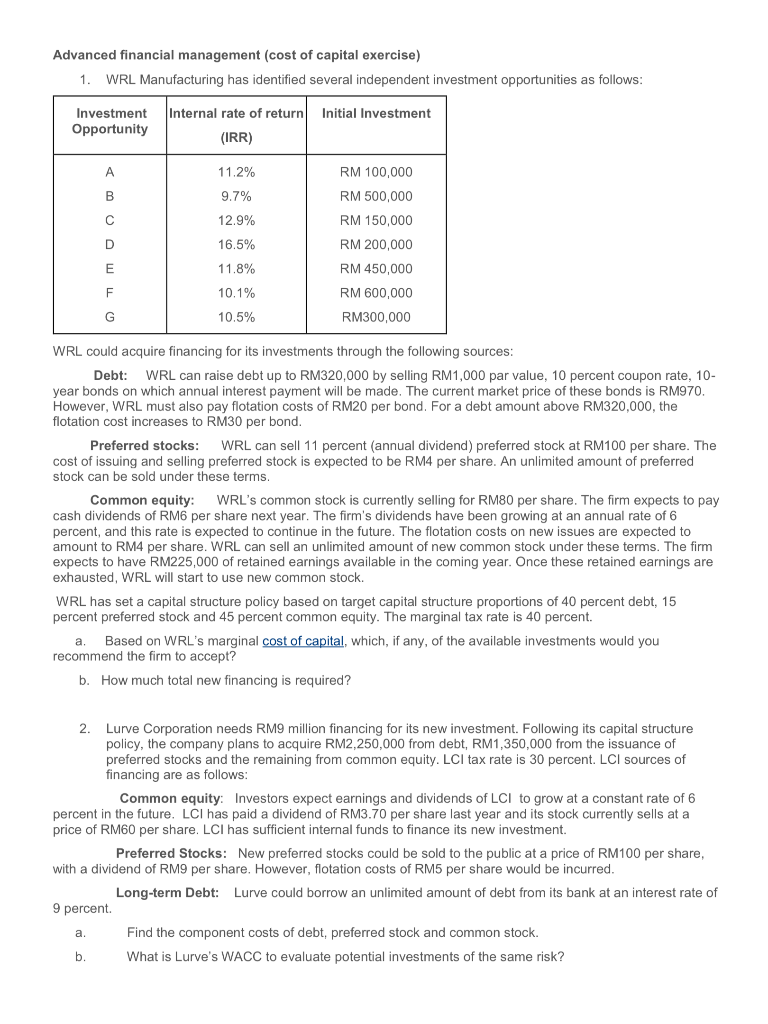

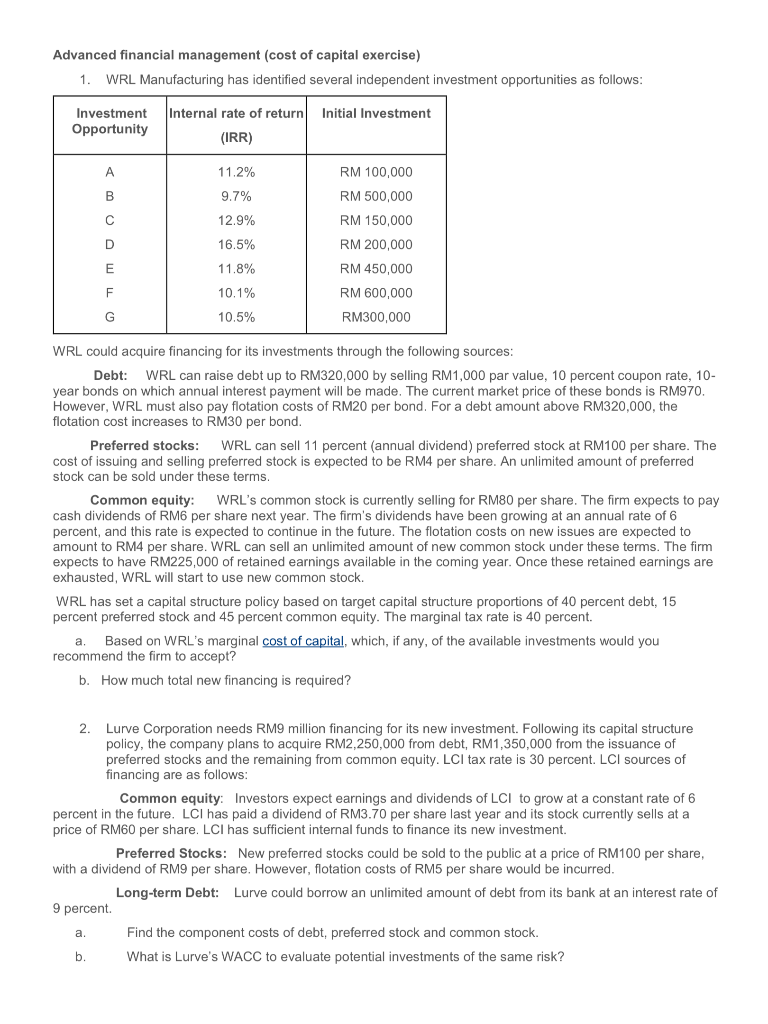

Advanced financial management (cost of capital exercise) 1. WRL Manufacturing has identified several independent investment opportunities as follows: Initial Investment Investment Opportunity Internal rate of return (IRR) A 11.2% RM 100,000 RM 500,000 B 9.7% 12.9% D 16.5% RM 150,000 RM 200,000 RM 450,000 E 11.8% F 10.1% RM 600,000 G 10.5% RM300,000 WRL could acquire financing for its investments through the following sources: Debt: WRL can raise debt up to RM320,000 by selling RM1,000 par value, 10 percent coupon rate, 10- year bonds on which annual interest payment will be made. The current market price of these bonds is RM970. However, WRL must also pay flotation costs of RM20 per bond. For a debt amount above RM320,000, the flotation cost increases to RM30 per bond. Preferred stocks: WRL can sell 11 percent (annual dividend) preferred stock at RM100 per share. The cost of issuing and selling preferred stock is expected to be RM4 per share. An unlimited amount of preferred stock can be sold under these terms. Common equity: WRL's common stock is currently selling for RM80 per share. The firm expects to pay cash dividends of RM6 per share next year. The firm's dividends have been growing at an annual rate of 6 percent, and this rate is expected to continue in the future. The flotation costs on new issues are expected to amount to RM4 per share. WRL can sell an unlimited amount of new common stock under these terms. The firm expects to have RM225,000 of retained earnings available in the coming year. Once these retained earnings are exhausted, WRL will start to use new common stock. WRL has set a capital structure policy based on target capital structure proportions of 40 percent debt, 15 percent preferred stock and 45 percent common equity. The marginal tax rate is 40 percent. a. Based on WRL's marginal cost of capital, which, if any, of the available investments would you recommend the firm to accept? b. How much total new financing is required? 2. Lurve Corporation needs RM9 million financing for its new investment. Following its capital structure policy, the company plans to acquire RM2,250,000 from debt, RM1,350,000 from the issuance of preferred stocks and the remaining from common equity. LCI tax rate is 30 percent. LCI sources of financing are as follows: Common equity: Investors expect earnings and dividends of LCI to grow at a constant rate of 6 percent in the future. LCI has paid a dividend of RM3.70 per share last year and its stock currently sells at a price of RM60 per share. LCI has sufficient internal funds to finance its new investment. Preferred Stocks: New preferred stocks could be sold to the public at a price of RM100 per share, with a dividend of RM9 per share. However, flotation costs of RM5 per share would be incurred. Long-term Debt: Lurve could borrow an unlimited amount of debt from its bank at an interest rate of 9 percent a. Find the component costs of debt, preferred stock and common stock. b. What is Lurve's WACC to evaluate potential investments of the same risk