Question

After graduating, you join the headquarter of Buck Star, a famous cafe chain. Buck Star has the following financial information: A market capitalization (value of

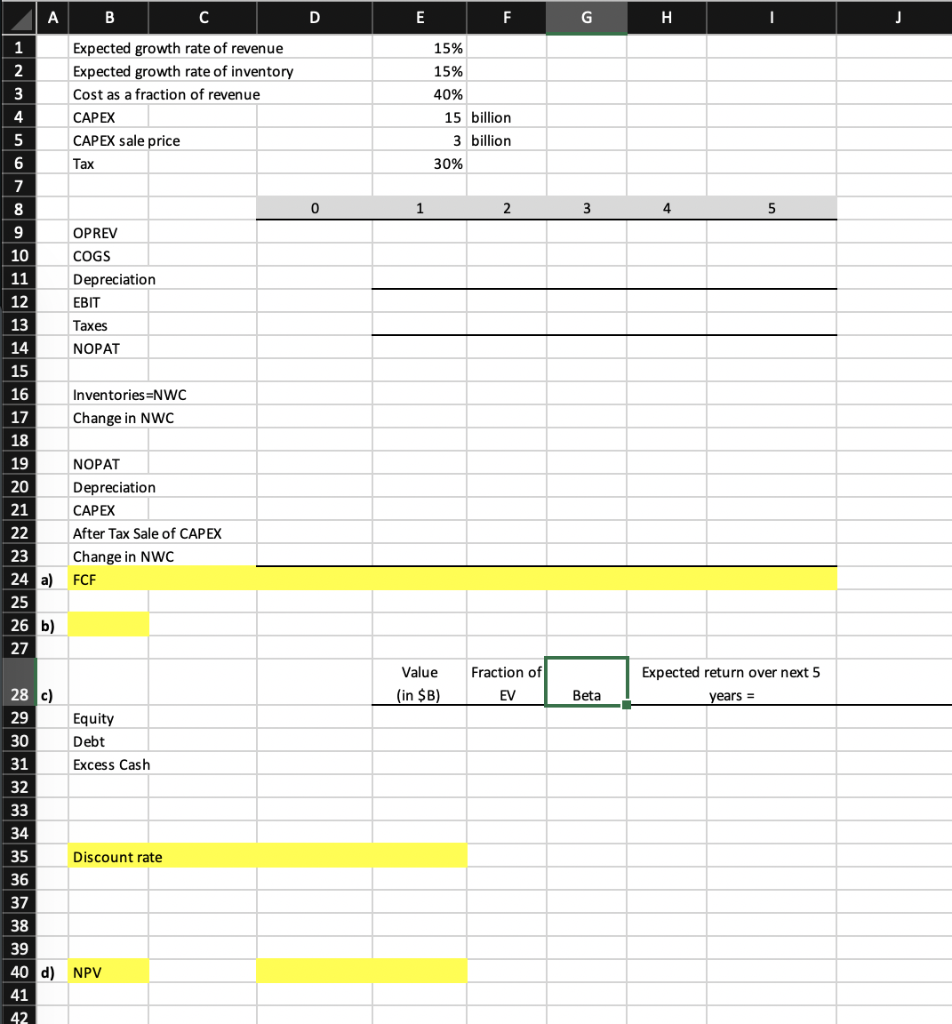

After graduating, you join the headquarter of Buck Star, a famous cafe chain. Buck Star has the following financial information:

-

A market capitalization (value of equity) of 85 billion USD.

-

Debt with a face value of 30 billion USD. Currently the debt has a market valuation of 26 billion USD.

-

A negligible amount of excess cash and cash equivalent assets.

-

An equity beta of 1.2.

-

A debt beta of 0.15 based on Moody's long-term credit rating of A+.

Your first task is to figure out whether to expand your business in Southeastern Asia, a market for potential growth. Your team makes the following projections over the next 5 years of this project.

-

Total revenues are expected to be $5 billion per annum starting in one year (at t = 1), and expected to grow at 15% for the four years after that (until t = 5).

-

Costs of goods sold are expected to be 40% of the total revenues. These costs include the coffee beans required to brew the coffee.

-

The project will require an initial capital expenditure of $15 billion (at t=0). It can be depreciated over the next 5 years (from t = 1 through t = 5) using straight line depreciation down to a remaining accounting value of 0.

-

Coffee beans must be purchased a year in advance. The project will require an initial inventory of $1.3 billion in coffee beans (at t = 0) and this is expected to grow at 15% per year over the lifetime of the project. Inventories are needed at time t only if the project continues at time t+1.

-

The project liquidates at the end of five years (at t = 5). The current plan is to leave this market and sell the equipment. The estimated sale price is $3 billion.

-

The marginal corporate tax rate is 30%. The current yield of a 1-year Treasury bond is 1.2% and the current yield of a 5-year Treasury bond is 2.1%. Going

forward you expect the average stock market return to be 7%.

-

a) Calculate the stream of free-cash flows (FCF) generated by the project.

-

b) What is the IRR (internal rate of return) of the projects cash flows?

-

c) Calculate the appropriate cost of capital for this project using CAPM.

-

d) Under this cost of capital, what is the NPV of the project?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started