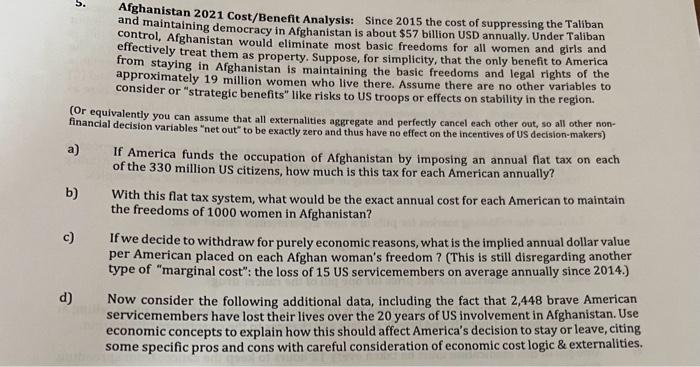

Afghanistan 2021 Cost/Benefit Analysis: Since 2015 the cost of suppressing the Taliban and maintaining democracy in Afghanistan is about $57 billion USD annually. Under Taliban control, Afghanistan would eliminate most basic freedoms for all women and girls and effectively treat them as property. Suppose, for simplicity, that the only benefit to America from staying in Afghanistan is maintaining the basic freedoms and legal rights of the approximately 19 million women who live there. Assume there are no other variables to consider or "strategic benefits" like risks to US troops or effects on stability in the region. (Or equivalently you can assume that all externalities aggregate and perfectly cancel each other out, so all other nonfinancial decision variables "net out" to be exactly zero and thus have no effect on the incentives of US decision-makers) a) If America funds the occupation of Afghanistan by imposing an annual flat tax on each of the 330 million US citizens, how much is this tax for each American annually? b) With this flat tax system, what would be the exact annual cost for each American to maintain the freedoms of 1000 women in Afghanistan? c) If we decide to withdraw for purely economic reasons, what is the implied annual dollar value per American placed on each Afghan woman's freedom ? (This is still disregarding another type of "marginal cost": the loss of 15 US servicemembers on average annually since 2014.) d) Now consider the following additional data, including the fact that 2,448 brave American servicemembers have lost their lives over the 20 years of US involvement in Afghanistan. Use economic concepts to explain how this should affect America's decision to stay or leave, citing some specific pros and cons with careful consideration of economic cost logic \& externalities. Afghanistan 2021 Cost/Benefit Analysis: Since 2015 the cost of suppressing the Taliban and maintaining democracy in Afghanistan is about $57 billion USD annually. Under Taliban control, Afghanistan would eliminate most basic freedoms for all women and girls and effectively treat them as property. Suppose, for simplicity, that the only benefit to America from staying in Afghanistan is maintaining the basic freedoms and legal rights of the approximately 19 million women who live there. Assume there are no other variables to consider or "strategic benefits" like risks to US troops or effects on stability in the region. (Or equivalently you can assume that all externalities aggregate and perfectly cancel each other out, so all other nonfinancial decision variables "net out" to be exactly zero and thus have no effect on the incentives of US decision-makers) a) If America funds the occupation of Afghanistan by imposing an annual flat tax on each of the 330 million US citizens, how much is this tax for each American annually? b) With this flat tax system, what would be the exact annual cost for each American to maintain the freedoms of 1000 women in Afghanistan? c) If we decide to withdraw for purely economic reasons, what is the implied annual dollar value per American placed on each Afghan woman's freedom ? (This is still disregarding another type of "marginal cost": the loss of 15 US servicemembers on average annually since 2014.) d) Now consider the following additional data, including the fact that 2,448 brave American servicemembers have lost their lives over the 20 years of US involvement in Afghanistan. Use economic concepts to explain how this should affect America's decision to stay or leave, citing some specific pros and cons with careful consideration of economic cost logic \& externalities