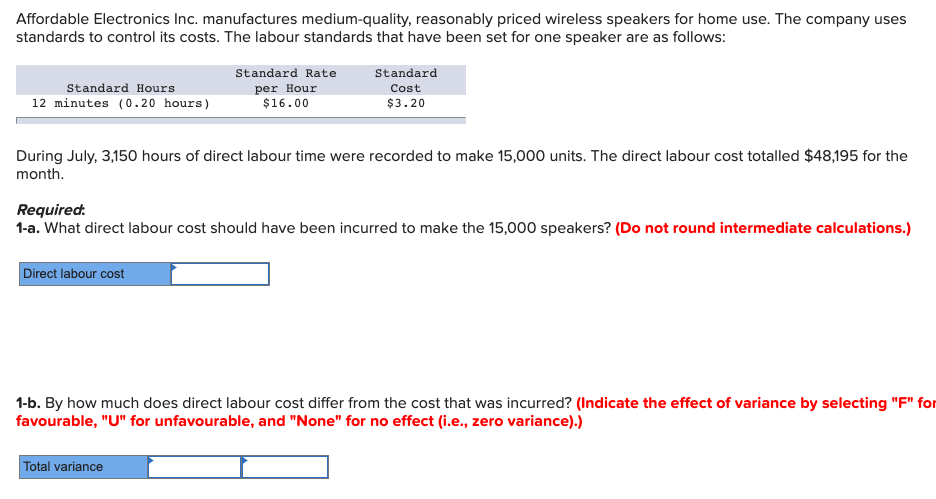

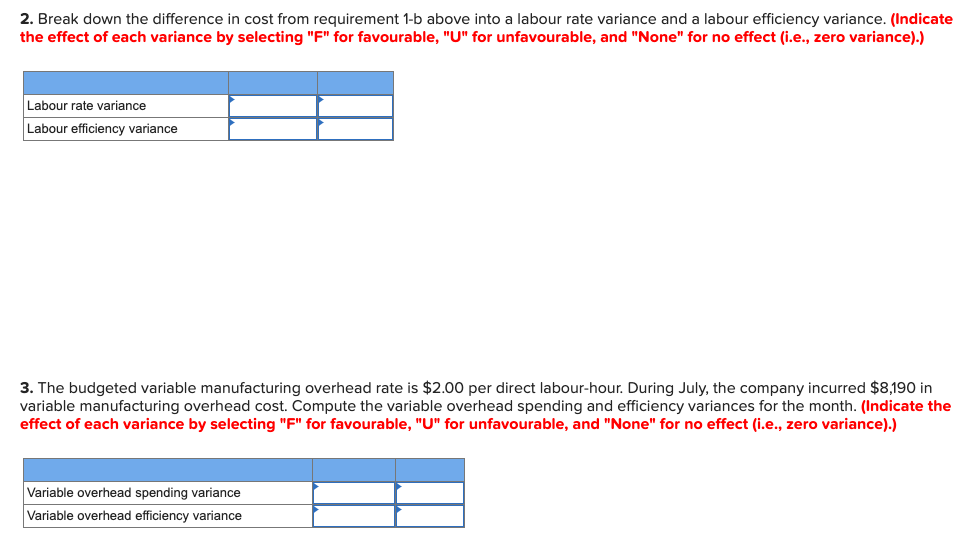

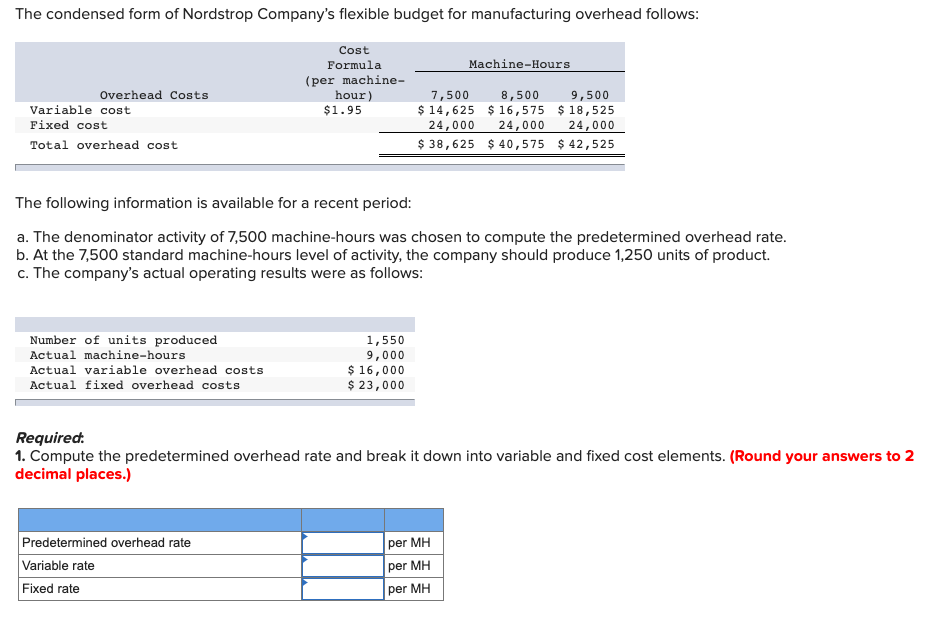

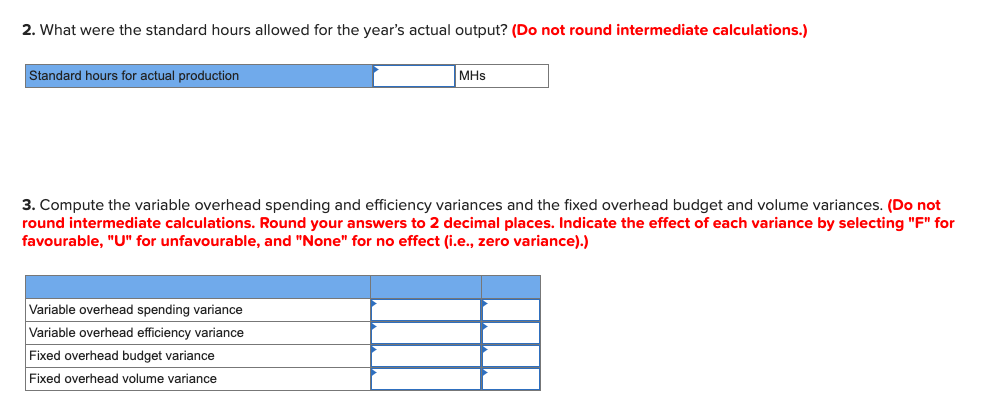

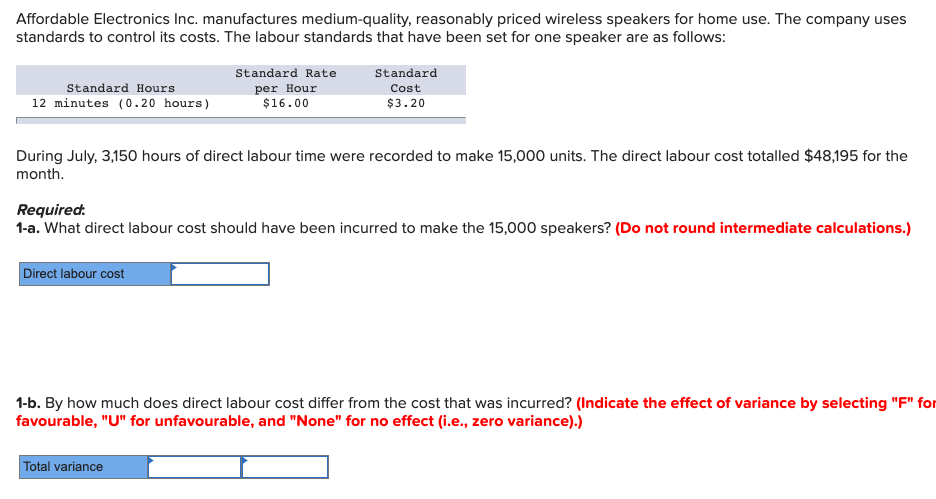

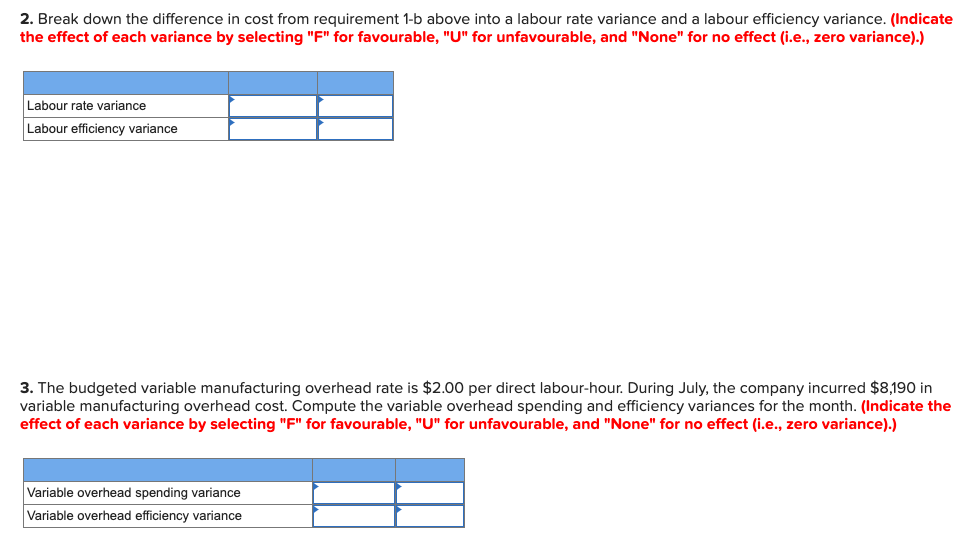

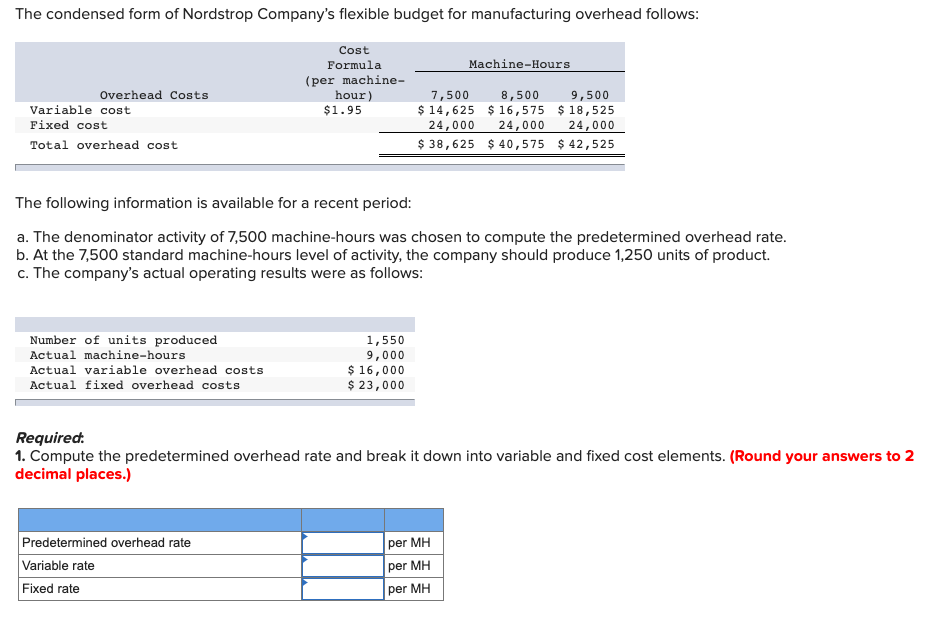

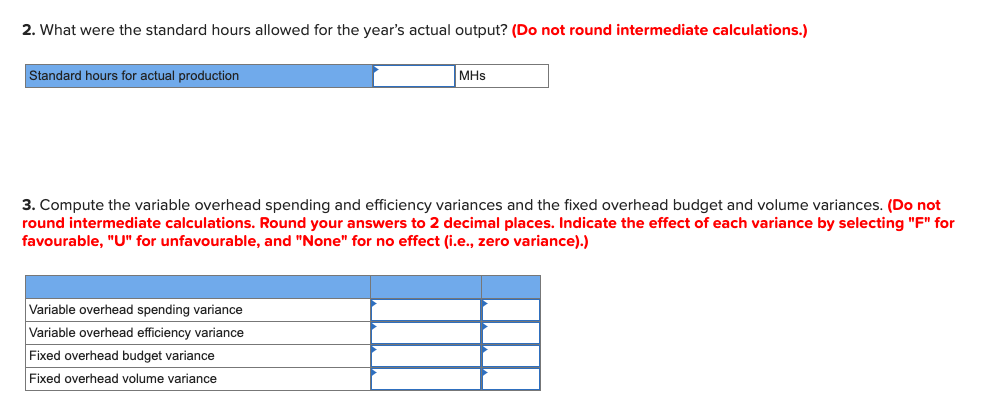

Affordable Electronics Inc. manufactures medium-quality, reasonably priced wireless speakers for home use. The company uses standards to control its costs. The labour standards that have been set for one speaker are as follows: Standard Hours 12 minutes (0.20 hours) Standard Rate per Hour $16.00 Standard Cost $3.20 During July, 3,150 hours of direct labour time were recorded to make 15,000 units. The direct labour cost totalled $48,195 for the month. Required: 1-a. What direct labour cost should have been incurred to make the 15,000 speakers? (Do not round intermediate calculations.) Direct labour cost 1-b. By how much does direct labour cost differ from the cost that was incurred? (Indicate the effect of variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Total variance 2. Break down the difference in cost from requirement 1-b above into a labour rate variance and a labour efficiency variance. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Labour rate variance Labour efficiency variance 3. The budgeted variable manufacturing overhead rate is $2.00 per direct labour-hour. During July, the company incurred $8,190 in variable manufacturing overhead cost. Compute the variable overhead spending and efficiency variances for the month. (Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (.e., zero variance).) Variable overhead spending variance Variable overhead efficiency variance The condensed form of Nordstrop Company's flexible budget for manufacturing overhead follows: Machine-Hours Cost Formula (per machine- hour) $1.95 Overhead Costs Variable cost Fixed cost Total overhead cost 7,500 8,500 9,500 $ 14,625 $ 16,575 $ 18,525 24,000 24,000 24,000 $ 38,625 $ 40,575 $ 42,525 The following information is available for a recent period: a. The denominator activity of 7,500 machine-hours was chosen to compute the predetermined overhead rate. b. At the 7,500 standard machine-hours level of activity, the company should produce 1,250 units of product. c. The company's actual operating results were as follows: Number of units produced Actual machine-hours Actual variable overhead costs Actual fixed overhead costs 1,550 9,000 $ 16,000 $ 23,000 Required: 1. Compute the predetermined overhead rate and break it down into variable and fixed cost elements. (Round your answers to 2 decimal places.) Predetermined overhead rate Variable rate Fixed rate per MH per MH per MH 2. What were the standard hours allowed for the year's actual output? (Do not round intermediate calculations.) Standard hours for actual production MHS 3. Compute the variable overhead spending and efficiency variances and the fixed overhead budget and volume variances. (Do not round intermediate calculations. Round your answers to 2 decimal places. Indicate the effect of each variance by selecting "F" for favourable, "U" for unfavourable, and "None" for no effect (i.e., zero variance).) Variable overhead spending variance Variable overhead efficiency variance Fixed overhead budget variance Fixed overhead volume variance