Answered step by step

Verified Expert Solution

Question

1 Approved Answer

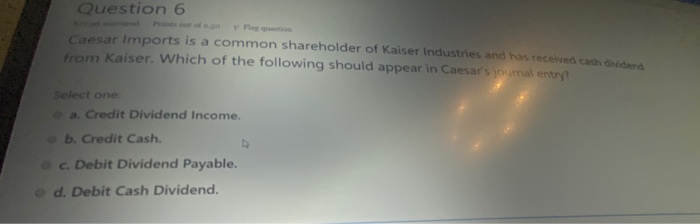

please help me Question 6 Caesar Imports is a common shareholder of Kaiser Industries and has received cash dividend from Kaiser. Which of the following

please help me

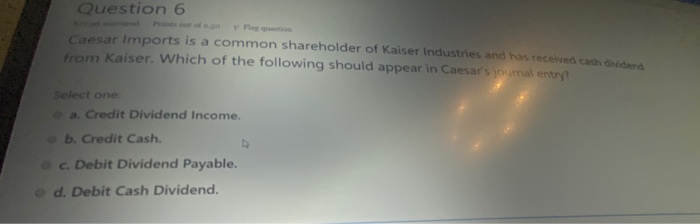

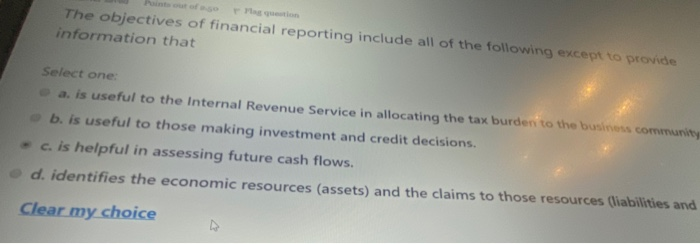

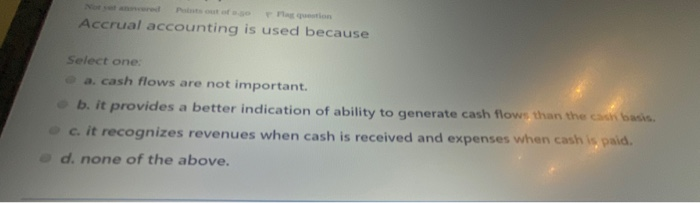

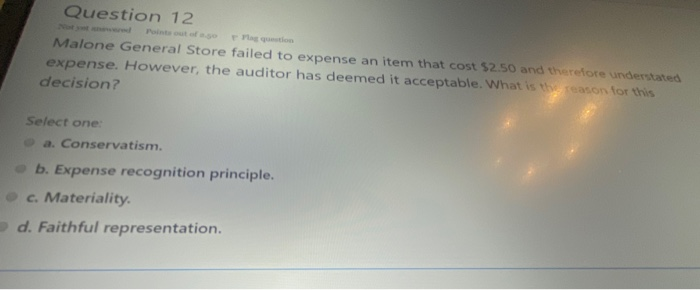

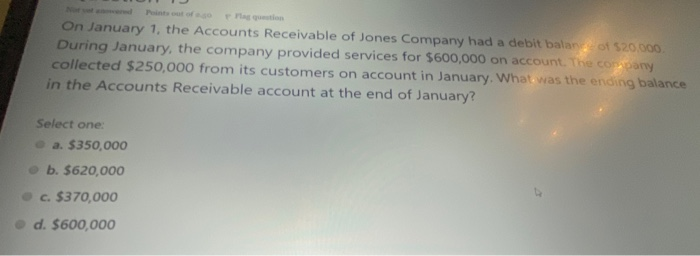

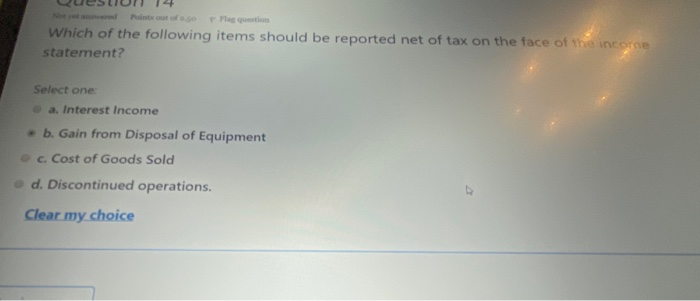

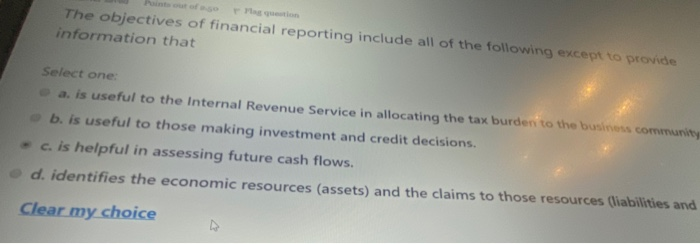

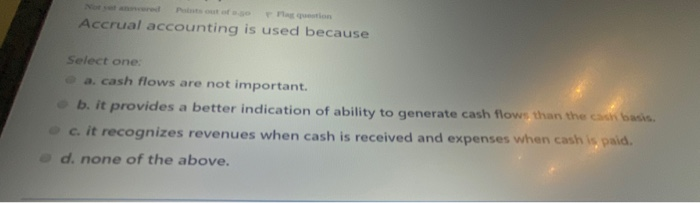

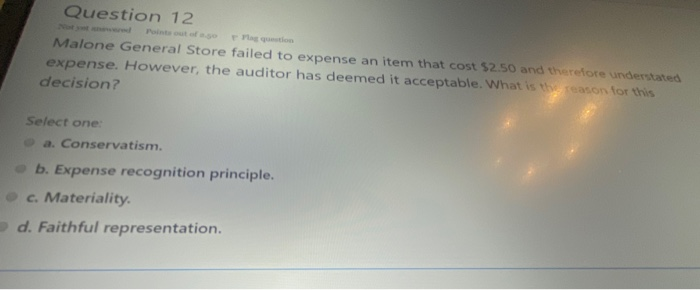

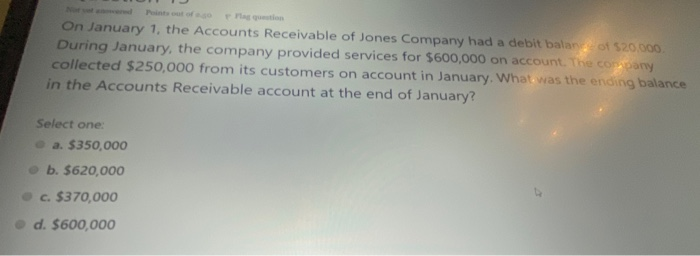

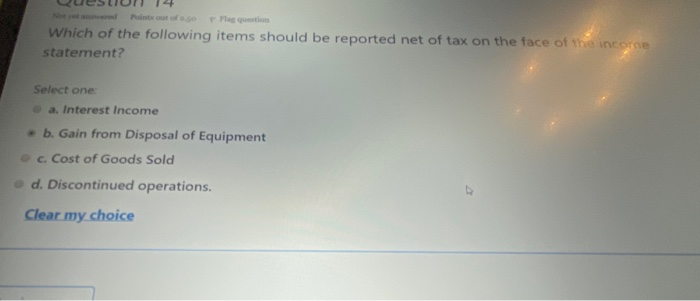

Question 6 Caesar Imports is a common shareholder of Kaiser Industries and has received cash dividend from Kaiser. Which of the following should appear in Caesar's journal entry Select one a. Credit Dividend Income. b. Credit Cash. c. Debit Dividend Payable. d. Debit Cash Dividend. The objectives of financial reporting include all of the following except to provide information that Select one: a. is useful to the Internal Revenue Service in allocating the tax burden to the business community b. is useful to those making investment and credit decisions. - c. is helpful in assessing future cash flows. d. identifies the economic resources (assets) and the claims to those resources (liabilities and Clear my choice Fatto Accrual accounting is used because Select one: - cash flows are not important. b. it provides a better indication of ability to generate cash flows than the basis c. it recognizes revenues when cash is received and expenses when cash is paid. d. none of the above. Paulo Question 12 Malone General Store failed to expense an item that cost $2.50 and therefore understated expense. However, the auditor has deemed it acceptable. What is the season for this decision? Select one a. Conservatism. b. Expense recognition principle. c. Materiality. d. Faithful representation. On January 1, the Accounts Receivable of Jones Company had a debit balance of $20.000 During January, the company provided services for $600,000 on account. The company collected $250,000 from its customers on account in January. What was the ending balance in the Accounts Receivable account at the end of January? Select one a. $350,000 b. $620,000 c. $370,000 d. $600,000 les question Which of the following items should be reported net of tax on the face of the income statement? Select one a. Interest Income b. Gain from Disposal of Equipment c. Cost of Goods Sold d. Discontinued operations. Clear my choice

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started