Answered step by step

Verified Expert Solution

Question

1 Approved Answer

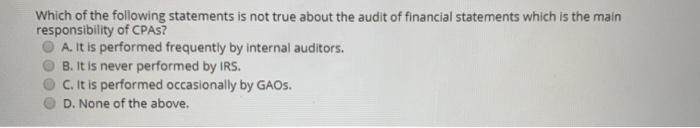

Ahmed is a CPA who is engaged to perform a variety of services to both audit and non-audit clients. Most of his work involves financial

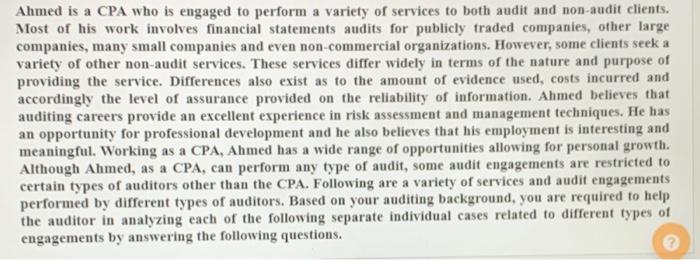

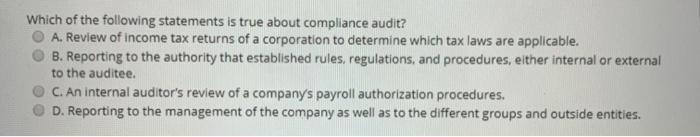

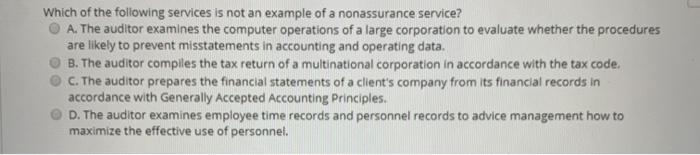

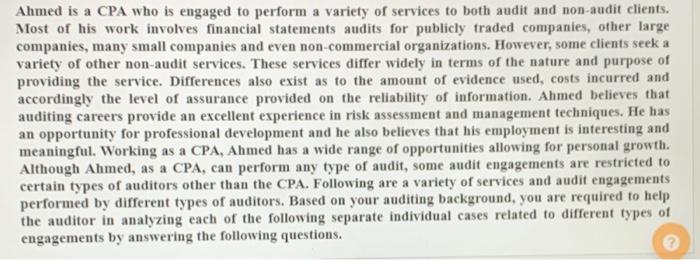

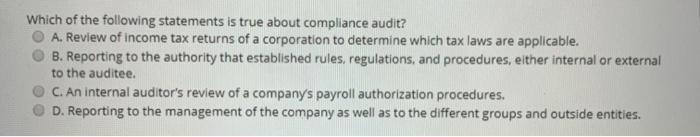

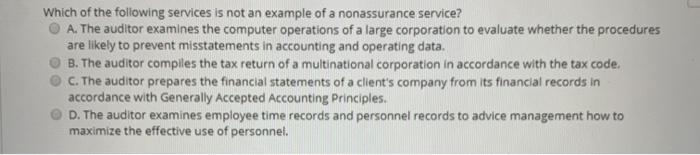

Ahmed is a CPA who is engaged to perform a variety of services to both audit and non-audit clients. Most of his work involves financial statements audits for publicly traded companies, other large companies, many small companies and even non-commercial organizations. However, some clients seek a variety of other non-audit services. These services differ widely in terms of the nature and purpose of providing the service. Differences also exist as to the amount of evidence used, costs incurred and accordingly the level of assurance provided on the reliability of information. Ahmed believes that auditing careers provide an excellent experience in risk assessment and management techniques. He has an opportunity for professional development and he also believes that his employment is interesting and meaningful. Working as a CPA, Ahmed has a wide range of opportunities allowing for personal growth. Although Ahmed, as a CPA, can perform any type of audit, some audit engagements are restricted to certain types of auditors other than the CPA. Following are a variety of services and audit engagements performed by different types of auditors. Based on your auditing background, you are required to help the auditor in analyzing each of the following separate individual cases related to different types of engagements by answering the following questions. Which of the following statements is true about compliance audit? A. Review of income tax returns of a corporation to determine which tax laws are applicable. B. Reporting to the authority that established rules, regulations, and procedures, either internal or external to the auditee. C. An internal auditor's review of a company's payroll authorization procedures. D. Reporting to the management of the company as well as to the different groups and outside entities. Which of the following services is not an example of a nonassurance service? A. The auditor examines the computer operations of a large corporation to evaluate whether the procedures are likely to prevent misstatements in accounting and operating data. B. The auditor compiles the tax return of a multinational corporation in accordance with the tax code. C. The auditor prepares the financial statements of a client's company from its financial records in accordance with Generally accepted Accounting Principles. D. The auditor examines employee time records and personnel records to advice management how to maximize the effective use of personnel. Ahmed is a CPA who is engaged to perform a variety of services to both audit and non-audit clients. Most of his work involves financial statements audits for publicly traded companies, other large companies, many small companies and even non-commercial organizations. However, some clients seek a variety of other non-audit services. These services differ widely in terms of the nature and purpose of providing the service. Differences also exist as to the amount of evidence used, costs incurred and accordingly the level of assurance provided on the reliability of information. Ahmed believes that auditing careers provide an excellent experience in risk assessment and management techniques. He has an opportunity for professional development and he also believes that his employment is interesting and meaningful. Working as a CPA, Ahmed has a wide range of opportunities allowing for personal growth. Although Ahmed, as a CPA, can perform any type of audit, some audit engagements are restricted to certain types of auditors other than the CPA. Following are a variety of services and audit engagements performed by different types of auditors. Based on your auditing background, you are required to help the auditor in analyzing each of the following separate individual cases related to different types of engagements by answering the following questions. Which of the following statements is true about compliance audit? A. Review of income tax returns of a corporation to determine which tax laws are applicable. B. Reporting to the authority that established rules, regulations, and procedures, either internal or external to the auditee. C. An internal auditor's review of a company's payroll authorization procedures. D. Reporting to the management of the company as well as to the different groups and outside entities. Which of the following services is not an example of a nonassurance service? A. The auditor examines the computer operations of a large corporation to evaluate whether the procedures are likely to prevent misstatements in accounting and operating data. B. The auditor compiles the tax return of a multinational corporation in accordance with the tax code. C. The auditor prepares the financial statements of a client's company from its financial records in accordance with Generally accepted Accounting Principles. D. The auditor examines employee time records and personnel records to advice management how to maximize the effective use of personnel

Ahmed is a CPA who is engaged to perform a variety of services to both audit and non-audit clients. Most of his work involves financial statements audits for publicly traded companies, other large companies, many small companies and even non-commercial organizations. However, some clients seek a variety of other non-audit services. These services differ widely in terms of the nature and purpose of providing the service. Differences also exist as to the amount of evidence used, costs incurred and accordingly the level of assurance provided on the reliability of information. Ahmed believes that auditing careers provide an excellent experience in risk assessment and management techniques. He has an opportunity for professional development and he also believes that his employment is interesting and meaningful. Working as a CPA, Ahmed has a wide range of opportunities allowing for personal growth. Although Ahmed, as a CPA, can perform any type of audit, some audit engagements are restricted to certain types of auditors other than the CPA. Following are a variety of services and audit engagements performed by different types of auditors. Based on your auditing background, you are required to help the auditor in analyzing each of the following separate individual cases related to different types of engagements by answering the following questions. Which of the following statements is true about compliance audit? A. Review of income tax returns of a corporation to determine which tax laws are applicable. B. Reporting to the authority that established rules, regulations, and procedures, either internal or external to the auditee. C. An internal auditor's review of a company's payroll authorization procedures. D. Reporting to the management of the company as well as to the different groups and outside entities. Which of the following services is not an example of a nonassurance service? A. The auditor examines the computer operations of a large corporation to evaluate whether the procedures are likely to prevent misstatements in accounting and operating data. B. The auditor compiles the tax return of a multinational corporation in accordance with the tax code. C. The auditor prepares the financial statements of a client's company from its financial records in accordance with Generally accepted Accounting Principles. D. The auditor examines employee time records and personnel records to advice management how to maximize the effective use of personnel. Ahmed is a CPA who is engaged to perform a variety of services to both audit and non-audit clients. Most of his work involves financial statements audits for publicly traded companies, other large companies, many small companies and even non-commercial organizations. However, some clients seek a variety of other non-audit services. These services differ widely in terms of the nature and purpose of providing the service. Differences also exist as to the amount of evidence used, costs incurred and accordingly the level of assurance provided on the reliability of information. Ahmed believes that auditing careers provide an excellent experience in risk assessment and management techniques. He has an opportunity for professional development and he also believes that his employment is interesting and meaningful. Working as a CPA, Ahmed has a wide range of opportunities allowing for personal growth. Although Ahmed, as a CPA, can perform any type of audit, some audit engagements are restricted to certain types of auditors other than the CPA. Following are a variety of services and audit engagements performed by different types of auditors. Based on your auditing background, you are required to help the auditor in analyzing each of the following separate individual cases related to different types of engagements by answering the following questions. Which of the following statements is true about compliance audit? A. Review of income tax returns of a corporation to determine which tax laws are applicable. B. Reporting to the authority that established rules, regulations, and procedures, either internal or external to the auditee. C. An internal auditor's review of a company's payroll authorization procedures. D. Reporting to the management of the company as well as to the different groups and outside entities. Which of the following services is not an example of a nonassurance service? A. The auditor examines the computer operations of a large corporation to evaluate whether the procedures are likely to prevent misstatements in accounting and operating data. B. The auditor compiles the tax return of a multinational corporation in accordance with the tax code. C. The auditor prepares the financial statements of a client's company from its financial records in accordance with Generally accepted Accounting Principles. D. The auditor examines employee time records and personnel records to advice management how to maximize the effective use of personnel

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started