Question

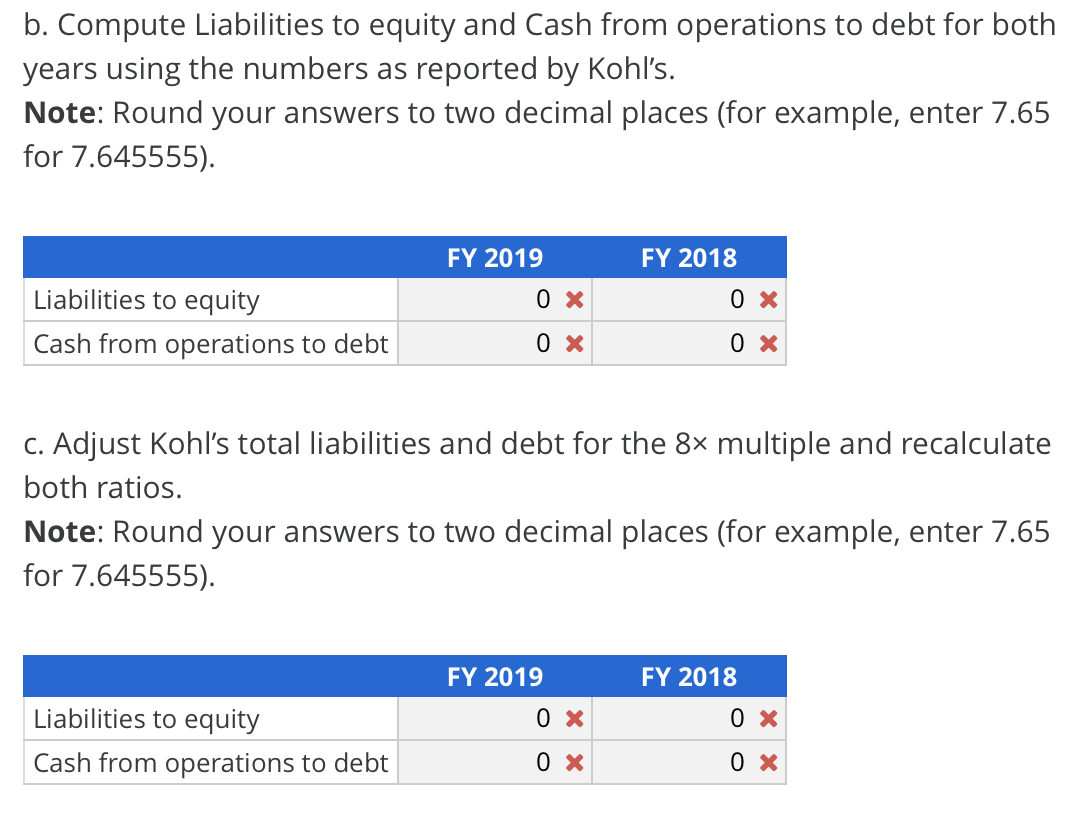

Adjusting for Off-Balance Sheet Liabilities Fitchs current analytical approach views operating leases as a debt-like form of funding and their analysts adjust core leverage and

Adjusting for Off-Balance Sheet Liabilities Fitchs current analytical approach views operating leases as a debt-like form of funding and their analysts adjust core leverage and coverage ratios using a multiple to create a debt-equivalent for all companies that have not yet adopted the new lease standard. Fitch believes a standard 8 multiple is appropriate for assets with a long economic life, such as property leases. Specifically, Fitch multiplies the annual operating lease payments by 8 and adds that amount to debt prior to calculating ratios. In its 2018 annual report, Kohls reports the following amounts. Note: Kohls had not yet adopted the new lease standard.

| $ millions | Feb. 2, 2019 | Feb. 3, 2018 |

|---|---|---|

| Liabilities | $6,942 | $7,970 |

| Total debt | 3,499 | 4,514 |

| Equity | 5,527 | 5,419 |

| Cash from operations | 2,107 | 1,691 |

| Operating lease payments (annual) | 301 | 293 |

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started