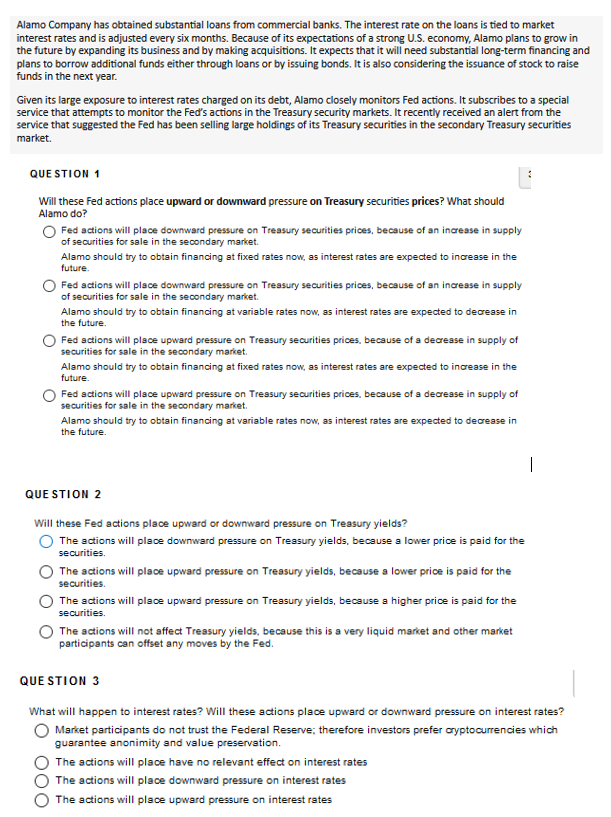

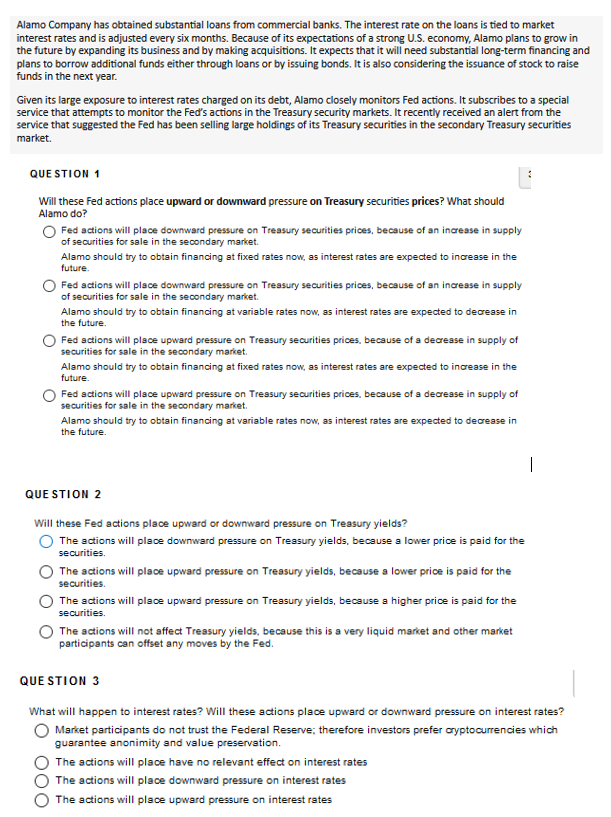

Alamo Company has obtained substantial loans from commercial banks. The interest rate on the loans is tied to market interest rates and is adjusted every six months. Because of its expectations of a strong U.S. economy, Alamo plans to grow in the future by expanding its business and by making acquisitions. It expects that it will need substantial long-term financing and plans to borrow additional funds either through loans or by issuing bonds. It is also considering the issuance of stock to raise funds in the next year. Given its large exposure to interest rates charged on its debt, Alamo closely monitors Fed actions. It subscribes to a special service that attempts to monitor the Fed's actions in the Treasury security markets. It recently received an alert from the service that suggested the Fed has been selling large holdings of its Treasury securities in the secondary Treasury securities market QUESTION 1 Will these Fed actions place upward or downward pressure on Treasury securities prices? What should Alamo do? Fed actions will place downward pressure on Treasury securities prices, because of an increase in supply of securities for sale in the secondary market. Alamo should try to obtain financing at fixed rates now, as interest rates are expected to increase in the future. Fed actions will place downward pressure on Treasury securities prices, because of an increase in supply of securities for sale in the secondary market. Alamo should try to obtain financing at variable rates now, as interest rates are expected to decrease in the future. Fed actions will place upward pressure on Treasury securities prices, because of a decrease in supply of securities for sale in the secondary market. Alamo should try to obtain financing at fixed rates now, as interest rates are expected to increase in the future. Fed actions will place upward pressure on Treasury securities prices, because of a decrease in supply of securities for sale in the secondary market. Alamo should try to obtain financing at variable rates now, as interest rates are expected to decrease in the future. | QUESTION 2 Will these Fed actions place upward or downward pressure on Treasury yields? The actions will place downward pressure on Treasury yields, because a lower price is paid for the securities The actions will place upward pressure on Treasury yields, because a lower price is paid for the securities The actions will place upward pressure on Treasury yields, because a higher price is paid for the securities The actions will not affect Treasury yields, because this is a very liquid market and other market participants can offset any moves by the Fed. QUESTION 3 What will happen to interest rates? Will these actions place upward or downward pressure on interest rates? Market participants do not trust the Federal Reserve; therefore investors prefer cryptocurrencies which guarantee anonimity and value preservation. The actions will place have no relevant effect on interest rates The actions will place downward pressure on interest rates The actions will place upward pressure on interest rates