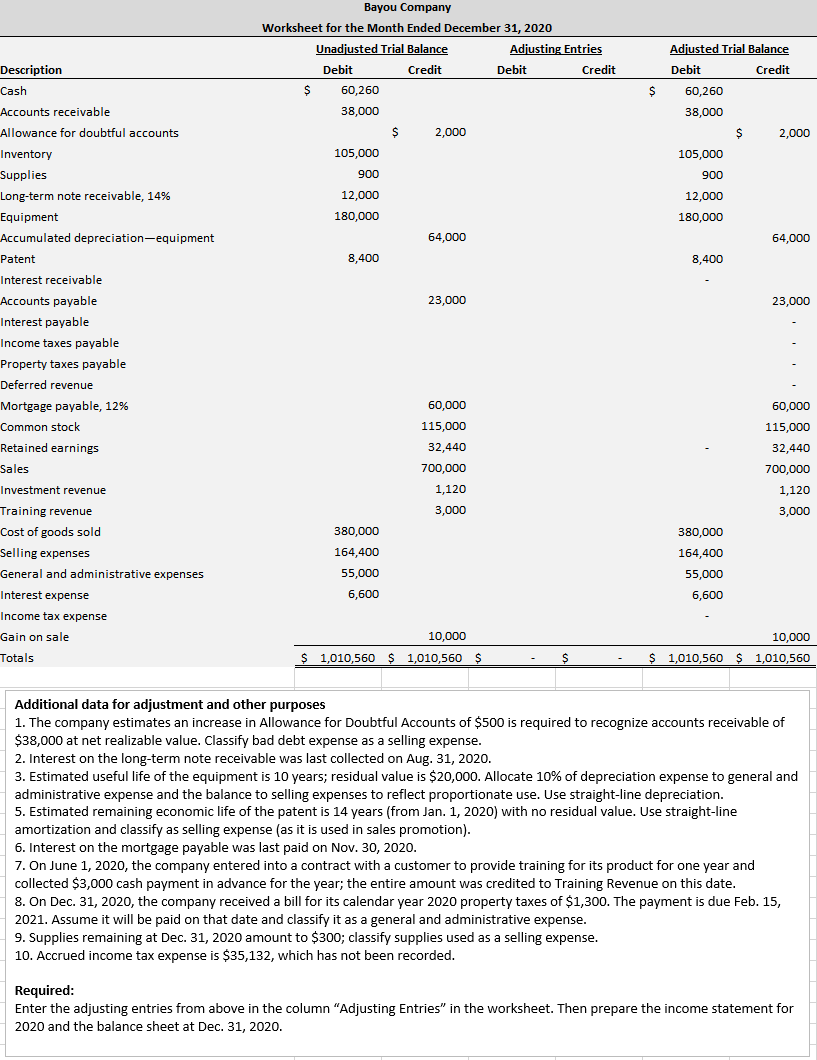

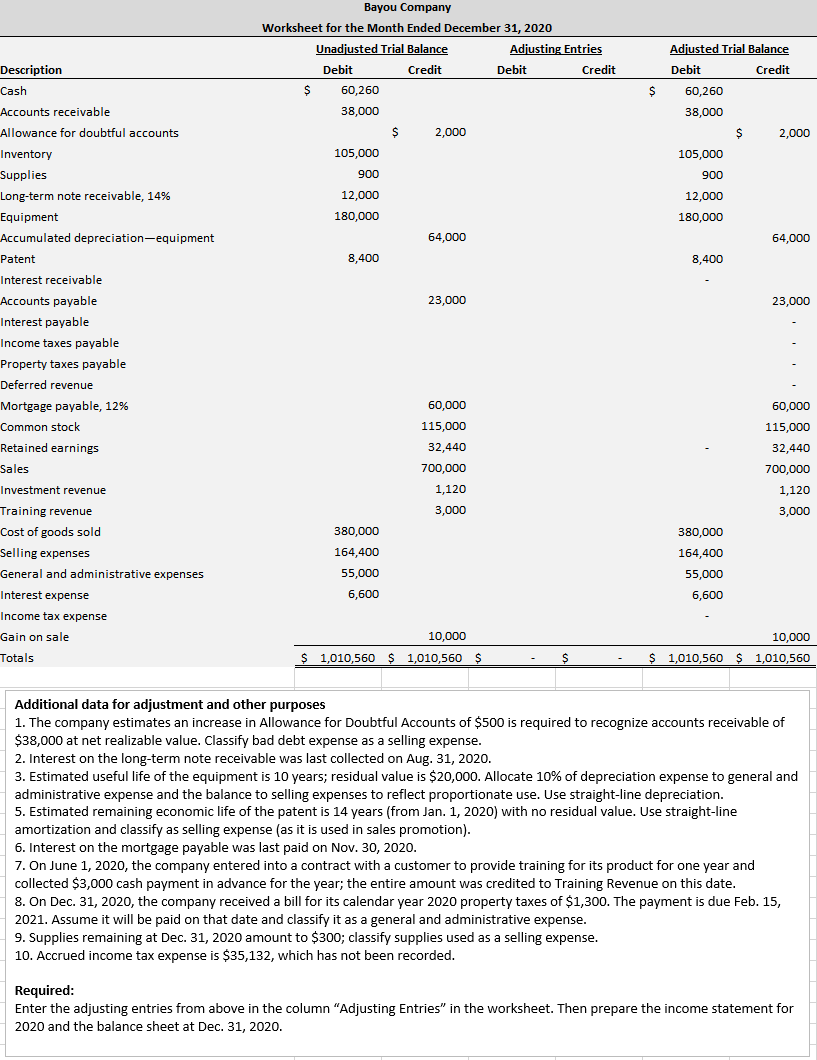

Adjusted Trial Balance Debit Credit Bayou Company Worksheet for the Month Ended December 31, 2020 Unadjusted Trial Balance Adjusting Entries Debit Credit Debit Credit $ 60,260 38,000 $ 2,000 105,000 $ 60,260 38,000 $ 2,000 900 105,000 900 12,000 12,000 180,000 180,000 64,000 64,000 8,400 8,400 23,000 23,000 Description Cash Accounts receivable Allowance for doubtful accounts Inventory Supplies Long-term note receivable, 14% Equipment Accumulated depreciation equipment Patent Interest receivable Accounts payable Interest payable Income taxes payable Property taxes payable Deferred revenue Mortgage payable, 12% Common stock Retained earnings Sales Investment revenue Training revenue Cost of goods sold Selling expenses General and administrative expenses Interest expense Income tax expense Gain on sale Totals 60,000 60,000 115,000 32,440 700,000 1,120 115,000 32,440 700,000 1,120 3,000 3,000 380,000 164,400 380,000 164,400 55,000 6,600 55,000 6,600 10,000 $ 1,010,560 $ 1,010,560 $ 10,000 $ 1,010,560 $ 1,010,560 $ Additional data for adjustment and other purposes 1. The company estimates an increase in Allowance for Doubtful Accounts of $500 is required to recognize accounts receivable of $38,000 at net realizable value. Classify bad debt expense as a selling expense. 2. Interest on the long-term note receivable was last collected on Aug. 31, 2020. 3. Estimated useful life of the equipment is 10 years; residual value is $20,000. Allocate 10% of depreciation expense to general and administrative expense and the balance to selling expenses to reflect proportionate use. Use straight-line depreciation. 5. Estimated remaining economic life of the patent is 14 years (from Jan. 1, 2020) with no residual value. Use straight-line amortization and classify as selling expense (as it is used in sales promotion). 6. Interest on the mortgage payable was last paid on Nov. 30, 2020. 7. On June 1, 2020, the company entered into a contract with a customer to provide training for its product for one year and collected $3,000 cash payment in advance for the year; the entire amount was credited to Training Revenue on this date. 8. On Dec. 31, 2020, the company received a bill for its calendar year 2020 property taxes of $1,300. The payment is due Feb. 15, 2021. Assume it will be paid on that date and classify it as a general and administrative expense. 9. Supplies remaining at Dec. 31, 2020 amount to $300; classify supplies used as a selling expense. 10. Accrued income tax expense is $35,132, which has not been recorded. Required: Enter the adjusting entries from above in the column "Adjusting Entries" in the worksheet. Then prepare the income statement for 2020 and the balance sheet at Dec. 31, 2020