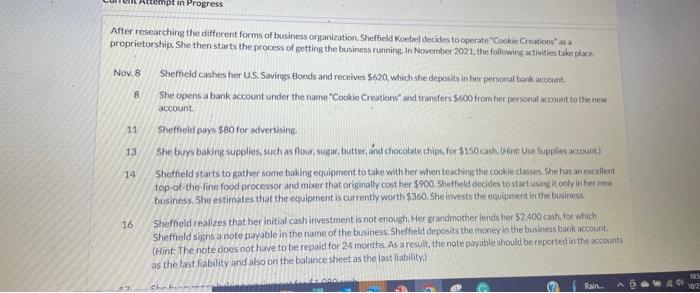

After researching the different forms of business organization. Sheffield Koebel decides to operate "Cooket Creations" as a proprietorship. She then starts the procers of getting the business funing. In November 202.1, the followirg activities tabo place. Nov. 8 Sheffield cashes her U.S. Sovings Bonds and rectives $620 which she deposits in her personal bank account. 8. She opens a bank account under the name "Cookie Creations" and transfers \$600 from her per sonal actount to the new account. 11 Sheffield pays $80 for advertising: 13 She buys baking supplies, such as flour, sugar, butter, nd chocolate chips, for $150 cash. (Hint Use Supplies accpuns.) 14 Sheffeld starts to gather some baking equipment to take with her wien texching the cookie classes. She tas an racellent top-of-the-line food processor and miver that oripinally cost her $900. Shetfinld decides to start using lf only in her new business. She estimates that the equipment is currently worth. $360. She invests the equiperent in the business. 16 Sheffeld realizes that her initial cash investment is not enough. Her grandmother lends her $2.400cach, for which Sheffield signs a note payable in the name of the business. Sheffield deposits the noney in the basiness bark accoant. (Hint The note does not have to be repajd for 24 moriths. As a result, the note payable ahould be reported in the accounts as the last liability and also on the balance sheet as the last liability) After researching the different forms of business organization. Sheffield Koebel decides to operate "Cooket Creations" as a proprietorship. She then starts the procers of getting the business funing. In November 202.1, the followirg activities tabo place. Nov. 8 Sheffield cashes her U.S. Sovings Bonds and rectives $620 which she deposits in her personal bank account. 8. She opens a bank account under the name "Cookie Creations" and transfers \$600 from her per sonal actount to the new account. 11 Sheffield pays $80 for advertising: 13 She buys baking supplies, such as flour, sugar, butter, nd chocolate chips, for $150 cash. (Hint Use Supplies accpuns.) 14 Sheffeld starts to gather some baking equipment to take with her wien texching the cookie classes. She tas an racellent top-of-the-line food processor and miver that oripinally cost her $900. Shetfinld decides to start using lf only in her new business. She estimates that the equipment is currently worth. $360. She invests the equiperent in the business. 16 Sheffeld realizes that her initial cash investment is not enough. Her grandmother lends her $2.400cach, for which Sheffield signs a note payable in the name of the business. Sheffield deposits the noney in the basiness bark accoant. (Hint The note does not have to be repajd for 24 moriths. As a result, the note payable ahould be reported in the accounts as the last liability and also on the balance sheet as the last liability)