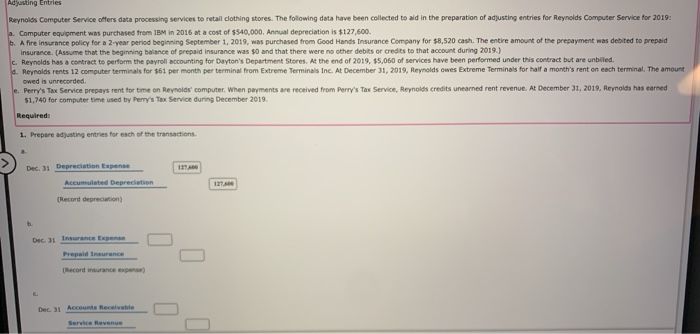

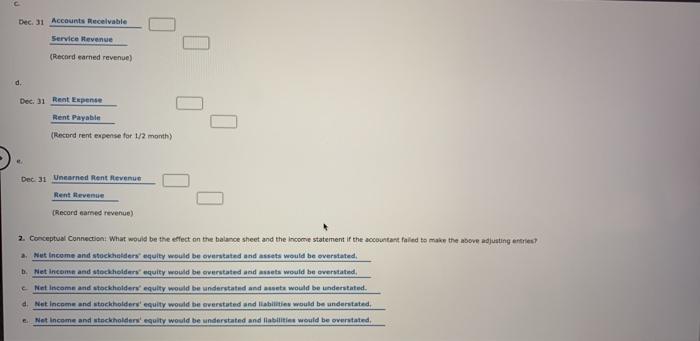

Adjusting Entries Reynolds Computer Service offers data processing services to retail clothing stores. The following data have been collected to aid in the preparation of adjusting entries for Reynolds Computer Service for 2019: a. Computer equipment was purchased from IBM in 2016 at a cost of $540,000. Annual depreciation is $127,600 b. A fire insurance policy for a 2 year period beginning September 1, 2019, was purchased from Good Hands Insurance Company for $8,520 cash. The entire amount of the prepayment was debited to prepaid insurance. (Assume that the beginning balance of prepaid insurance was 50 and that there were no other debits or credits to that account during 2019.) c. Reynolds has a contract to perform the payroll accounting for Dayton's Department Stores. At the end of 2019, $5,060 of services have been performed under this contract but are unbilled. d. Reynoldsrents 12 computer terminals for $61 per month per terminal from Extreme Terminals Inc. At December 31, 2019, Reynolds owes Extreme Terminals for half a month's rent on each terminal. The amount owed is unrecorded e. Perry's Tax Service prepays rent for time on Reynolds' computer. When payments are received from Perry's Tax Service, Reynolds credits unearned rent revenue. At December 31, 2019, Reynolds has earned $1,740 for computer time used by Perry's Tax Service during December 2019. Required: 1. Prepare adyasting entries for each of the transactions Dec 31 Depreciation Expense Accumulated Depreciation (Record depreciation) Dec 31 Insurance Expense Prepaid Insurance Record insurance expense) Dec. 31 Accounts Receivable Service Revenue Dec. 31 Accounts Receivable Service Revenue (Record earned revenue) d. Dec. 31 Rent Expense Rent Payable (Record rent expense for 1/2 month) e Dec.31 Unearned Rent Revenue Rent Revenue (Record earned revenue) 2. Conceptual Connection: What would be the effect on the balance sheet and the income statement if the accountant failed to make the above adjusting entries? 3. Net Income and stockholders' equity would be overstated and assets would be overstated. b. Net income and stockholders' equity would be overstated and assets would be overstated. c. Net Income and stockholders' equity would be understated and assets would be understated. d. Net Income and stockholders' equity would be overstated and liabilities would be understated. e. Net Income and stockholders' equity would be understated and liabilities would be overstated