Question

Advanced Fuels Corporation (AFC) was founded five years ago by Dr. Zachary Aplin, who left his faculty position at Texas A&M to work full me

Advanced Fuels Corporation (AFC) was founded five years ago by Dr. Zachary Aplin, who left his faculty position at Texas A&M to work full me developing a process to convert waste products into fuel. He used a government grant, personal funds, and loans from friends and relatives as seed money to finance his new company, and he was the sole stockholder.

Dr. Aplin and his two-member staff worked feverishly for three years, and at the beginning of the fourth year, they made a major break-through that led to the development of an efficient process for converting waste products into ethanol, a compound that can be blended with gasoline to produce a cleaner automobile fuel. Ethanol-gasoline blends have been around for some time, and over a billion gallons of ethanol a year are currently being produced in the United States. However, most ethanol is currently produced from feed corn, and the ethanol is more expensive than the gasoline to which it is added. Only a federal subsidy makes the ethanol-gasoline mixture economically feasible. However, producing ethanol from waste products would lower its cost dramatically hence greatly increase the market potential of the blended fuel.

AFC has received a patent from the U .S. Patent Office for Dr. Aplin's unique ethanol production process. After considering licensing the process to major oil companies, Aplin decided that AFC itself should produce the ethanol. However, this would require a substantial amount of capital, and Dr. Aplin had exhausted his personal financial resources. Therefore, he began a series of discussions with AFC's accountants and bankers. Both sets of advisors stated that the first step toward attaining outside capital is to develop a business plan.

The Business Plan

A business plan is a document that describes in detail the key aspects of a proposed business venture. Everything from raw material sources to a description of how a product will meet the specific needs of future customers is contained in the plan. Business plans range from 10 over 100 pages in length, but most are about 50 pages. The 10 key segments of a business plan for a typical manufacturing venture are listed below:

1. Summary. A summary of no more than three pages should {a) provide a clear and concise overview of the business and {b) capture the reader's interest.

2. Business Description. The business description should explain in detail what the new company will do, the markets it will serve, and how it will operate. This section should also provide industry background information. Additionally, any competitive advantages or disadvantages, which the new venture will have, should be discussed.

3. Marketing. Sales projections, supported by market research data, should be delineated in the marketing segment. This segment is a critical component of the plan for two main reasons. First, potential capital providers must be convinced that there is a well-defined customer base for the venture's product. Unless they have a clear understanding of the target market, potential investors will be reluctant to provide the necessary capital. Second, the projected sales volume will affect the size of the enterprise, hence the amount of capital it will require.

4. Research, Design, and Development. This section should provide a description of all research performed to date and give the extent and cost of future research required for the venture. Also, all technical processes and equipment should be explained in detail.

5. Manufacturing. The manufacturing segment should first define plant location(s) and the strategic reasoning behind location choices. Labor cost and availability, proximity to suppliers and customers, and community support should all be discussed.

6. Management. The management section presents the organizational, ownership, and compensation structures of the company. All key personnel should be identified, and brief resumes for these individuals should be provided.

7. Critical Risks Segment. In this section, existing and potential problems, including the company's major competition and any negative industry trends, should be discussed. Alternative solutions and their costs should be offered for all current and potential obstacles.

8. Financial Segment. The financial segment documents the projected profitability of the venture and is absolutely crucial to the capital acquisition process. Projected income statements, balance sheets, cash flow statements, and cash budgets are included. The most important element is probably the cash flow statement. Potential lenders can use it to gain insights into the amounts and timing of external capital requirements and repayments, while potential equity investors use it to estimate future equity cash flows, which form the primary basis for estimating the value of the enterprise.

9. Milestone Schedule. The milestone schedule gives projected dates for future significant events in the life of the business. This schedule might include the dates that plant construction will begin and end, equipment installation dates, hiring dates, and dates of first product shipments.

10. Critical Assumptions. In a well-developed business plan, most of the key assumptions behind the projected financial statements are spelled out in detail throughout the document. Still, it is useful to include a summary section which lists the most important assumptions. For example, if getting final approval for pending patents is vital to moving forward, this fact should be noted here.

Generally, a start-up firm's final business plan is developed jointly by its managers and an investment banking firm that specializes in start-up financing. The investment banker must be familiar both with sources of capital and the legal requirements associated with security offerings. Often though, companies develop preliminary plans with the help of commercial bankers and CP As; Dr. Aplin and his staff followed this route. Working on the preliminary plan is generally a useful exercise, and in this case it forced Aplin to think about issues that he had not previously considered. For example, he knew that his production process offered a cost advantage over the competition, but he was amazed to discover that his projected production costs would be only 70 percent of those of his closest competitor. On the other hand, the capital-intensive nature of the production process was revealed by the business plan, and it was sobering to learn just how much capital his fledgling firm would need to actually produce ethanol on a commercial scale.

The cost of building one production facility was determined to be $10 million. Since Aplin's manufacturing strategy called for building plants in five major cities in the United States, and since $1 million in working capital is needed to start up each plant, AFC's total capital requirement is $55 million. This was a lot more than Dr. Aplin had anticipated, so he decided to hire an investment banking firm to help him finalize AFC's business plan and to identify and approach potential capital providers.

Venture Capital Sources

The investment bankers identified four main sources of start-up capital: venture capital funds, banks, individuals, and public offerings.

Venture Capital Funds. Some financial institutions such as insurance companies and pension funds, and wealthy individuals, often locate a certain portion of their capital to high-risk investments. Much of this risk capital is placed into venture capital funds managed by experienced professionals called "venture capitalists." Venture capital fund managers generally purchase either the common stock or convertible debentures of new businesses with the potential for rapid growth. Because of the very high risk associated with such investments, venture capitalists require a high expected rate of return, typically in the 20-40 percent range.

Banks. In the 1980s, banks would lend money to start-up companies assets such as real estate, plant, and equipment were available for collateral. However, since 1989, when Congress approved new rules governing bank capital requirements, banks have not been active in the art-up financing market. The banks entered the 1990s with many bad real estate loans, and, after the savings-and-loan debacle, bank examiners are quick to force banks to write down problem loans, which puts additional pressure on bank capital. As a result, start-up companies now find it very difficult to obtain bank financing. Further, if bank loans are available at all, the terms are normally short-term (less than one year), hence not suitable for funding long-term investments or permanent working capital.

Individuals. Sometimes entrepreneurs are able to convince friends, relatives, or wealthy individuals to provide the capital needed to start a company. Capital provided by these individuals is termed "informal risk," and a wealthy individual who invests directly in a start-up venture is called an "angel." If significant amounts of money are to be obtained, it may be necessary to obtain it only from "informed, sophisticated" individuals who are in a position to understand the risks they are taking and to afford a loss should the venture fail. This qualification is generally met by having the individual sign an affidavit that his or her net worth is in excess of $1 million.

Public Offerings. A public offering involves raising capital by selling equity or debt securities to the public at large. An investment banking firm is vital to a public offering, both to assist in determining the value of the securities to be sold and to market the securities to investors. While public offerings are a valuable source of capital for companies once they beyond the start-up stage and have established a track record, they are virtually impossible for most start-ups.

Commonly Used Terms

Venture capital financing has a "lingo" of its own. Here are some of the more commonly used terms:

Bridge Loan. It often takes some time to line up permanent investors for a start-up venture. Often, a business will obtain short-term loans from individuals or, possibly, its investment bank, to get operations started, with the intention of paying this loan off when permanent financing is obtained. Such a loan "bridges the gap from here to permanent financing," hence it is called a "bridge loan."

Equity Kicker. With start-ups, there is generally a high probability lure, but also a small probability of success and rich rewards. For example, suppose three out of four new companies fail within a year and cause investors to lose their entire stake, but one out of four succeeds and has a payoff of 400 percent. If a fund invested equal amounts in the four companies, then it would have a 25 percent rate of return.

Now, suppose a bank or other lender (as opposed to an equity investor) formed a portfolio consisting of loans to the four companies, charging a high 25 percent on each loan (in most states, usury laws would limit the rate to 16-18 percent on this type of loan). The lender would lose 100 percent on three loans, make 25 percent on the fourth, and up with large losses on the entire operation. The moral of the story is that portfolio theory works well only if investors can share in upside results.

Now consider the situation when the founder of a start-up firm, such as Dr. Aplin, exhausts his personal funds and is forced to seek outside capital. Outsiders think (correctly) that the founder has better information about the firm's prospects than they do. Accordingly, they want the most secure position they can get in an admittedly risky venture. That often means that outsiders will insist on supplying their capital in the form of debt, so that they will have first claims on assets and income in the event that the founder's projections fail to materialize. However, as we have seen, lenders cannot achieve their desired results by forming portfolios of risky debt securities, because they do not share in upside gains beyond the stated interest rate.

How can lenders share in upside gains? The answer is to use convertibles or warrants, which are called "equity kickers" and which have no upside limitation. Note also that U.S. banks are prohibited from taking equity kickers; this helps explain why their participation in venture financing is limited.

Mezzanine Capital. As companies progress beyond the start-up phase, their capital often includes two or more layers of debt: senior debt, which is secured by assets, and subordinated debt, which is unsecured but which often includes an equity kicker. This second level of debt is called mezzanine capital."

Private Placement. A private placement is any debt or equity issue that is not offered to the general public.

Seed Money. The initial capital required to start an entrepreneurial project is called "seed money." In AFC's case, this is the capital supplied by Dr. Aplin and his friends and relatives.

Venture Capital Networks. Computerized databases have been developed that contain profiles of ventures needing capital and profiles of private investors who are interested in providing venture capital. A computer program periodically compares all profiles of both types to a determine if there are matches. If a match exists, the entrepreneur and the potential investor are introduced to see if a funding agreement can be reached.

After explaining the different sources of start-up capital and some key terms, the investment banker stated that the next step should be to determine AFC's value, as this will be of interest to all potential investors. Five methods are commonly used to value the equity of a start-up firm.

Discounted Cash Flow Approach. The discounted cash flow approach recognizes that the value of a business is a function of the timing, riskiness, and amounts of cash flow that the business generates. Three steps are involved: (1) Historical financial data and current trends are used to forecast the firm's future cash flows to equityholders. In a start-up situation, the forecasting problem is complicated by a lack of historical data, which makes good judgment and market research very important. (2) A discount rate based on the riskiness of the cash flows must be determined. (3) The present value of the cash flows must be calculated to arrive at the equity value.

The discounted cash flow approach is the most comprehensive valuation technique, but for a start-up firm it has obvious weaknesses. Anyone with Lotus 1-2-3 or some other spreadsheet can make forecasts and determine a firm's "value," but that value is no better than the forecasts. Therefore, investors also like to consider less refined, but possibly less subjective, valuation approaches.

Liquidation Value. This method determines the value if the business ceases operations and is liquidated. Liquidation value is calculated by first summing the estimated net selling prices that would be realized if each asset were sold individually. From this sum we subtract all existing liabilities, and the result is the liquidation value of the business to its equity investors. Included in liabilities are costs associated with liquidation, such as severance pay for terminated employees. The liquidation value method generally establishes the minimum worth of a business's equity. Additionally, lending institutions sometimes use the liquidation value of an individual asset to determine the amount that can be loaned using that asset as collateral.

Adjusted Tangible Book Value. This valuation method starts with the latest balance sheet. The book value of each account is adjusted upwards or downwards in order to arrive at its fair-market value. Adjustments are made to account for land appreciation, uncollectible accounts receivable, and obsolete inventories. Additionally, the values of intangible assets such as patents or goodwill and other assets or liabilities that are not on the books must be added. Once the adjusted book values have been established, total liabilities are subtracted from total assets to arrive at the business's adjusted tangible book value. This method is similar to the liquidation value method except that fair-market values are determined within the context of a continuing business.

Earnings Multiple Method. If historical income statements are available, if the past is likely to be indicative of the future, and if recent earnings are "normal" in the sense of not being relatively high or low, because of temporary conditions, then one can use the earnings multiple method. First, find the price-to-earnings ratios (P/E ratios) of a group of public companies in the same industry and similar in size to the firm being valued. Data on companies that recently went public are especially useful for this purpose if such data are available. Based on comparisons of the company being valued and the public companies, judgment is used to establish a P/E ratio to apply to the company's earnings. For example, suppose a company is relatively stable and has averaged $200,000 in net income for the past three years, and a P/E of 5 is deemed appropriate. The value of the company's equity would be 5($200,000) = $1,000,000.

Replacement Value. This method requires a determination of the total cost that would be incurred if the business were to be reconstructed from scratch. The cost must include items such as land, buildings, and equipment, as well as marketing and advertising expenses associated with building a customer base. This method is most often used to value firms by companies seeking merger partners as an alternative to de novo expansion and by insurance companies to determine policy premiums. The firm's liabilities could be subtracted from the total replacement value to obtain the value of the equity.

Combination of Methods. Generally, more than one method is used to value a company. For example, an analyst might use the discounted cash flow and earnings multiple methods together with the replacement value method. These three values might be averaged, or greater weight might be placed on one method because of the circumstances. If it were known that a larger company wanted to make an acquisition in the industry, and the replacement valuation produced a relatively high value, then the analyst might assume that the company could be sold at close to its replacement value. Clearly, a great deal of judgment is required, and different experts will reach very different conclusions.

At times, it is appropriate to analyze different groups of a firm's assets differently. For example, a steel company may have diversified outside of its core business (steel) into several different industries such as oi1 and chemicals. Analysts may conclude that the company's "break-up value" exceeds its value as a conglomerate corporation, and they might use the replacement value method to evaluate the chemical and oil divisions and the discounted cash flow method to evaluate the core steel business.

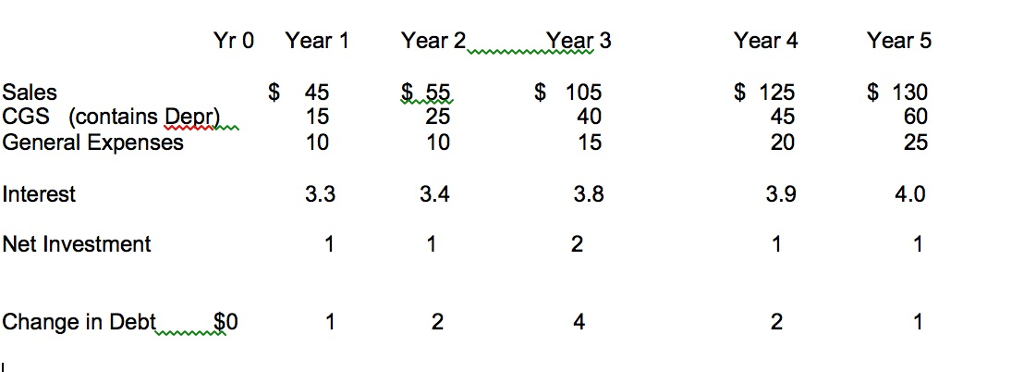

For question 1-3 assume that the assets are worth $60 million with $40 million in debt financing at an 8% interest. Debt will increase each year as shown below. The other $20 million will come from equity financing. Assume a tax rate of 25% and no non-operating assets.

1.)Assuming the appropriate required return for equity holders is 27% along with a 6% growth rate for year 6 and thereafter, calculate FCFE and horizon value. What is the forecasted value of AFC?

2.) Assuming the earnings (P/E) multiple is 4.5 for this type of small business calculate the value of equity with this approach.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started