Answered step by step

Verified Expert Solution

Question

1 Approved Answer

afe INCOME FROM SALARIES 2753 2. Mr. X has been provided with a car (1800 cc) facility to be used both for official purposes as

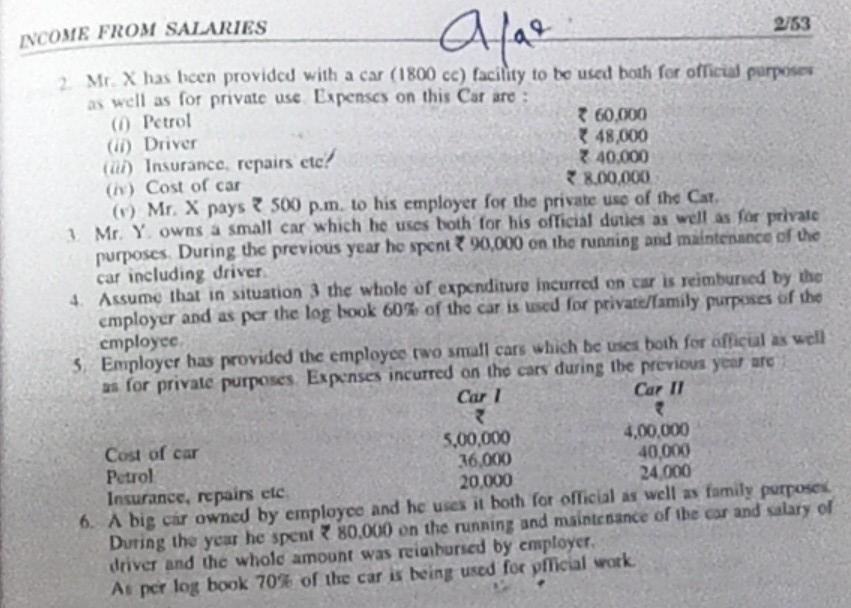

afe INCOME FROM SALARIES 2753 2. Mr. X has been provided with a car (1800 cc) facility to be used both for official purposes as well as for private use Expenses on this Car are: (1) Petrol * 60,000 (1) Driver 48,000 (uh) Insurance, repairs etc! 340,000 (h) Cost of car 8.00.000 (1) Mr. X pays ? 500p.m. to his employer for the private use of the Car 1 Mr. Y owns a small car which he uses both for his official duties as well as for private purposes. During the previous year he spent 90,000 on the running and maintenance of the car including driver 4. Assume that in situation 3 the whole of expenditure incurred on car is reimbursed by the employer and as per the log book 60% of the car is used for private/lamily purposes of the cmployee 5. Employer has provided the employee two small cars which be uses both for officul as well as for private purposes Expenses incurred on the cars during the previous year are Car 1 Car IT Cost of car 5,00,000 4,00,000 Petrol 36,000 40.000 20.000 24.000 Insurance, repairs etc 6. A big car owned by employee and he uses it both for official as well as family purposes During the year he spent 80.000 on the running and maintenance of the car and salary of driver and the whole amount was reig bursed by employer. As per log book 70% of the car is being used for pflicial work afe INCOME FROM SALARIES 2753 2. Mr. X has been provided with a car (1800 cc) facility to be used both for official purposes as well as for private use Expenses on this Car are: (1) Petrol * 60,000 (1) Driver 48,000 (uh) Insurance, repairs etc! 340,000 (h) Cost of car 8.00.000 (1) Mr. X pays ? 500p.m. to his employer for the private use of the Car 1 Mr. Y owns a small car which he uses both for his official duties as well as for private purposes. During the previous year he spent 90,000 on the running and maintenance of the car including driver 4. Assume that in situation 3 the whole of expenditure incurred on car is reimbursed by the employer and as per the log book 60% of the car is used for private/lamily purposes of the cmployee 5. Employer has provided the employee two small cars which be uses both for officul as well as for private purposes Expenses incurred on the cars during the previous year are Car 1 Car IT Cost of car 5,00,000 4,00,000 Petrol 36,000 40.000 20.000 24.000 Insurance, repairs etc 6. A big car owned by employee and he uses it both for official as well as family purposes During the year he spent 80.000 on the running and maintenance of the car and salary of driver and the whole amount was reig bursed by employer. As per log book 70% of the car is being used for pflicial work

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started