Question

ADP Mining Company mines an iron ore called Alpha. During the month of August, 350,000 tons of Alpha were mined and processed at a cost

ADP Mining Company mines an iron ore called Alpha. During the month of August, 350,000 tons of Alpha were mined and processed at a cost of $675,000. As the Alpha ore is mined, it is processed into Delta and Pi, where 60% of the Alpha output becomes Delta and 40% becomes Pi. Each product can be sold as is or processed into the refined products Super Delta and Precision Pi. Selling prices for these products are as follows:

| Delta | Super Delta | Pi | Precision Pi | |

| Selling price | $6/ton | $12/ton | $15/ton | $25/ton |

Processing costs to refine Delta into Super Delta are $1,680,000; processing costs to refine Pi into Precision Pi are $1,120,000. Required:

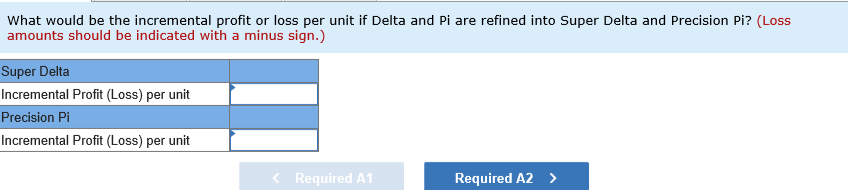

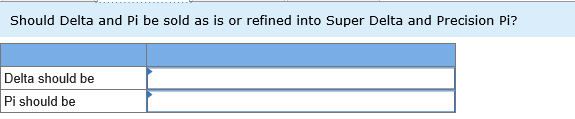

- What would be the incremental profit or loss per unit if Delta and Pi are refined into Super Delta and Precision Pi? Should Delta and Pi be sold as is or refined into Super Delta and Precision Pi?

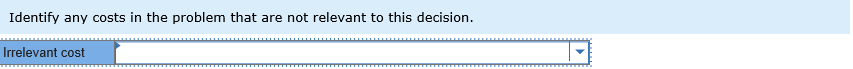

- Identify any costs in the problem that are not relevant to this decision.

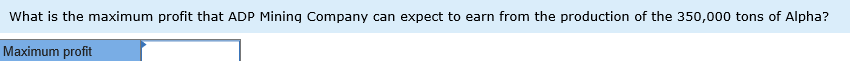

- What is the maximum profit that ADP Mining Company can expect to earn from the production of the 350,000 tons of Alpha?

ADP Mining Company mines an iron ore called Alpha. During the month of August, 350,000 tons of Alpha were mined and processed at a cost of $675,000. As the Alpha ore is mined, it is processed into Delta and Pi, where 60% of the Alpha output becomes Delta and 40% becomes Pi. Each product can be sold as is or processed into the refined products Super Delta and Precision Pi. Selling prices for these products are as follows:

| Delta | Super Delta | Pi | Precision Pi | |

| Selling price | $6/ton | $12/ton | $15/ton | $25/ton |

Processing costs to refine Delta into Super Delta are $1,680,000; processing costs to refine Pi into Precision Pi are $1,120,000. Required:

- What would be the incremental profit or loss per unit if Delta and Pi are refined into Super Delta and Precision Pi? Should Delta and Pi be sold as is or refined into Super Delta and Precision Pi?

- Identify any costs in the problem that are not relevant to this decision.

- What is the maximum profit that ADP Mining Company can expect to earn from the production of the 350,000 tons of Alpha?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started