Answered step by step

Verified Expert Solution

Question

1 Approved Answer

After losing his own zoo in a legal battle, Joe Exotic is in the process of planning his next business venture. At the moment, he's

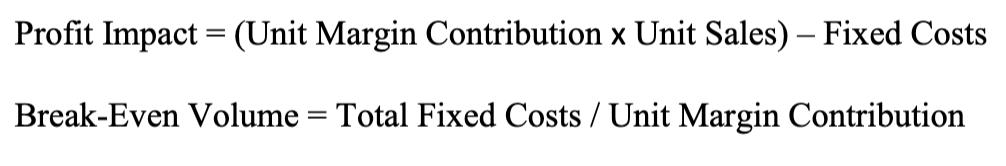

After losing his own zoo in a legal battle, Joe Exotic is in the process of planning his next business venture. At the moment, he's thinking about selling plush toy tigers to other zoos' gift shops in the US and Canada. However, before embarking on his next business adventure, he wants to estimate the market share he will need to break even on his investment. Joe will manufacturer the toy tigers and sell them to a wholesaler who will then sell them to zoo gift shops throughout the US and Canada. The zoo gift shops will price the toy tigers at $10 and take a 30% gross margin, while the wholesaler will take a 20% gross margin. Joe estimated that his fixed costs will be $200,000 and his variable costs will be $3.60 per unit. An industry report estimates that a total of 10 million plush toy animals are sold in US and Canadian zoo gift shops every year.

Profit Impact (Unit Margin Contribution x Unit Sales) - Fixed Costs Break-Even Volume = Total Fixed Costs / Unit Margin Contribution

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started