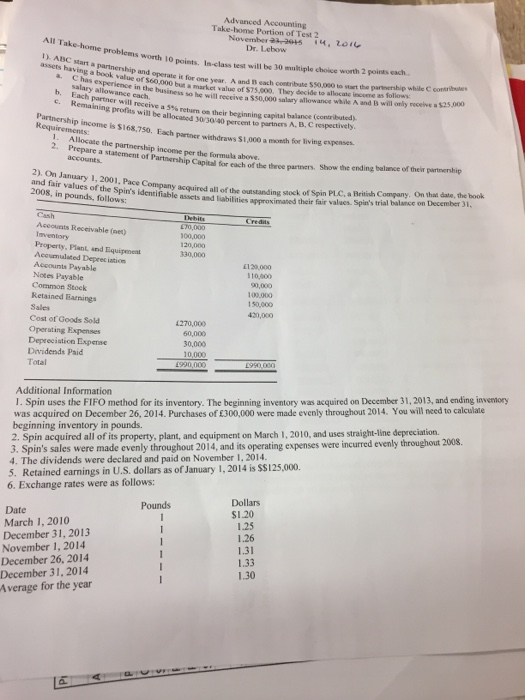

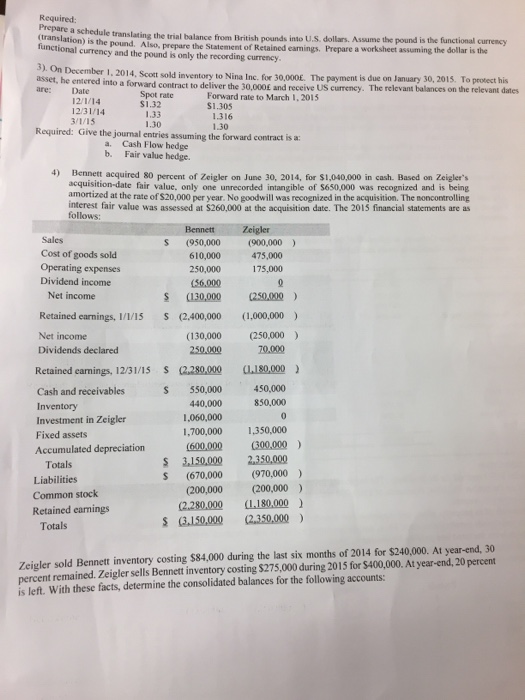

Advanced Accounting Take-home Portion of Test 2 Dr. Lebow All Take-home problems worth 10 points. Is 10 points. Is-class test will be 30 mukiple chokce worth 2 points each. ) ABC tart a partnership and operate it f assets having a book value of $60,000 bus a markct shaving a bookt e. Remaining profits will be allocased 30 30 40 percent to partners 1. Allocate the partnership income per the formula above operate it for one year. A and I each conenibate $50.,080 to stat the parnership while C contribubes the in 0 butamarket valuc of 575,000. They decide to allocate income as Sollow: o he will receive a $50,000 salary allowance while A and B will only receive a $25,0 ach partner will receive a 5% return on their beginning capital balance (contrilbuted). A, B. C respectively. Partnership income is $168,750. Each partner withdraws $1,000 a monsh for living expenser 2. Prepare a statement of Partmership accounts ership Capital fior each of the theee partners. Show the ending balance of their partnenship 2). On January 1, 2001, Pace Company acquired all of the outstanding eny acquired all of the outstanding stock of Spin PLC, a Beitish Company. On that and fair values of the Spin's identifiable assets and liabilities approximated their 2008, in pounds, follows: stock of Spin PLC, a British Company, On that date, the book fair values. Spin's trial balance on December 31 L70,000 100,000 120,000 330,000 Aceounts Receivable (net) Imventory Property, Plant and Equipment Accumulated Deprec iation Accounts Payable Notes Payable Common Stoek Retained Earnings Sales Cost of Goods Sokd Operating Expenses Deprecistion Expense 120,000 110,000 90,000 150,000 420,000 30,000 Dividends Paid Total Additional Information I. Spin uses the FIFO method for its inventory. The beginning inventory was acquired on December 31, 2013, and ending invemory was acquired on December 26, 2014. Purchases of 300,000 were made evenly throughout 2014. You will need to calculate beginning inventory in pounds. 2. Spin acquired all of its property, plant, and equipment on March 1, 2010, and uses straight-line depreciation. 4The dividends were declared and paid on November 1, 2014. 5. Retained earnings in U.S. dollars as of January 1, 2014 is S$125.000 6. Exchange rates were as follows: 3. Spin's sales were made evenly throughout 2014, and its operating expenses were incurred evenly throughout 2008. Dollars $1.20 1.25 1.26 1.31 1.33 1.30 Pounds Date March 1, 2010 December 31, 2013 November 1, 2014 December 26, 2014 December 31, 2014 verage for the year