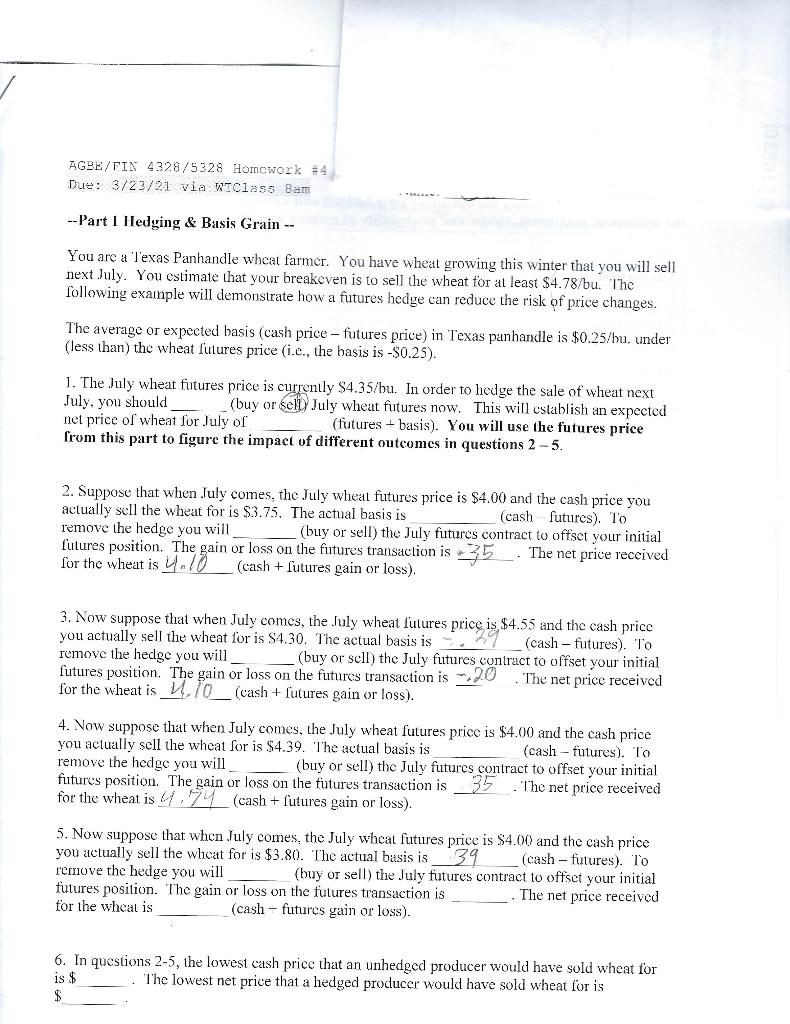

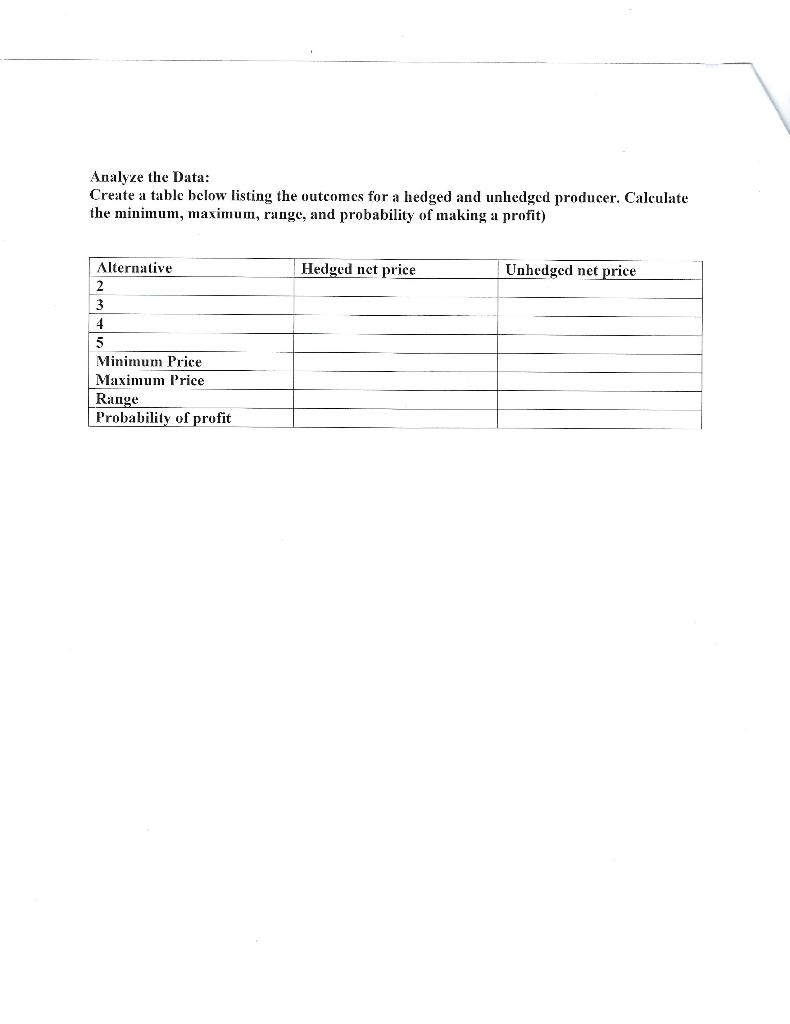

AGBE/FIN 4328/5328 Homework #4 Due: 3/23/21 via WIClass Bam --Part I Hedging & Basis Grain -- You are a Texas Panhandle wheat farmer. You have wheat growing this winter that you will sell next July. You estimate that your breakeven is to sell the wheat for at least $4.78/bu. The following example will demonstrate how a futures hedge can reduce the risk of price changes. The average or expected basis (cash price - futures price) in Texas panhandle is $0.25/bu. under (less than) the wheat futures price (i.e., the basis is -$0.25). 1. The July wheat futures price is currently $4.35/bu. In order to hedge the sale of wheat next July, you should (buy or sely) July wheat futures now. This will establish an expected net price of wheat for July of (futures + basis). You will use the futures price from this part to figure the impact of different outcomes in questions 2-5. 2. Suppose that when July comes, the July wheat futures price is $4.00 and the cash price you actually sell the wheat for is $3.75. The actual basis is (cash futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is - 35 The net price received for the wheat is 4.10 (cash + utures gain or loss). 3. Now suppose that when July comes, the July wheat futures price is $4.55 and the cash price you actually sell the wheat for is $4.30. The actual basis is (cash-futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is - 20 The net price received for the wheat is U. 10_(cash + futures gain or loss). 4. Now suppose that when July comes, the July wheat futures price is $4.00 and the cash price you actually sell the wheat for is $4.39. The actual basis is (cash-futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is The net price received for the wheat is 4.74 (cash + futures gain or loss). 5. Now suppose that when July comes, the July wheat futures price is $4.00 and the cash price you actually sell the wheat for is $3.80. The actual basis is 39 (cash-futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is The net price received for the whcal is (cash-futures gain or loss). 6. In questions 2-5, the lowest cash price that an unhedged producer would have sold wheat for is $ The lowest net price that a hedged producer would have sold wheat for is $ Analyze the Data: Create a table below listing the outcomes for a hedged and unledged producer. Calculate the minimum, maximum, range, and probability of making a profit) Hedged net price Unhedged net price Alternative 2 3 4 5 Minimum Price Maximum Price Range Probability of profit AGBE/FIN 4328/5328 Homework #4 Due: 3/23/21 via WIClass Bam --Part I Hedging & Basis Grain -- You are a Texas Panhandle wheat farmer. You have wheat growing this winter that you will sell next July. You estimate that your breakeven is to sell the wheat for at least $4.78/bu. The following example will demonstrate how a futures hedge can reduce the risk of price changes. The average or expected basis (cash price - futures price) in Texas panhandle is $0.25/bu. under (less than) the wheat futures price (i.e., the basis is -$0.25). 1. The July wheat futures price is currently $4.35/bu. In order to hedge the sale of wheat next July, you should (buy or sely) July wheat futures now. This will establish an expected net price of wheat for July of (futures + basis). You will use the futures price from this part to figure the impact of different outcomes in questions 2-5. 2. Suppose that when July comes, the July wheat futures price is $4.00 and the cash price you actually sell the wheat for is $3.75. The actual basis is (cash futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is - 35 The net price received for the wheat is 4.10 (cash + utures gain or loss). 3. Now suppose that when July comes, the July wheat futures price is $4.55 and the cash price you actually sell the wheat for is $4.30. The actual basis is (cash-futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is - 20 The net price received for the wheat is U. 10_(cash + futures gain or loss). 4. Now suppose that when July comes, the July wheat futures price is $4.00 and the cash price you actually sell the wheat for is $4.39. The actual basis is (cash-futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is The net price received for the wheat is 4.74 (cash + futures gain or loss). 5. Now suppose that when July comes, the July wheat futures price is $4.00 and the cash price you actually sell the wheat for is $3.80. The actual basis is 39 (cash-futures). To remove the hedge you will (buy or sell) the July futures contract to offset your initial futures position. The gain or loss on the futures transaction is The net price received for the whcal is (cash-futures gain or loss). 6. In questions 2-5, the lowest cash price that an unhedged producer would have sold wheat for is $ The lowest net price that a hedged producer would have sold wheat for is $ Analyze the Data: Create a table below listing the outcomes for a hedged and unledged producer. Calculate the minimum, maximum, range, and probability of making a profit) Hedged net price Unhedged net price Alternative 2 3 4 5 Minimum Price Maximum Price Range Probability of profit