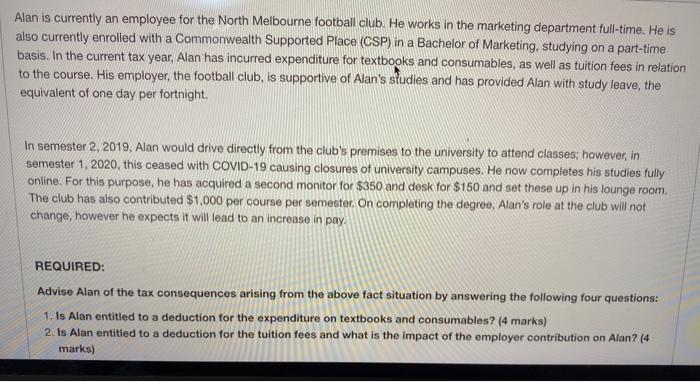

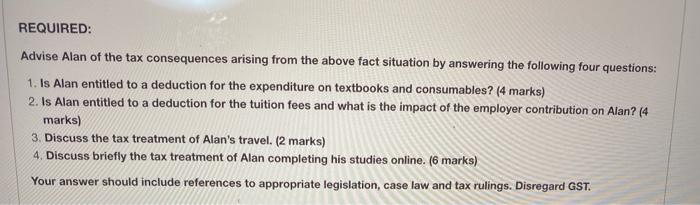

Alan is currently an employee for the North Melbourne football club. He works in the marketing department full-time. He is also currently enrolled with a Commonwealth Supported Place (CSP) in a Bachelor of Marketing, studying on a part-time basis. In the current tax year, Alan has incurred expenditure for textbooks and consumables, as well as tuition fees in relation to the course. His employer, the football club, is supportive of Alan's studies and has provided Alan with study leave, the equivalent of one day per fortnight. In semester 2, 2019, Alan would drive directly from the club's premises to the university to attend classes; however, in semester 1, 2020, this ceased with COVID-19 causing closures of university campuses. He now completes his studies fully online. For this purpose, he has acquired a second monitor for $350 and desk for $150 and set these up in his lounge room. The club has also contributed $1,000 per course per semester. On completing the degree, Alan's role at the club will not change, however he expects it will lead to an increase in pay. REQUIRED: Advise Alan of the tax consequences arising from the above fact situation by answering the following four questions: 1. Is Alan entitled to a deduction for the expenditure on textbooks and consumables? (4 marks) 2. Is Alan entitled to a deduction for the tuition fees and what is the impact of the employer contribution on Alan? (4 marks) REQUIRED: Advise Alan of the tax consequences arising from the above fact situation by answering the following four questions: 1. Is Alan entitled to a deduction for the expenditure on textbooks and consumables? (4 marks) 2. Is Alan entitled to a deduction for the tuition fees and what is the impact of the employer contribution on Alan? (4 marks) 3. Discuss the tax treatment of Alan's travel. (2 marks) 4. Discuss briefly the tax treatment of Alan completing his studies online. (6 marks) Your answer should include references to appropriate legislation, case law and tax rulings. Disregard GST. Alan is currently an employee for the North Melbourne football club. He works in the marketing department full-time. He is also currently enrolled with a Commonwealth Supported Place (CSP) in a Bachelor of Marketing, studying on a part-time basis. In the current tax year, Alan has incurred expenditure for textbooks and consumables, as well as tuition fees in relation to the course. His employer, the football club, is supportive of Alan's studies and has provided Alan with study leave, the equivalent of one day per fortnight. In semester 2, 2019, Alan would drive directly from the club's premises to the university to attend classes; however, in semester 1, 2020, this ceased with COVID-19 causing closures of university campuses. He now completes his studies fully online. For this purpose, he has acquired a second monitor for $350 and desk for $150 and set these up in his lounge room. The club has also contributed $1,000 per course per semester. On completing the degree, Alan's role at the club will not change, however he expects it will lead to an increase in pay. REQUIRED: Advise Alan of the tax consequences arising from the above fact situation by answering the following four questions: 1. Is Alan entitled to a deduction for the expenditure on textbooks and consumables? (4 marks) 2. Is Alan entitled to a deduction for the tuition fees and what is the impact of the employer contribution on Alan? (4 marks) REQUIRED: Advise Alan of the tax consequences arising from the above fact situation by answering the following four questions: 1. Is Alan entitled to a deduction for the expenditure on textbooks and consumables? (4 marks) 2. Is Alan entitled to a deduction for the tuition fees and what is the impact of the employer contribution on Alan? (4 marks) 3. Discuss the tax treatment of Alan's travel. (2 marks) 4. Discuss briefly the tax treatment of Alan completing his studies online. (6 marks) Your answer should include references to appropriate legislation, case law and tax rulings. Disregard GST