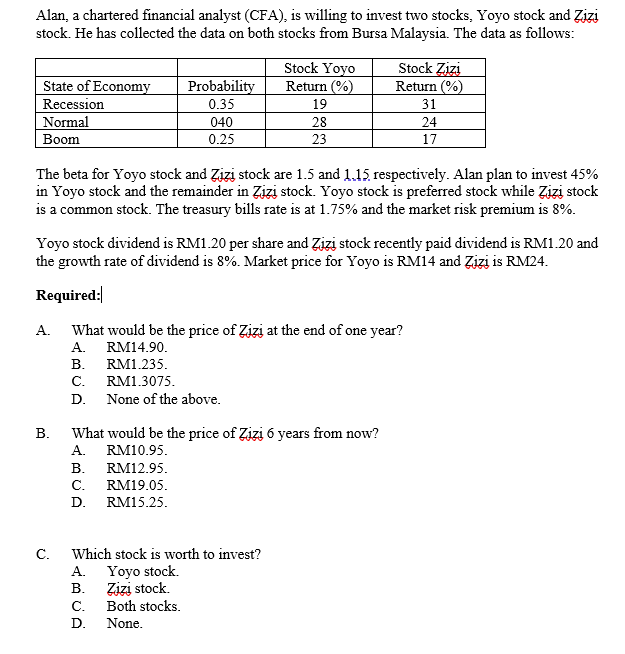

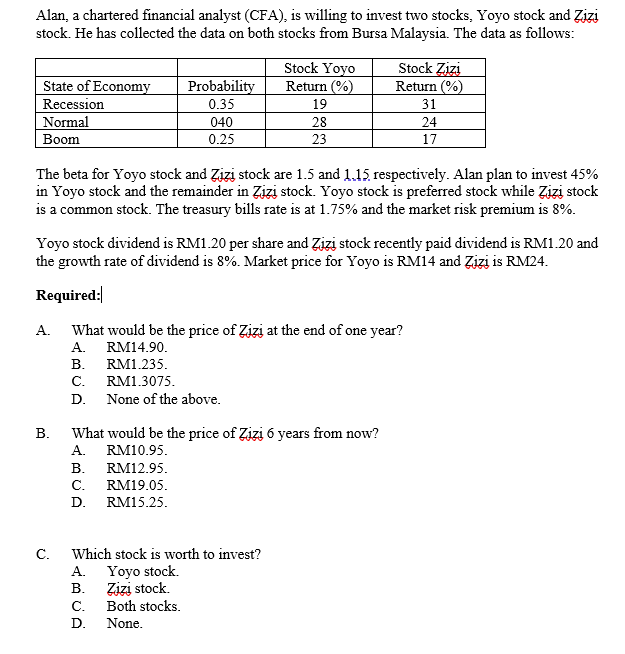

Alan, a chartered financial analyst (CFA), is willing to invest two stocks, Yoyo stock and Zizi stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: State of Economy Recession Normal Boom Probability 0.35 040 0.25 Stock Yoyo Return% 19 28 23 Stock Zizi Return (% 31 24 17 The beta for Yoyo stock and Zizi stock are 1.5 and 1.15, respectively. Alan plan to invest 45% in Yoyo stock and the remainder in Zizi stock. Yoyo stock is preferred stock while Zizi stock is a common stock. The treasury bills rate is at 1.75% and the market risk premium is 8%. Yoyo stock dividend is RM1.20 per share and Zizi stock recently paid dividend is RM1.20 and the growth rate of dividend is 8%. Market price for Yoyo is RM14 and Zizi is RM24. Required: A What would be the price of Zizi at the end of one year? A RM14.90. B. RM1.235. C. RM1.3075. D. None of the above. B. What would be the price of Zizi 6 years from now? A RM10.95. B. RM12.95. C. RM19.05. D. RM15.25. C. Which stock is worth to invest? A Yoyo stock. B. Zizi stock. C. Both stocks. D. None. Alan, a chartered financial analyst (CFA), is willing to invest two stocks, Yoyo stock and Zizi stock. He has collected the data on both stocks from Bursa Malaysia. The data as follows: State of Economy Recession Normal Boom Probability 0.35 040 0.25 Stock Yoyo Return% 19 28 23 Stock Zizi Return (% 31 24 17 The beta for Yoyo stock and Zizi stock are 1.5 and 1.15, respectively. Alan plan to invest 45% in Yoyo stock and the remainder in Zizi stock. Yoyo stock is preferred stock while Zizi stock is a common stock. The treasury bills rate is at 1.75% and the market risk premium is 8%. Yoyo stock dividend is RM1.20 per share and Zizi stock recently paid dividend is RM1.20 and the growth rate of dividend is 8%. Market price for Yoyo is RM14 and Zizi is RM24. Required: A What would be the price of Zizi at the end of one year? A RM14.90. B. RM1.235. C. RM1.3075. D. None of the above. B. What would be the price of Zizi 6 years from now? A RM10.95. B. RM12.95. C. RM19.05. D. RM15.25. C. Which stock is worth to invest? A Yoyo stock. B. Zizi stock. C. Both stocks. D. None