Answered step by step

Verified Expert Solution

Question

1 Approved Answer

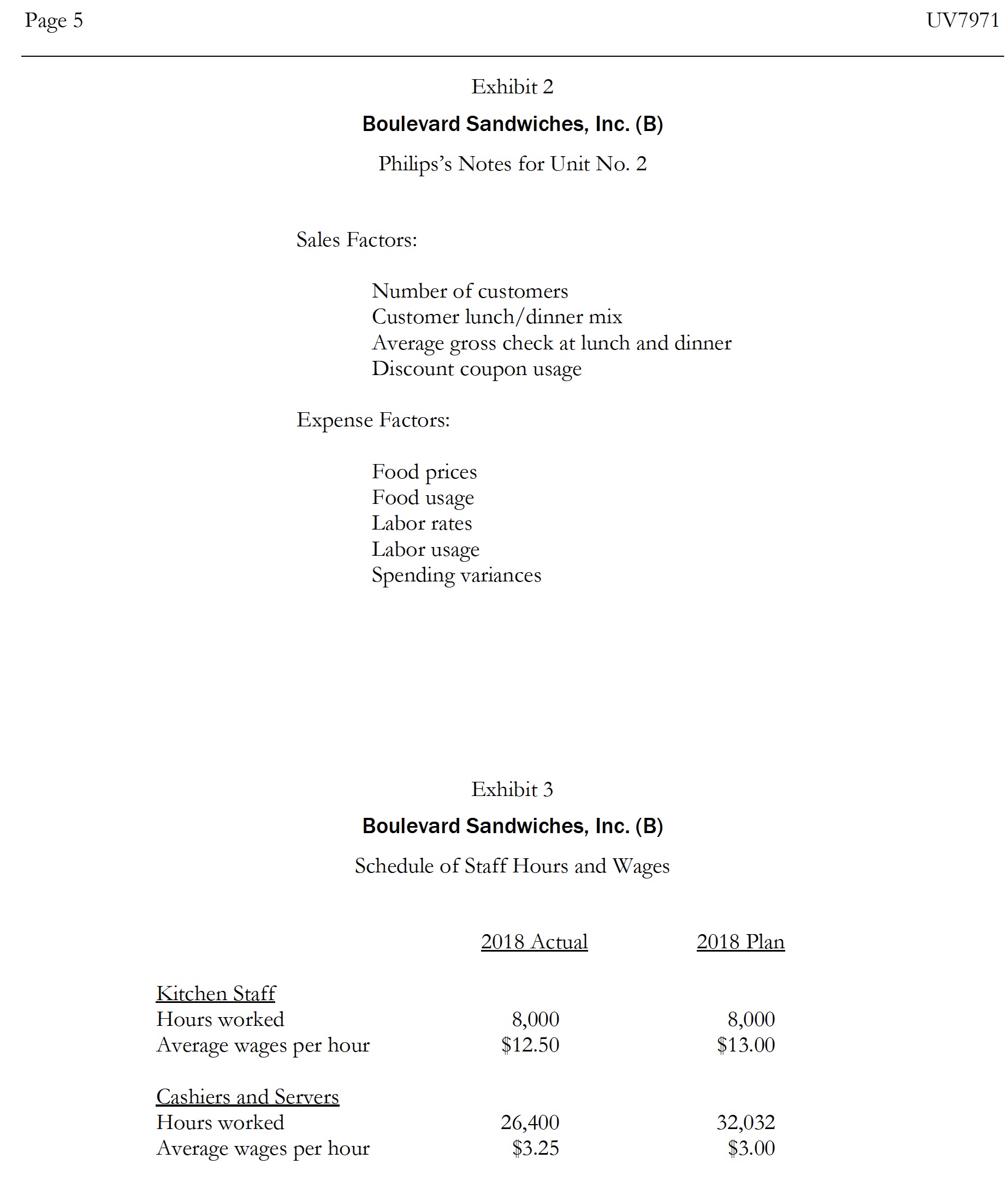

Using actual sales data, create a flexible budget. Using that flexible budget determine the flexible budget food expense, the labor expenses including cooks, cashiers, and

Using actual sales data, create a flexible budget. Using that flexible budget determine the flexible budget food expense, the labor expenses including cooks, cashiers, and servers (remembering the average cost of cashiers and servers is 0.4754/customer), and the depreciation expense.

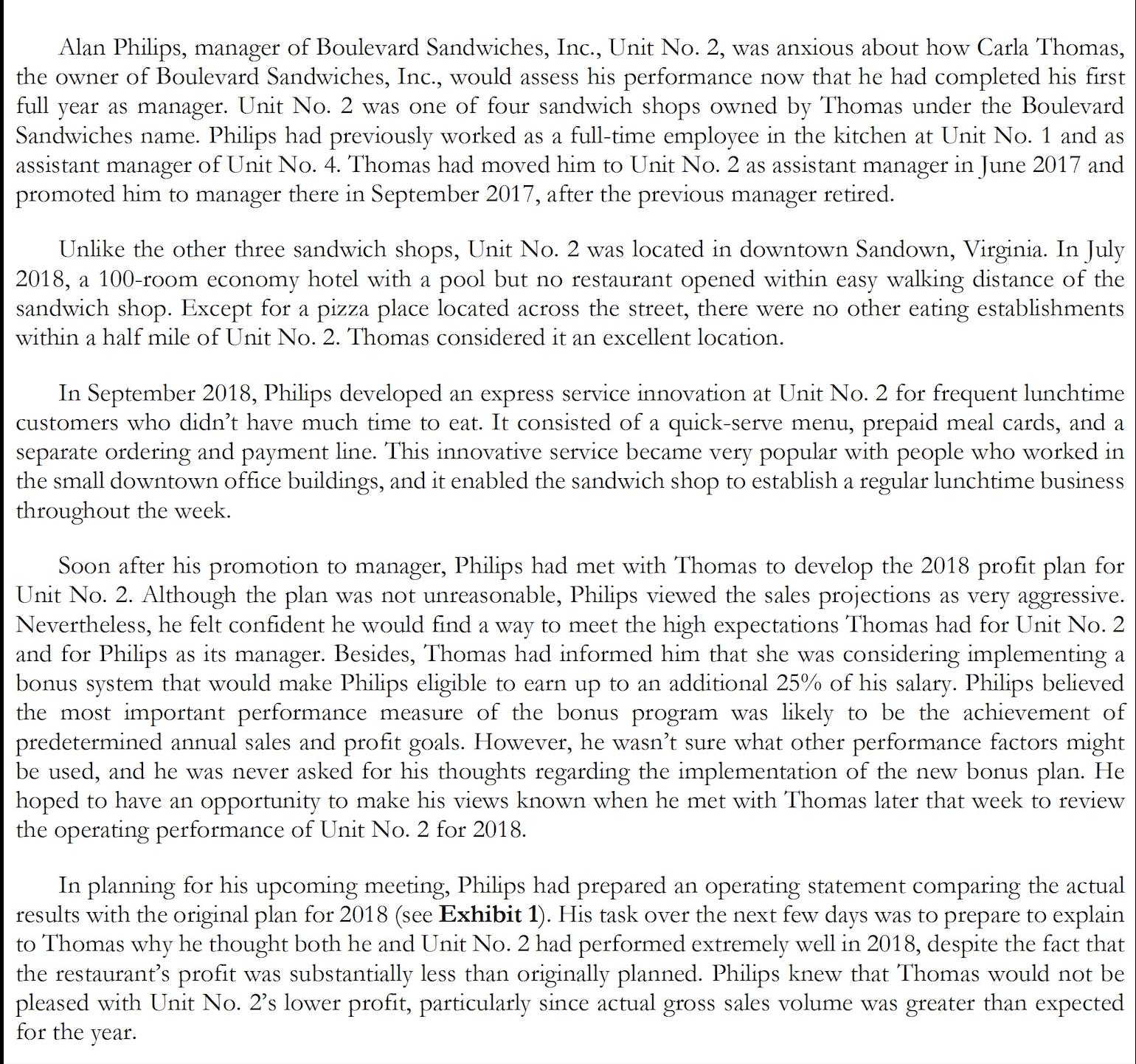

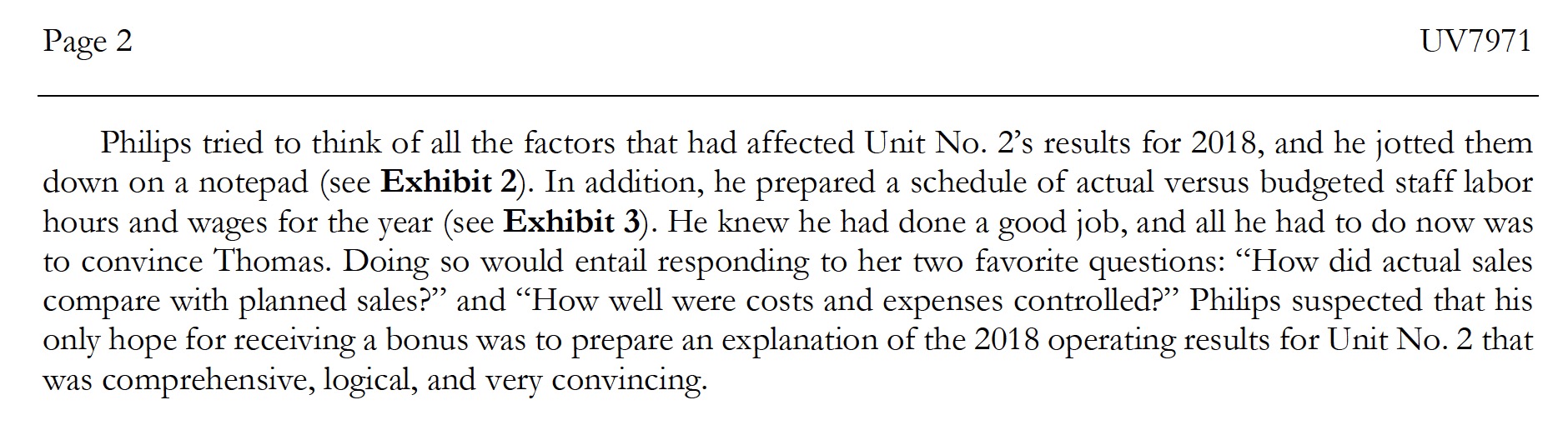

Alan Philips, manager of Boulevard Sandwiches, Inc., Unit No. 2, was anxious about how Carla Thomas, the owner of Boulevard Sandwiches, Inc., would assess his performance now that he had completed his first full year as manager. Unit No. 2 was one of four sandwich shops owned by Thomas under the Boulevard Sandwiches name. Philips had previously worked as a full-time employee in the kitchen at Unit No. 1 and as assistant manager of Unit No. 4. Thomas had moved him to Unit No. 2 as assistant manager in June 2017 and promoted him to manager there in September 2017, after the previous manager retired. Unlike the other three sandwich shops, Unit No. 2 was located in downtown Sandown, Virginia. In July 2018, a 100-room economy hotel with a pool but no restaurant opened within easy walking distance of the sandwich shop. Except for a pizza place located across the street, there were no other eating establishments within a half mile of Unit No. 2. Thomas considered it an excellent location. In September 2018, Philips developed an express service innovation at Unit No. 2 for frequent lunchtime customers who didn't have much time to eat. It consisted of a quick-serve menu, prepaid meal cards, and a separate ordering and payment line. This innovative service became very popular with people who worked in the small downtown office buildings, and it enabled the sandwich shop to establish a regular lunchtime business throughout the week. Soon after his promotion to manager, Philips had met with Thomas to develop the 2018 profit plan for Unit No. 2. Although the plan was not unreasonable, Philips viewed the sales projections as very aggressive. Nevertheless, he felt confident he would find a way to meet the high expectations Thomas had for Unit No. 2 and for Philips as its manager. Besides, Thomas had informed him that she was considering implementing a bonus system that would make Philips eligible to earn up to an additional 25% of his salary. Philips believed the most important performance measure of the bonus program was likely to be the achievement of predetermined annual sales and profit goals. However, he wasn't sure what other performance factors might be used, and he was never asked for his thoughts regarding the implementation of the new bonus plan. He hoped to have an opportunity to make his views known when he met with Thomas later that week to review the operating performance of Unit No. 2 for 2018. In planning for his upcoming meeting, Philips had prepared an operating statement comparing the actual results with the original plan for 2018 (see Exhibit 1). His task over the next few days was to prepare to explain to Thomas why he thought both he and Unit No. 2 had performed extremely well in 2018, despite the fact that the restaurant's profit was substantially less than originally planned. Philips knew that Thomas would not be pleased with Unit No. 2's lower profit, particularly since actual gross sales volume was greater than expected for the year.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started