Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Advanced International Tax USAco. a domestic corporation, is the wholly-owned U.S. subsidiary of FORco. a foreign corporation. The U.S.-Country F tax treaty exempts interest payments

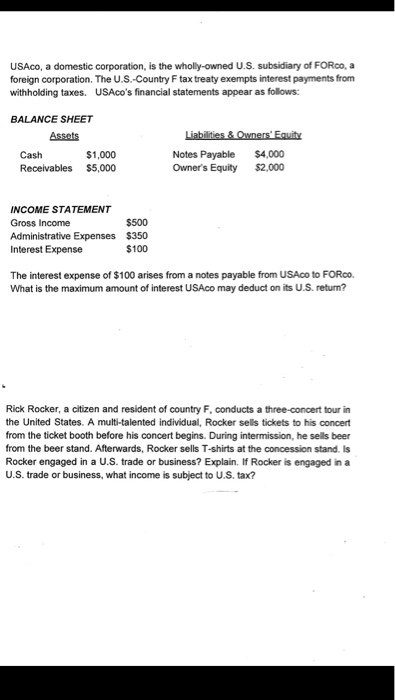

Advanced International Tax  USAco. a domestic corporation, is the wholly-owned U.S. subsidiary of FORco. a foreign corporation. The U.S.-Country F tax treaty exempts interest payments from withholding taxes. USAco's financial statements appear as follows: The interest expense of $100 arises from a notes payable from USAco to FORco What is the maximum amount of interest USAco may deduct on its U.S. return' Rick Rocker, a citizen and resident of country F. conducts a lour in the United States A multi-talented individual. Rocker sets tickets to his concert from the ticket booth before his concert begins During intermission, he se*s beer from the beer stand. Afterwards. Rocker sells T-shirts at the concession stand is Rocker engaged in a U.S. trade or business? Explain If Rocker a engaged n a U.S. trade or business, what income is subject to U.S. tax

USAco. a domestic corporation, is the wholly-owned U.S. subsidiary of FORco. a foreign corporation. The U.S.-Country F tax treaty exempts interest payments from withholding taxes. USAco's financial statements appear as follows: The interest expense of $100 arises from a notes payable from USAco to FORco What is the maximum amount of interest USAco may deduct on its U.S. return' Rick Rocker, a citizen and resident of country F. conducts a lour in the United States A multi-talented individual. Rocker sets tickets to his concert from the ticket booth before his concert begins During intermission, he se*s beer from the beer stand. Afterwards. Rocker sells T-shirts at the concession stand is Rocker engaged in a U.S. trade or business? Explain If Rocker a engaged n a U.S. trade or business, what income is subject to U.S. tax

Advanced International Tax

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started