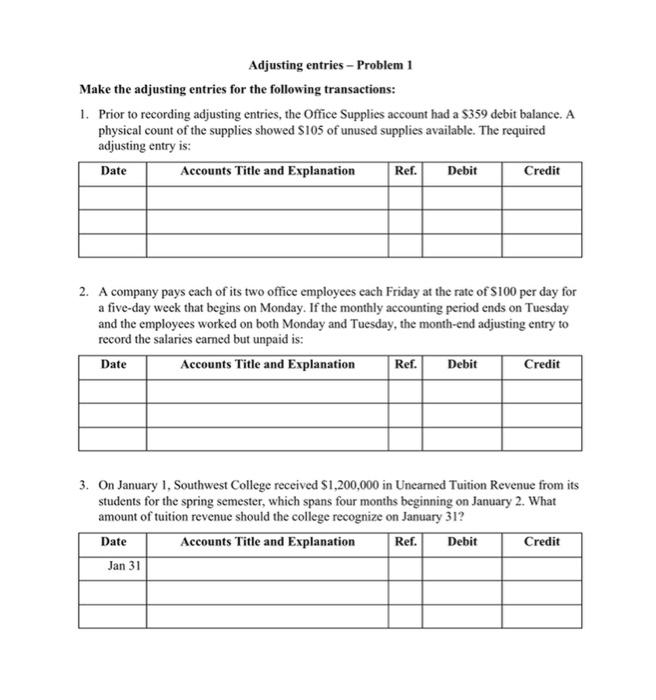

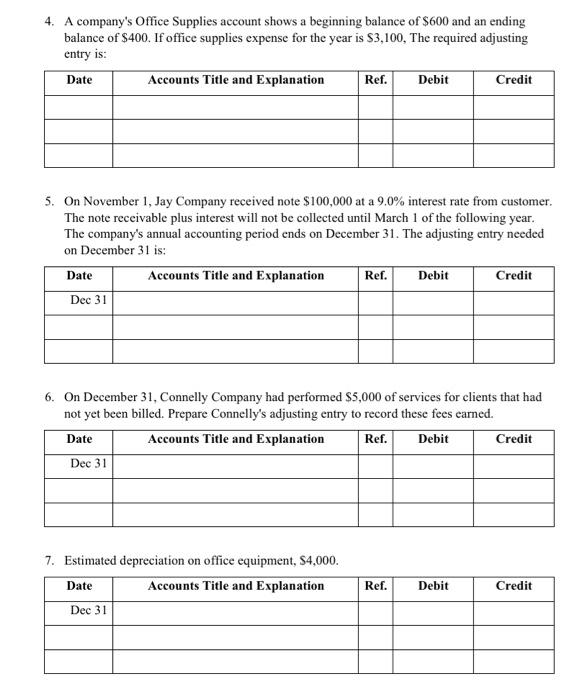

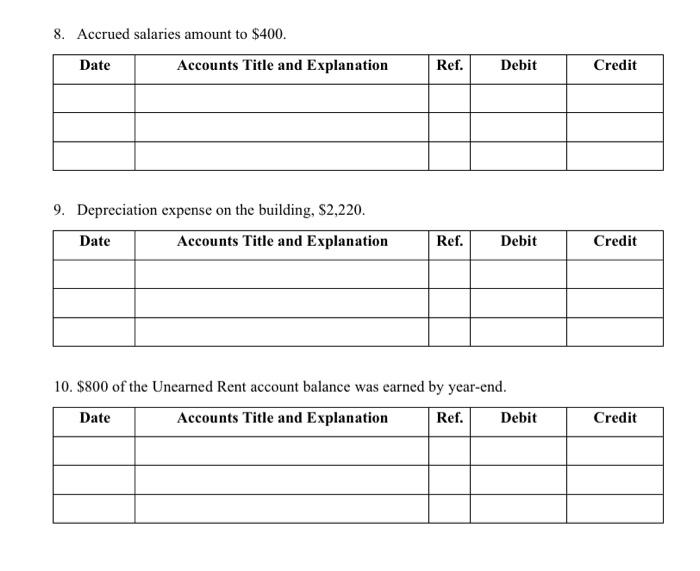

Adjusting entries - Problem 1 Make the adjusting entries for the following transactions: 1. Prior to recording adjusting entries, the Office Supplies account had a $359 debit balance. A physical count of the supplies showed $105 of unused supplies available. The required adjusting entry is: Date Accounts Title and Explanation Ref. Debit Credit 2. A company pays each of its two office employees each Friday at the rate of S100 per day for a five-day week that begins on Monday. If the monthly accounting period ends on Tuesday and the employees worked on both Monday and Tuesday, the month-end adjusting entry to record the salaries eamed but unpaid is: Date Accounts Title and Explanation Ref. Debit Credit 3. On January 1, Southwest College received $1,200,000 in Uncarned Tuition Revenue from its students for the spring semester, which spans four months beginning on January 2. What amount of tuition revenue should the college recognize on January 31? Date Accounts Title and Explanation Ref. Debit Credit Jan 31 4. A company's Office Supplies account shows a beginning balance of $600 and an ending balance of $400. If office supplies expense for the year is $3,100, The required adjusting entry is: Date Accounts Title and Explanation Ref. Debit Credit 5. On November 1, Jay Company received note $100,000 at a 9.0% interest rate from customer. The note receivable plus interest will not be collected until March 1 of the following year. The company's annual accounting period ends on December 31. The adjusting entry needed on December 31 is: Date Accounts Title and Explanation Ref. Debit Credit Dec 31 6. On December 31, Connelly Company had performed $5,000 of services for clients that had not yet been billed. Prepare Connelly's adjusting entry to record these fees earned. Accounts Title and Explanation Debit Date Ref. Credit Dec 31 7. Estimated depreciation on office equipment, S4,000. Date Accounts Title and Explanation Dec 31 Ref. Debit Credit 8. Accrued salaries amount to $400. Date Accounts Title and Explanation Ref. Debit Credit 9. Depreciation expense on the building, $2,220. Date Accounts Title and Explanation Ref. Debit Credit 10. $800 of the Unearned Rent account balance was earned by year-end. Date Accounts Title and Explanation Ref. Debit Credit