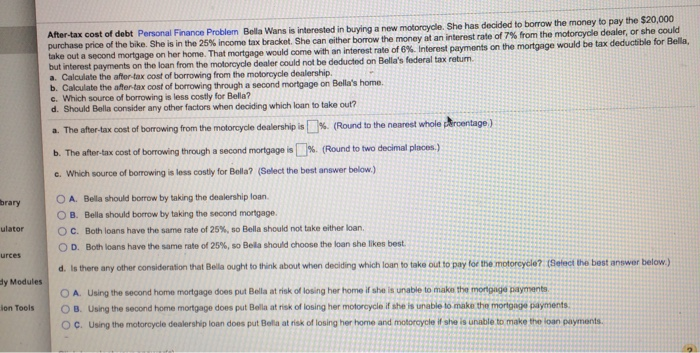

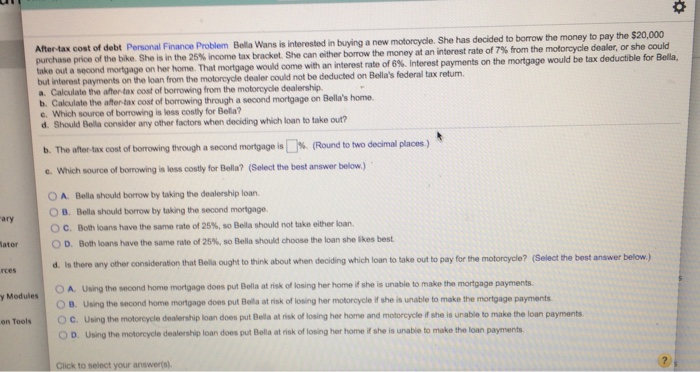

After-tax cost of debt Personal Finance Problem Bolla Wans is interested in buying a new motorcycle. She has decided to borrow the money to pay the $20,000 purchase price of the bike. She is in the 25% income tax bracket. She can either borrow the money of an interest rate of 7% from the motorcycle dealer, or she could take out a second mortgage on her home. That mortgage would come with an interest rate of 6%. Interest payments on the mortgage would be tax deductible for Bella, but interest payments on the loan from the motorcycle dealer could not be deducted on Bella's federal tax ratum. a. Calculate the after-tax cost of borrowing from the motorcycle dealership. b. Calculate the after-tax cost of borrowing through a second mortgage on Bella's home. c. Which source of borrowing is less costly for Bella? d. Should Bella consider any other factors when deciding which loan to take out? a. The after-tax cost of borrowing from the motorcycle dealership is % (Round to the nearest whole prontage) b. The after-tax cost of borrowing through a second mortgage is %. (Round to two decimal places.) c. Which source of borrowing is less costly for Bella? (Select the best answer below.) brary ulator O A. Bella should borrow by taking the dealership loan O B. Bella should borrow by taking the second mortgage. O C. Both loans have the same rate of 25%, so Bella should not take either loan. OD. Both loans have the same rate of 25%, so Bela should choose the loan she likes best. d. Is there any other consideration that Bella ought to think about when deciding which loan to take out to pay for the motorcycle? (Select the best answer below.) urces dy Modules Ion Tools O A Using the second home mortgage does put Bella at risk of losing her home if she is unable to make the mortgage payments OB. Using the second home mortgage does put Bella at risk of losing her motorcycle if she is unable to make the more payments O C. Using the motorcycle dealership loan doos put Bella at risk of losing her home and motorcycle if she is unable to make the loan payments. After-tax cost of debt Personal Finance Problem Bolla Wans is interested in buying a new motorcycle She has decided to borrow the money to pay the $20,000 purchase price of the bike. She is in the 25% income tax bracket. She can either borrow the money at an interest rate of 7% from the motorcycle dealer, or she could take out a second mortgage on her home. That mortgage would come with an interest rate of 6%. Interest payments on the mortgage would be tax deductible for Bella but interest payments on the loan from the motorcycle dealer could not be deducted on Bella's federal tax retum a. Calculate the after tax cost of borrowing from the motorcycle dealership b. Calculate the after tax cost of borrowing through a second mortgage on Bella's home. e. Which source of borrowing is less costly for Bella? d. Should Bella consider any other factors when deciding which loan to take out? b. The after-tax cost of borrowing through a second mortgage is % (Round to two decimal places) e. Which source of borrowing is less costly for Bela? (Select the best answer below) O A Bella should borrow by taking the dealership loan OB Bells should borrow by taking the second mortgage OC. Both loans have the same rate of 25%, so Bella should not take either loan OD. Both loans have the same rate of 25%, so Bella should choose the loan she likes best d. Is there any other consideration that Bella ought to think about when deciding which loan to take out to pay for the motorcycle? (Select the best answer below.) lator rces Modules O A Using the second home mortgage does put Bella at risk of losing her home if she is unable to make the mortgage payments OB. Using the second home mortgage does put Bella at risk of losing her motorcycle she is unable to make the mortgage payments c. Using the motorcycle dealership loan does put Bela trisk of losing her home and motorcycle she is unable to make the loan payments OD. Using the motorcycle dealership loan does put Bella at risk of losing her home if she is unable to make the loan payments on Tools Click to select your answers