Answered step by step

Verified Expert Solution

Question

1 Approved Answer

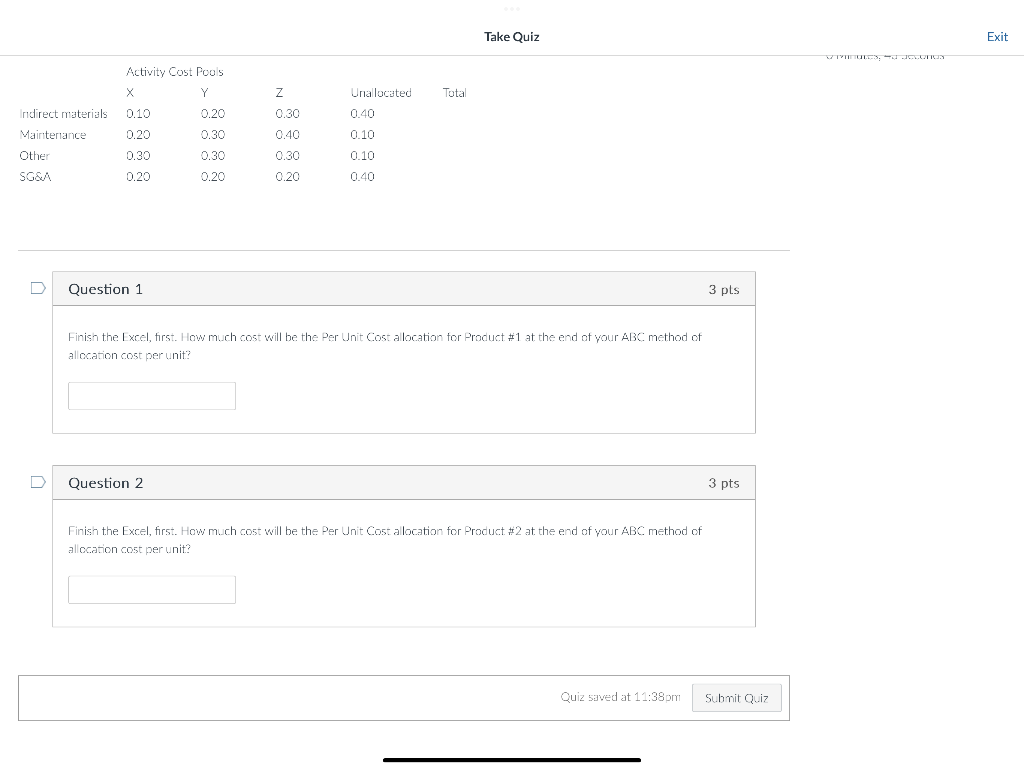

AFinish the Excel. first. How much cost will be the Per Unit Cost allocation for Product #1 at the end of your ABC method of

AFinish the Excel. first. How much cost will be the Per Unit Cost allocation for Product #1 at the end of your ABC method of allocation cost per unit?

BFinish the Excel, first. How much cost will be the Per Unit Cost allocation for Product #2 at the end of your ABC method of allocation cost per unit?

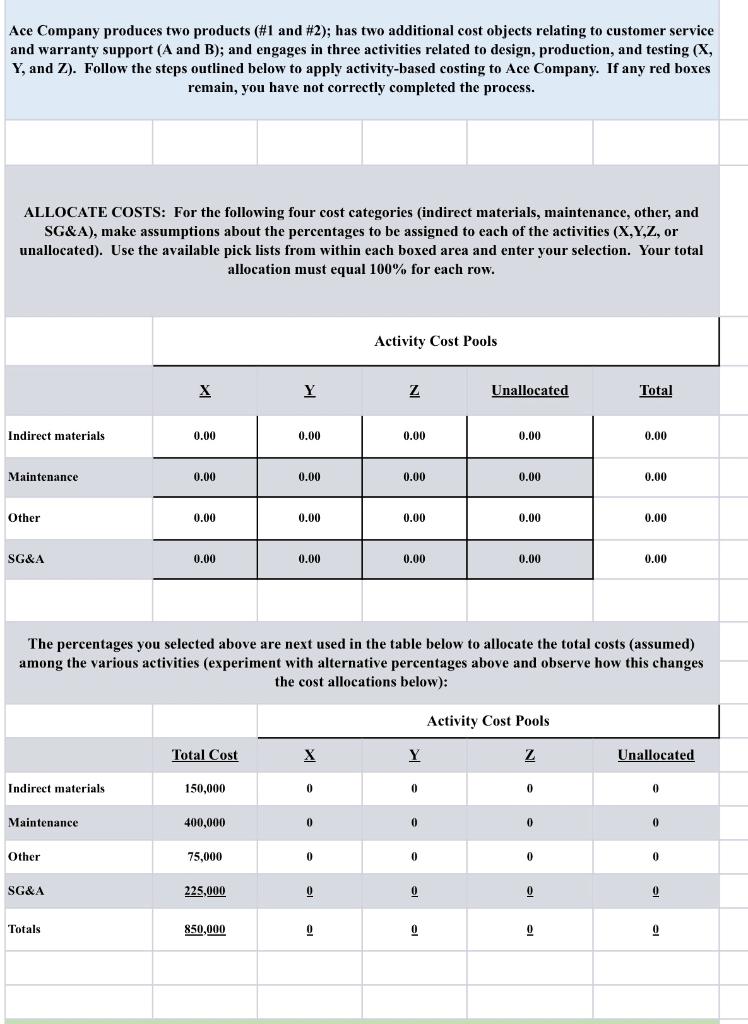

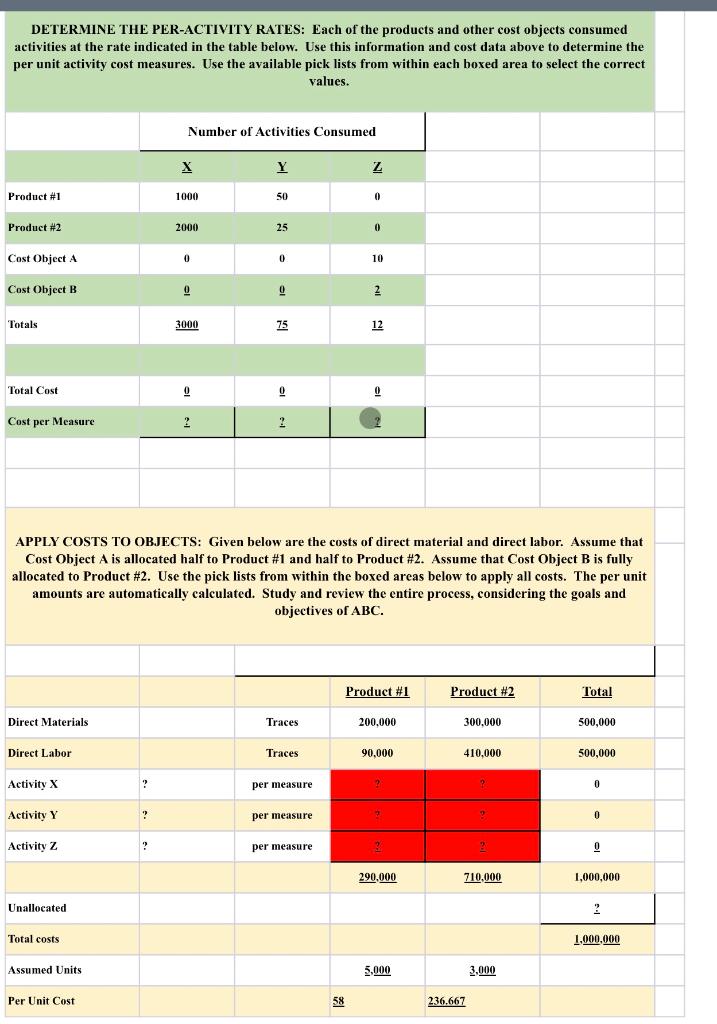

Ace Company produces two products (\#1 and \#2); has two additional cost objects relating to customer service and warranty support ( A and B ); and engages in three activities related to design, production, and testing ( X, Y, and Z). Follow the steps outlined below to apply activity-based costing to Ace Company. If any red boxes remain, you have not correctly completed the process. ALLOCATE COSTS: For the following four cost categories (indirect materials, maintenance, other, and SG\&A), make assumptions about the percentages to be assigned to each of the activities (X,Y,Z, or unallocated). Use the available pick lists from within each boxed area and enter your selection. Your total allocation must equal 100% for each row. The percentages you selected above are next used in the table below to allocate the total costs (assumed) among the various activities (experiment with alternative percentages above and observe how this changes the cost allocations below): DETERMINE THE PER-ACTIVITY RATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Use this information and cost data above to determine the per unit activity cost measures. Use the available pick lists from within each boxed area to select the correct values. APPLY COSTS TO OBJECTS: Given below are the costs of direct material and direct labor. Assume that Cost Object A is allocated half to Product \#1 and half to Product \#2. Assume that Cost Object B is fully allocated to Product \#2. Use the pick lists from within the boxed areas below to apply all costs. The per unit amounts are automatically calculated. Study and review the entire process, considering the goals and objectives of ABC. Finish the Excel, tirst. How much cost will be the Per Unit Cost alocation tor Product ti at the end of vour ABC. method of allocation cost per unit? Question 2 Finish the Excel, first. How much cost will be the Per Unit Cost alocation for Product ti 2 at the end of your ABC method of allocation cost per unit? Ace Company produces two products (\#1 and \#2); has two additional cost objects relating to customer service and warranty support ( A and B ); and engages in three activities related to design, production, and testing ( X, Y, and Z). Follow the steps outlined below to apply activity-based costing to Ace Company. If any red boxes remain, you have not correctly completed the process. ALLOCATE COSTS: For the following four cost categories (indirect materials, maintenance, other, and SG\&A), make assumptions about the percentages to be assigned to each of the activities (X,Y,Z, or unallocated). Use the available pick lists from within each boxed area and enter your selection. Your total allocation must equal 100% for each row. The percentages you selected above are next used in the table below to allocate the total costs (assumed) among the various activities (experiment with alternative percentages above and observe how this changes the cost allocations below): DETERMINE THE PER-ACTIVITY RATES: Each of the products and other cost objects consumed activities at the rate indicated in the table below. Use this information and cost data above to determine the per unit activity cost measures. Use the available pick lists from within each boxed area to select the correct values. APPLY COSTS TO OBJECTS: Given below are the costs of direct material and direct labor. Assume that Cost Object A is allocated half to Product \#1 and half to Product \#2. Assume that Cost Object B is fully allocated to Product \#2. Use the pick lists from within the boxed areas below to apply all costs. The per unit amounts are automatically calculated. Study and review the entire process, considering the goals and objectives of ABC. Finish the Excel, tirst. How much cost will be the Per Unit Cost alocation tor Product ti at the end of vour ABC. method of allocation cost per unit? Question 2 Finish the Excel, first. How much cost will be the Per Unit Cost alocation for Product ti 2 at the end of your ABC method of allocation cost per unitStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started