Question

After a few years, your teams business has thrived. You are approached by the private banker of a renowned institution to invest your hard-earned cash

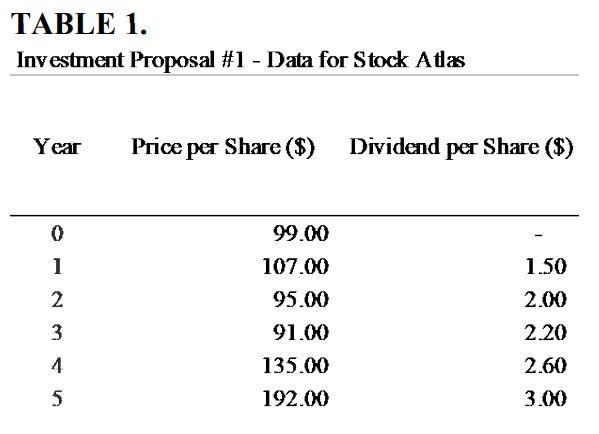

After a few years, your teams business has thrived. You are approached by the private banker of a renowned institution to invest your hard-earned cash in securities. The first investment proposal is a single stock for a company called Atlas. Atlas has the following historical price quotes and dividend payments.

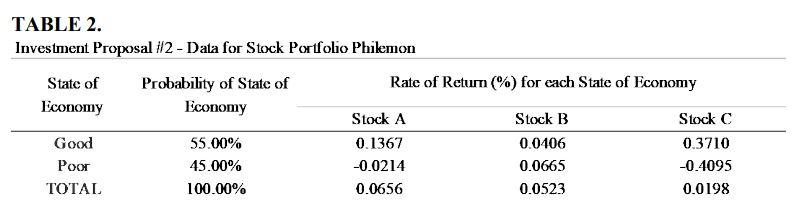

The second investment proposal is a combination of three stocks in a portfolio called Philemon. To inform your decision, the private banker indicated the expected rate of return for each of the stock, given two different economic situations. The proposal is to invest 25 percent each in stock A and C, and 50 percent in stock B.

The third investment proposal is a bond issued by Demeter Corp.. The private banker has laid down a base scenario to help you determine the total real return on this investment. You will buy the bond today for a clean price of $1,035.00. The bond makes annual coupon payments of 6.5 percent and mature in 10 years. You will sell the bond in one year from now when the required return on the bonds will be forecast to be 6.2%. Assume the inflation rate over this coming year is 2.5%.

(a) Determine the arithmetic and geometric returns for the Atlas stock. (15 marks)

(b) Compute the expected return for the Philemon portfolio of three (3) stocks. (10 marks)

(c) Compute the variance and the standard deviation for the portfolio. (7 marks)

(d) Compute the expected return and the standard deviation if the portfolio is invested 60 percent in stock B and 20 percent each in stock A and C. Discuss the change. (8 marks)

(e) Calculate what would be your total real return on investment for the Demeter Corp. bond. (10 marks)

TABLE 1. Investment Proposal #1 - Data for Stock Atlas Year Price per Share ($) Dividend per Share ($) 0 1 2 1.50 2.00 99.00 107.00 95.00 91.00 135.00 192.00 3 2.20 > 2.60 3.00 5 TABLE 2. Investment Proposal i/2 - Data for Stock Portfolio Philemon State of Probability of State of Rate of Retum (%) for each State of Economy Economy Economy Stock A Stock B Stock C Good 55.00% 0.1367 0.0106 0.3710 Poor 45.00% -0.0214 0.0665 -0.4095 TOTAL 100.00% 0.0656 0.0523 0.0198Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started