Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please show me calculations in Excel Ulion You invest $24,000,000 of cash equity in a project that will cost $40,000,000 to acquire and another $80,000,000

please show me calculations in Excel

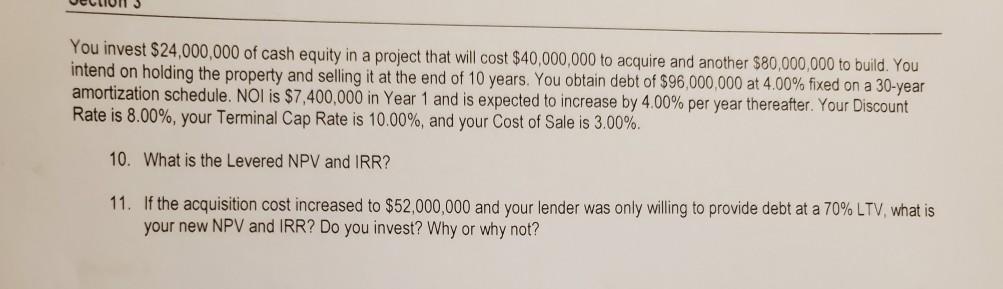

Ulion You invest $24,000,000 of cash equity in a project that will cost $40,000,000 to acquire and another $80,000,000 to build. You intend on holding the property and selling it at the end of 10 years. You obtain debt of $96,000,000 at 4.00% fixed on a 30-year amortization schedule. NOI is $7,400,000 in Year 1 and is expected to increase by 4.00% per year thereafter. Your Discount Rate is 8.00%, your Terminal Cap Rate is 10.00%, and your Cost of Sale is 3.00% 10. What is the Levered NPV and IRR? 11. If the acquisition cost increased to $52,000,000 and your lender was only willing to provide debt at a 70% LTV, what is your new NPV and IRR? Do you invest? Why or why not? Ulion You invest $24,000,000 of cash equity in a project that will cost $40,000,000 to acquire and another $80,000,000 to build. You intend on holding the property and selling it at the end of 10 years. You obtain debt of $96,000,000 at 4.00% fixed on a 30-year amortization schedule. NOI is $7,400,000 in Year 1 and is expected to increase by 4.00% per year thereafter. Your Discount Rate is 8.00%, your Terminal Cap Rate is 10.00%, and your Cost of Sale is 3.00% 10. What is the Levered NPV and IRR? 11. If the acquisition cost increased to $52,000,000 and your lender was only willing to provide debt at a 70% LTV, what is your new NPV and IRR? Do you invest? Why or why notStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started