Question

AFIN 2053 Financial Management Please note that there are two components to this assignment. This assignment is worth 15% of your total grade. Please see

AFIN 2053 Financial Management Please note that there are two components to this assignment. This assignment is worth 15% of your total grade. Please see submission instructions in ilearn. This is a research assignment and requires the use of independent, academic research. In this assignment, you have been lucky enough to get a role as a tutor of Afin 2053. In the attached files is an assignment question and a students answer that unfortunately contains errors. (see attached files Documents 1 and 2) For this assignment you are required to review the assignment answer provided for Jazzy Juices and write a description of each error and why they are in fact errors. Your answer must be concise and contain excellent spelling, grammar and referencing. You will also have to devote one paragraph as a reflection on what you learnt from this process. 1. Ability to identify errors made and the reason for those errors.(10 Marks) 2. Grammar, spelling and referencing style (3 Marks) 3. Depth and Quality of reflection undertaken. (2 marks)

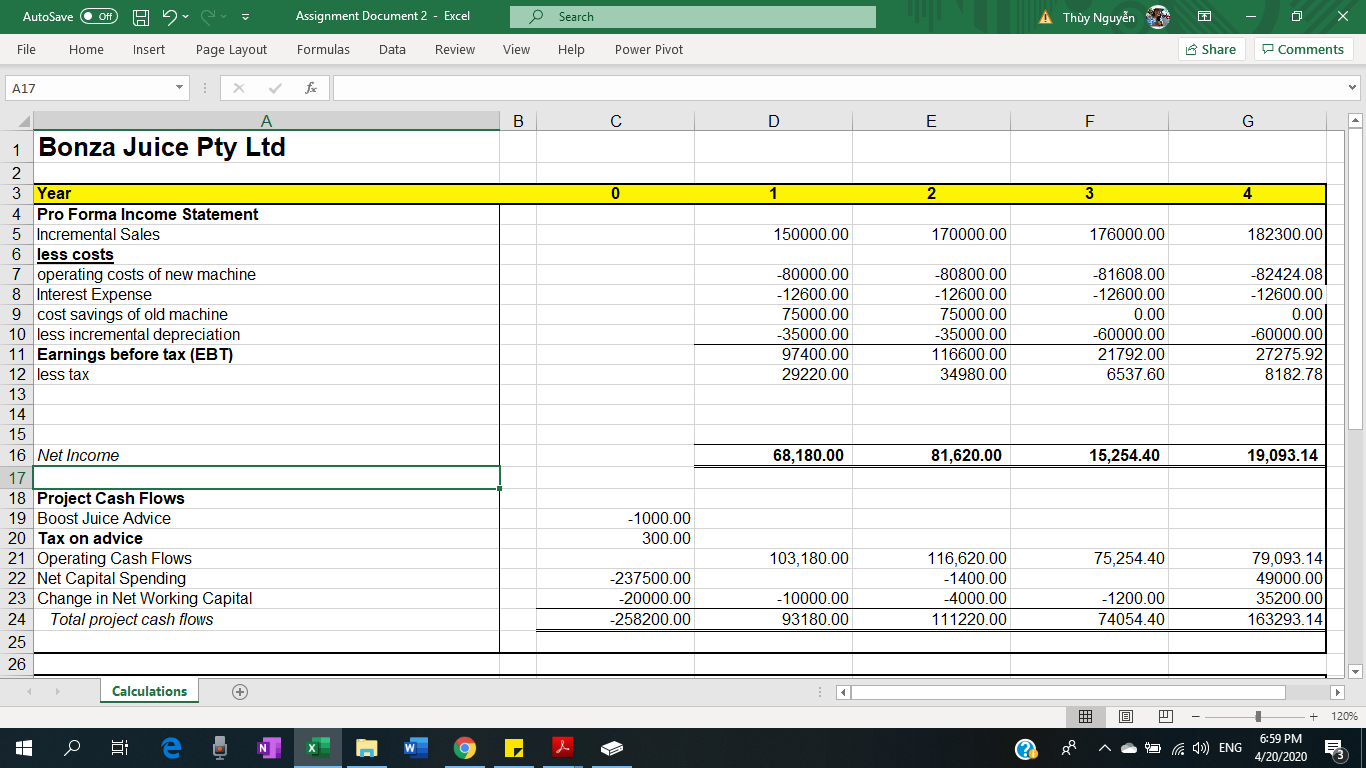

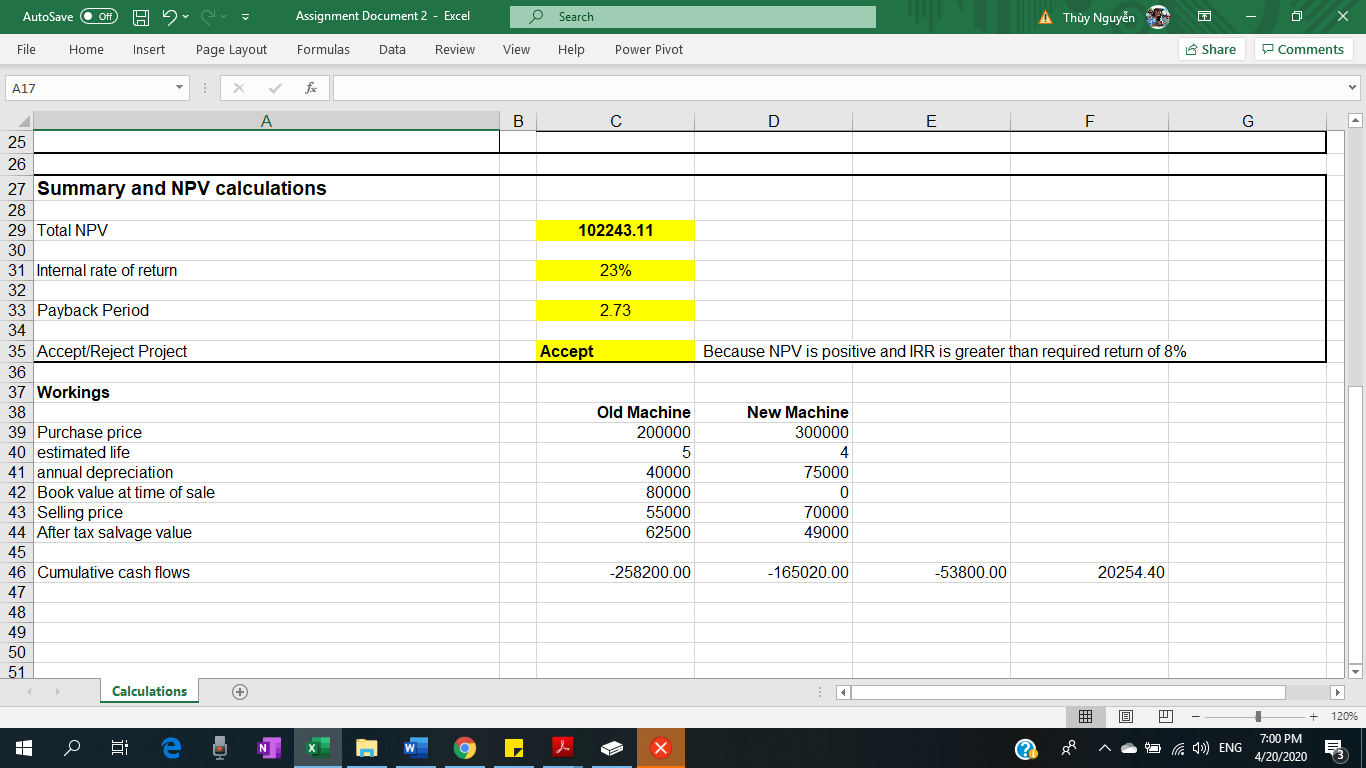

Jazzy Juice Pty Ltd Barry Jazzy is the Managing Director of Jazzy Juice Pty. Ltd. which operates a chain of stores located within major shopping malls. The flagship store is in the Warriewood Shopping Centre on the Northern Beaches of Sydney. The store currently achieves annual sales of $200,000 of fresh fruit juice, $20,000 of canned soft drinks and $15,000 of packaged flavoured milk drinks. Barry is interested in purchasing the Whizzer 2.0 for the Warriewood store, which can produce smoothies in addition to the usual fresh fruit juices. The machine currently sells for $300,000. In order to assess the suitability of the new machine, Barry consulted Barbara Boost from the famous Boost Juice family. Barbara charged $1,000 for her advice. This is immediately fully tax-deductible. The old juicing machine can be sold for $55,000 to a competitor, CarrotnGinger Plus. The new machine has the capacity to increase Jazzy Juices sales of traditional fruit juices to $250,000 per year. This is expected to remain constant forever. Sales of smoothies are expected to be $100,000 in the first year, $120,000 in the second year, and to increase by 5% each year thereafter. It is expected, however, that Jazzy Juice will cease sales of soft drinks and flavoured milk drinks. Assume all cash flows are in nominal terms. Some additional tools will be required to run the Whizzer 2.0 machine. These presently have a cost of $8,000 if purchased new. Barry does however have some of the required tools at his home. These have a book value of $3,000. He is relieved he still has them, as he recently tried to sell them but was not able to attract any buyers. The cash operating costs of the old machine are $75,000 per year. The new machine is more expensive to run. It is expected to have operating costs of $80,000 in the first year and this is expected to increase by 1% each year thereafter due to the extra maintenance involved with high volumes of production. Working capital of $20,000 is required immediately. This is mainly for yoghurt, milk and fruit. Total Net Working Capital at the end of each year will be about 20% of sales for that year. The old machine has an expected life of two years. In two years time the old machine (if it is kept) could be sold to a scrap merchant for about $2,000. The new machine has an expected life of four years and could be sold for $70,000 at the end of four years. The new machine will be depreciated down to zero using the straight-line method. Regarding the new machine, the company plans to 2(3) depreciate it over the estimate life (4 years). However the Australian Taxation Office (ATO) stipulates that for tax purposes the effective life of such machines is 5 years. The accountant has specified that they must follow corporate policy and depreciate over 4 years. The old machine was purchased 3 years ago for $200,000 and Barry has followed the ATO guidelines in determining the depreciation for this machine, assuming a 5 year life. The store currently sublets a portion of their floor space to Barrys friend Susan Spencer, who creates fruit-inspired artwork to sell at local markets. Susan pays rent to Jazzy Juice of $3,000 per year for the space. This is expected to increase by 2% at the end of every year. Susan will immediately be asked to leave the premises so as to fit the new machine. The company plans to borrow $200,000 from the National Juice Lending Authority, which charges an interest rate of 6.3% per annum. This is needed to partially finance the new machine. The interest is tax deductible to the company. The company will make interest-only payments each year, and at the end of the four years will repay the principal of $200,000. The current rate of inflation is 3%. Jazzy Juice pays tax at a rate of 30%. All amounts are in nominal dollars. The real rate of return of the ASX200 index is 10% pa and the real rate of return required on such projects is 8% pa. All rates are given as effective annual rates. 3(3) Questions Prepare a report in Spreadsheet form detailing: (a) A pro forma income statement for the project. (8 marks) (b) Calculation of Operating Cash Flows. (2 marks) (c) Calculation of Net Capital Spending. (6 marks) (d) Calculation of the annual change in Net Working Capital. (5 marks) (e) Calculation of the total project cash flows. (1 mark) (f) Calculation of the net present value of the cash flows. (2 marks) (g) Calculation of the internal rate of return on the project. (2 marks) (h) Calculation of the payback period of the project. (2 marks) (i) Whether Jazzy Juice should proceed with the purchase of the new machine, clearly outlining your reasons. (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started