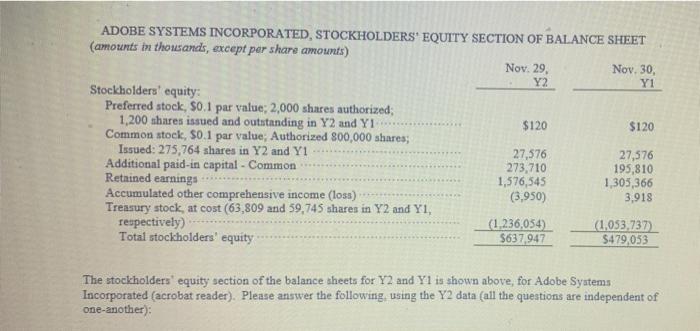

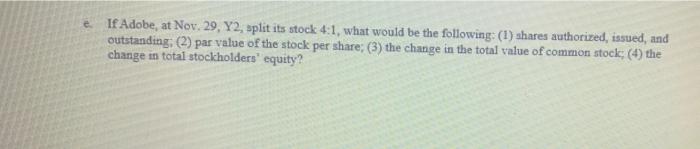

ADOBE SYSTEMS INCORPORATED, STOCKHOLDERS' EQUITY SECTION OF BALANCE SHEET (amounts in thousands, except par share amounts) Nov. 29. Nov. 30, Y2 Y1 Stockholders' equity Preferred stock, So.1 par value: 2,000 shares authorized 1,200 shares issued and outstanding in Y2 and Y1 $120 $120 Common stock, $0.1 par value; Authorized 800,000 shares; Issued: 275,764 shares in Y2 and Y1 27,576 27,576 Additional paid-in capital - Common 273,710 195,810 Retnined earnings 1,576,545 1,305,366 Accumulated other comprehensive income (loss) (3,950) 3,918 Treasury stock at cost (63,809 and 59,745 shares in Y2 and Y1, respectively) (1.236,054) (1,053,737) Total stockholders' equity $637 947 $479,053 The stockholders' equity section of the balance sheets for Y2 and Y1 is shown above, for Adobe Systems Incorporated (acrobat reader). Please answer the following using the Y2 data (all the questions are independent of one another): If Adobe, at Nov. 29, Y2, split its stock 4:1, what would be the following: (1) shares authorized, issued, and outstanding, (2) par value of the stock per share; (3) the change in the total value of common stock (4) the change in total stockholders' equity? ADOBE SYSTEMS INCORPORATED, STOCKHOLDERS' EQUITY SECTION OF BALANCE SHEET (amounts in thousands, except par share amounts) Nov. 29. Nov. 30, Y2 Y1 Stockholders' equity Preferred stock, So.1 par value: 2,000 shares authorized 1,200 shares issued and outstanding in Y2 and Y1 $120 $120 Common stock, $0.1 par value; Authorized 800,000 shares; Issued: 275,764 shares in Y2 and Y1 27,576 27,576 Additional paid-in capital - Common 273,710 195,810 Retnined earnings 1,576,545 1,305,366 Accumulated other comprehensive income (loss) (3,950) 3,918 Treasury stock at cost (63,809 and 59,745 shares in Y2 and Y1, respectively) (1.236,054) (1,053,737) Total stockholders' equity $637 947 $479,053 The stockholders' equity section of the balance sheets for Y2 and Y1 is shown above, for Adobe Systems Incorporated (acrobat reader). Please answer the following using the Y2 data (all the questions are independent of one another): If Adobe, at Nov. 29, Y2, split its stock 4:1, what would be the following: (1) shares authorized, issued, and outstanding, (2) par value of the stock per share; (3) the change in the total value of common stock (4) the change in total stockholders' equity