Answered step by step

Verified Expert Solution

Question

1 Approved Answer

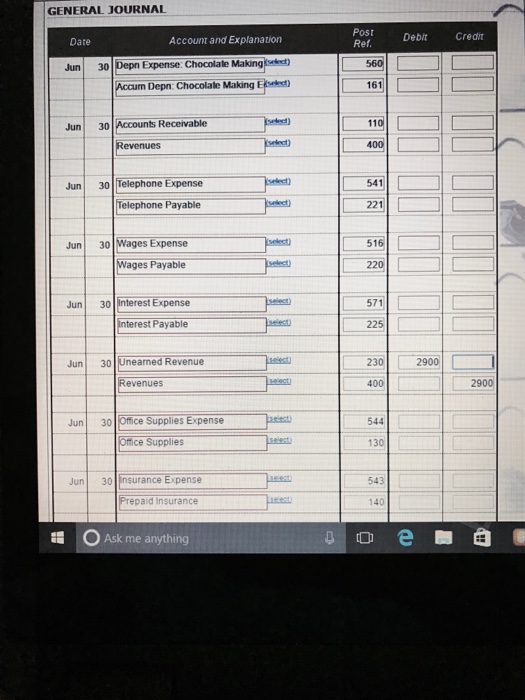

Adjusting entries General journal: Remember that the details of the end of month adjustments for June are as follows: 1) Chocolate making equipment owned by

"Adjusting entries"

General journal:

Remember that the details of the end of month adjustments for June are as follows:

1) Chocolate making equipment owned by the business: original purchase price was $59,000, estimated useful life was 7 year, and estimated residual value was $8,400 at the end of the useful life. Depreciation is calculated on a monthly basis using the straight line method. The monthly depreciation charge is calculated as the yearly depreciation expense divided by the number of months in a year.

2) A number of chocolate making lessons totaling $3,100 were provided during the method of June for Candy Rush but not yet invoiced.

3) The estimated telephone bill payable as the end of June is $90.

4) Instructors work every single day during the week including weekends and are paid on a periodic basis. Wages were last paid up to and including June 14. Wages incurred after that day (from June 15 to June 30 inclusive) are estimated to have been $600 per day.

5) Interest expense incurred during the month of June but not yet paid to EastPac Bank for the bank loan is $990.

6) Provided $2,900 worth of chocolate making lessons during the month of June in relation to the cash received in advance from Mercury Square on June 10.

7) Office supplies totaling $1,254 are still on hand at June 30.

8) $1,200 worth of prepaid insurance expired during the month of June.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started