Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ahmad plans to purchase a share that will pay a dividend of RM2 per share in year 1, RM 2,20 per share in year

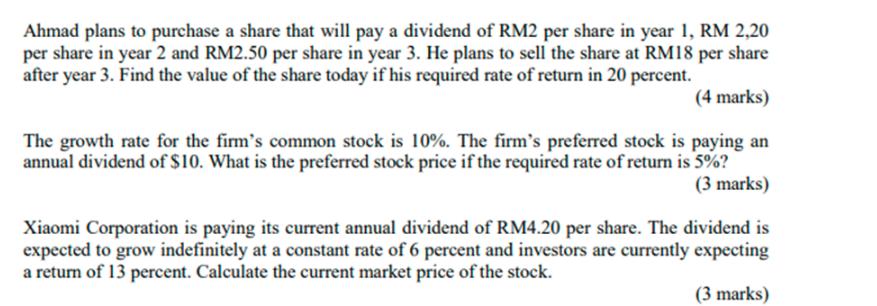

Ahmad plans to purchase a share that will pay a dividend of RM2 per share in year 1, RM 2,20 per share in year 2 and RM2.50 per share in year 3. He plans to sell the share at RM18 per share after year 3. Find the value of the share today if his required rate of return in 20 percent. (4 marks) The growth rate for the firm's common stock is 10%. The firm's preferred stock is paying an annual dividend of $10. What is the preferred stock price if the required rate of return is 5%? (3 marks) Xiaomi Corporation is paying its current annual dividend of RM4.20 per share. The dividend is expected to grow indefinitely at a constant rate of 6 percent and investors are currently expecting a return of 13 percent. Calculate the current market price of the stock. (3 marks)

Step by Step Solution

★★★★★

3.57 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

1 Value of the Share Today To find the value of the share today we need to calculate the present val...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started