Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Admission of Partnership Q3 Question 3 Abel and Betty are in a partnership business and share profits and losses in the ratio of 3:2. They

Admission of Partnership Q3

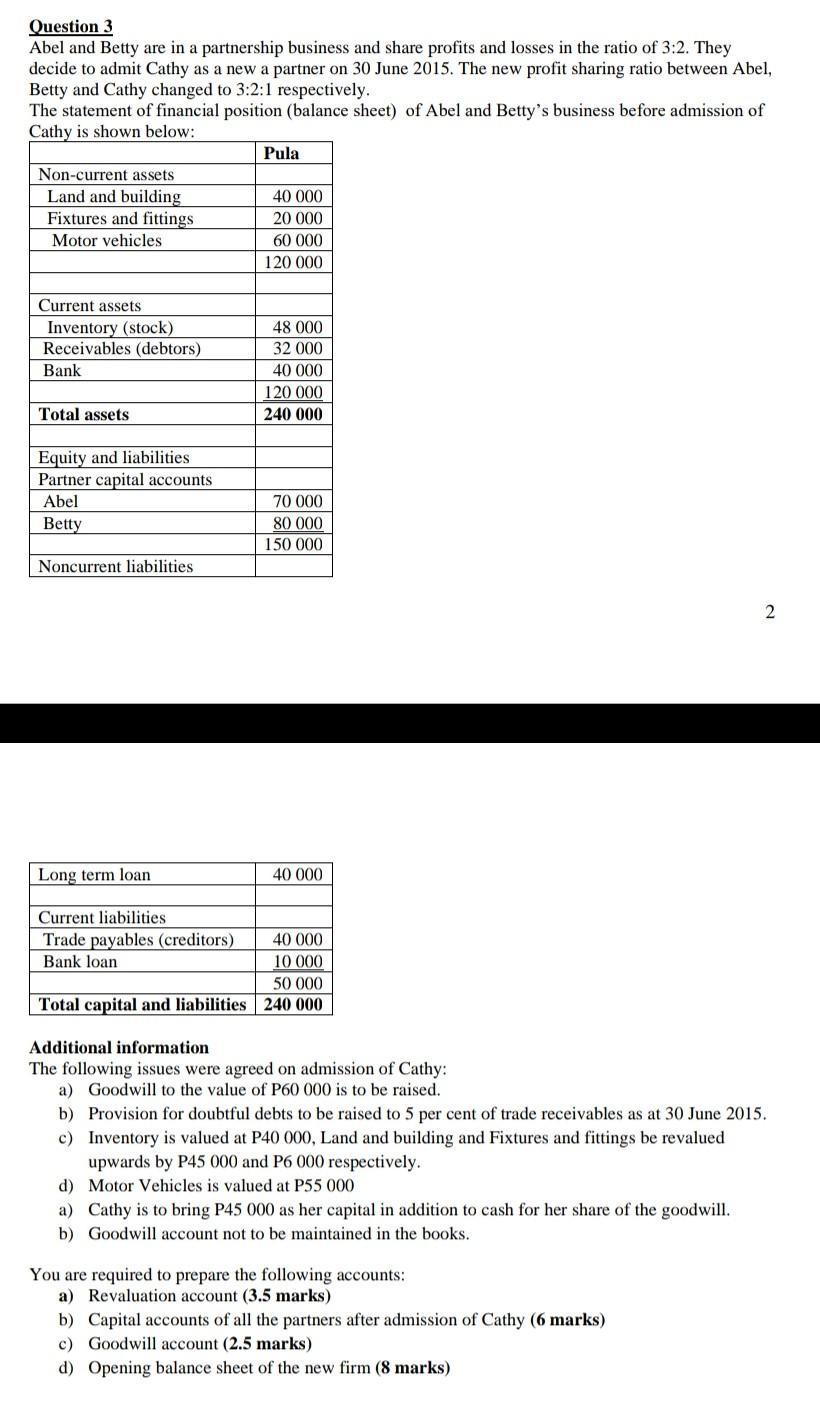

Question 3 Abel and Betty are in a partnership business and share profits and losses in the ratio of 3:2. They decide to admit Cathy as a new a partner on 30 June 2015. The new profit sharing ratio between Abel, Betty and Cathy changed to 3:2:1 respectively. The statement of financial position (balance sheet) of Abel and Betty's business before admission of Cathy is shown below: Pula Non-current assets Land and building 40 000 Fixtures and fittings 20 000 Motor vehicles 60 000 120 000 Current assets Inventory (stock) Receivables (debtors) Bank 48 000 32 000 40 000 120 000 240 000 Total assets Equity and liabilities Partner capital accounts Abel Betty 70 000 80 000 150 000 Noncurrent liabilities 2 Long term loan 40 000 Current liabilities Trade payables (creditors) 40 000 Bank loan 10 000 50 000 Total capital and liabilities 240 000 Additional information The following issues were agreed on admission of Cathy: a) Goodwill to the value of P60 000 is to be raised. b) Provision for doubtful debts to be raised to 5 per cent of trade receivables as at 30 June 2015. c) Inventory is valued at P40 000, Land and building and Fixtures and fittings be revalued upwards by P45 000 and P6 000 respectively. d) Motor Vehicles is valued at P55 000 a) Cathy is to bring P45 000 as her capital in addition to cash for her share of the goodwill. b) Goodwill account not to be maintained in the books. You are required to prepare the following accounts: a) Revaluation account (3.5 marks) b) Capital accounts of all the partners after admission of Cathy (6 marks) c) Goodwill account (2.5 marks) d) Opening balance sheet of the new firm (8 marks)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started