Answered step by step

Verified Expert Solution

Question

1 Approved Answer

ADJUSTMENTS a.) A count of supplies reveals $300 were on hand on June 30. b.) The $28,000 insurance policy was purchased on March 1, 2017

ADJUSTMENTS | ||||||||

| a.) A count of supplies reveals $300 were on hand on June 30. | ||||||||

| b.) The $28,000 insurance policy was purchased on March 1, 2017 for whole year. | March April May June | |||||||

| c.) The computers were purchased years ago for 214,000. At the time of purchase, the estimated life of the computers was 10 years with no estimated residual value. | ||||||||

| d.) The $30,000 note payable was issued on February 1, 2017 and accrues interest at a 10% annual rate. The note is expected to be repaid in late-2017. | ||||||||

| e.) On May 1, 2017 the company entered into a 3-month contract to provide security for a major corporation, the corporation paid $15,000 for their 3-month contract on May 1, | ||||||||

| and that amount was correctly recorded as unearned revenue. On June 30, Netlock had fulfilled the first 2 months of the contract. | ||||||||

| f.) The company had three employees who were owed for two days of salaries at year end. Each employee earns $250 per day. | ||||||||

| g.) On June 1, 2017, the company entered into an agreement to provide service for a new client at a rate of | ||||||||

| $4,000 per month. At the end of June the client had received their first month of service but had not yet been billed. | ||||||||

| Required: | ||||||||

| a.) As necessary, record adjusting journal entries based on items a.) through g.) above. | ||||||||

| b.) Using your adjusting journal entries, complete the adjusted trial balance | ||||||||

| c.) Based on the adjusted trial balance, prepare an income statement, statement of changes in equity and a balance sheet. Assume no common shares were issued during the year. | ||||||||

| h.) Prepare closing entries for the company. | ||||||||

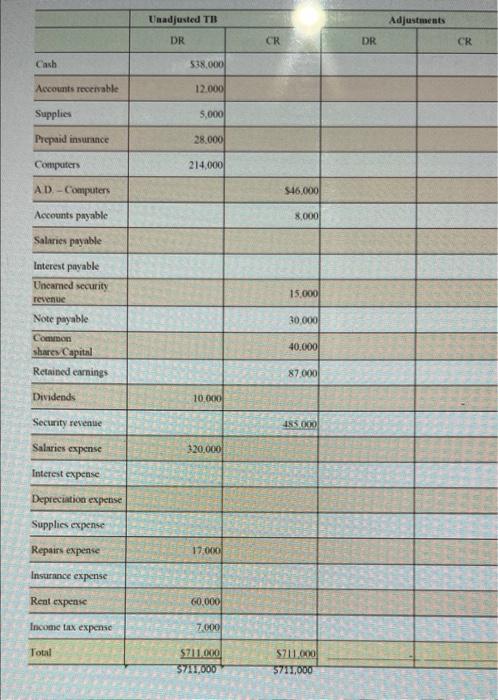

Unadjusted TIB Adjustments DR CR DR CR Cash 538.000 Accounts receivable 12.000 Supplies 5,000 Prepaid insurance 28.000 Computers 214,000 AD-Computers $46,000 Accounts payable 8,000 Salaries payable Interest payable Unearned security 15,000 revenue Note payable 30,000 Common shares Capital 40.000 Retained earnings 87,000 Dividends 10.000 Security revenue 485.000 Salaries expense 320.000 Interest expense Depreciation expense Supplies expense Repairs expense 17.000 Insurance expense Rent expense 60,000 Income tax expense 7,000 Total S711.000 $711.000 S711,000 5711,000

Step by Step Solution

★★★★★

3.45 Rating (152 Votes )

There are 3 Steps involved in it

Step: 1

Adjusted Trial Balance Credit Unadjusted Trial Balance Adjustment Account Title Debit Credit Debit C...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started