Question

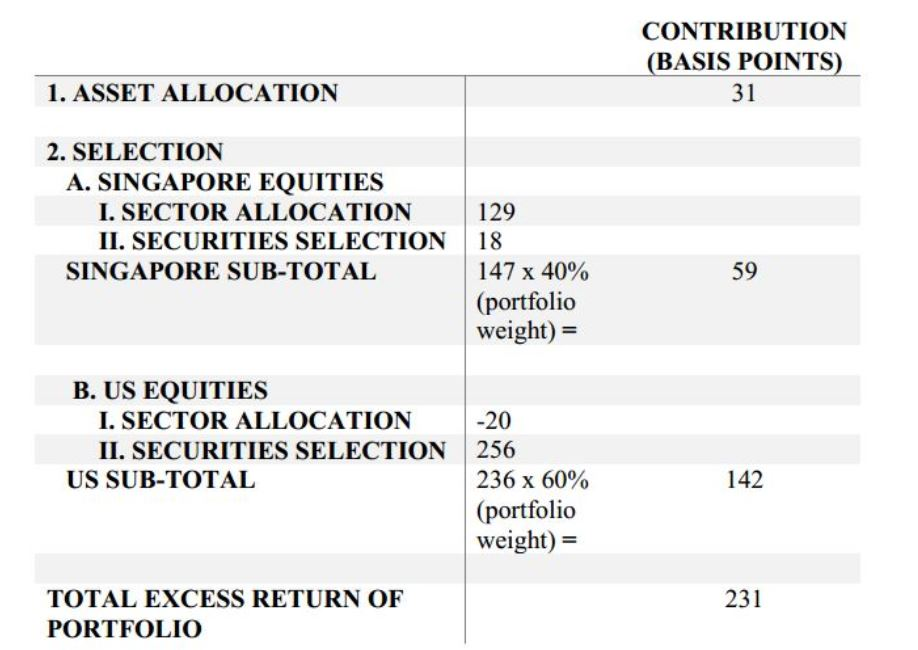

After a year, you compile the portfolio attribution report for Kyles portfolio. Analyse the portfolio returns by: (d) Calculating the contribution (in basis points) of

After a year, you compile the portfolio attribution report for Kyles portfolio.

Analyse the portfolio returns by: (d) Calculating the contribution (in basis points) of both the sector allocation of Singapore equities and the securities selection of US equities. (e) Discussing the results of the portfolio attribution report.

more info

https://www.chegg.com/homework-help/questions-and-answers/winter-coming-avid-fan-game-thrones-tv-series-kyle-could-help-smile-sadly-fiction-become-r-q21844861

look at the link above before commenting on incomplete because it is a continous questions.

1. ASSET ALLOCATION 2. SELECTION A. SINGAPORE EQUITIES 129 I. SECTOR ALLOCATION II. SECURITIES SELECTION 18 147 x 40% SINGAPORE SUB-TOTAL (portfolio weight) B. US EQUITIES I. SECTOR ALLOCATION 20 II. SECURITIES SELECTION 256 236 x 60% US SUB-TOTAL (portfolio weight) TOTAL EXCESS RETURN OF PORTFOLIO CONTRIBUTION BASIS POINTS 31 142 231 1. ASSET ALLOCATION 2. SELECTION A. SINGAPORE EQUITIES 129 I. SECTOR ALLOCATION II. SECURITIES SELECTION 18 147 x 40% SINGAPORE SUB-TOTAL (portfolio weight) B. US EQUITIES I. SECTOR ALLOCATION 20 II. SECURITIES SELECTION 256 236 x 60% US SUB-TOTAL (portfolio weight) TOTAL EXCESS RETURN OF PORTFOLIO CONTRIBUTION BASIS POINTS 31 142 231Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started