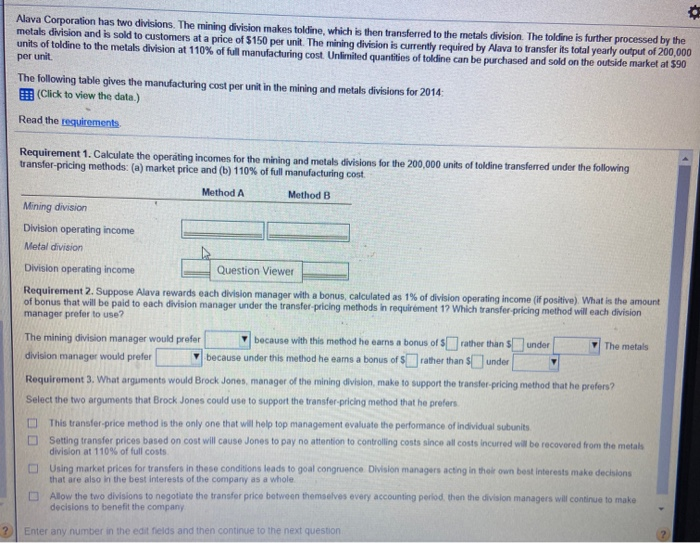

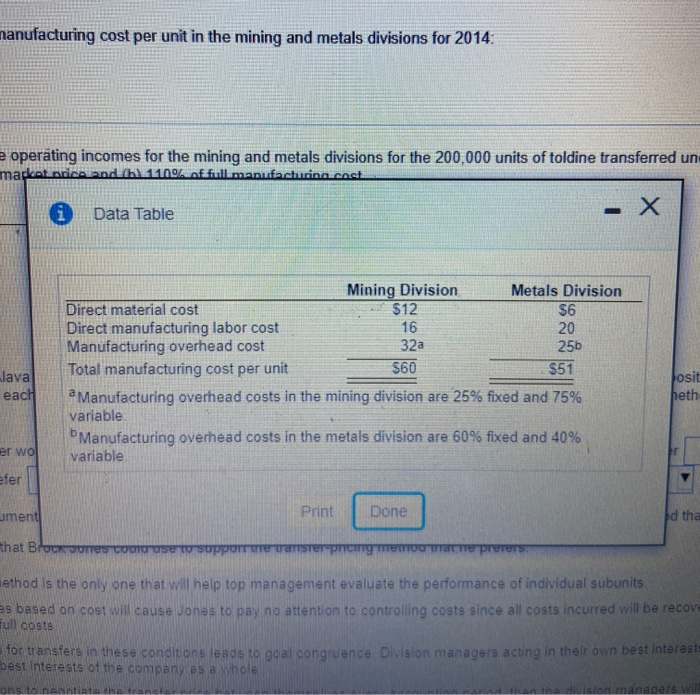

Alava Corporation has two divisions. The mining division makes toldine, which is then transferred to the metals division. The toldine is further processed by the metais division and is sold to customers at a price of $150 per unit. The mining division is currently required by Aava to transfer its total yearly output of 200,000 units of toldine to the metals division at 110% of full manufacturing cost Unlimited quantities of toline can be purchased and sold on the outside market of 590 per unit The following table gives the manufacturing cost per unit in the mining and metals divisions for 2014: (Click to view the data.) Read the requirements Requirement 1. Calculate the operating incomes for the mining and metals divisions for the 200,000 units of toldine transferred under the following transfer pricing methods: (a) market price and (b) 110% of full manufacturing cost. Method A Method B Mining division Division operating income Metal division Division operating income Question Viewer Requirement 2. Suppose Alava rewards each division manager with a bonus, calculated as 1% of division operating income (if positive). What is the amount of bonus that will be paid to each division manager under the transfer pricing methods in requirement 1? Which transfer pricing method will each division manager prefer to use? The mining division manager would prefer because with this method he earns a bonus of $ rather than under the metals division manager would prefer because under this method he cams a bonus of rather than $ under Requirement 3. What arguments would Brock Jones, manager of the mining division, make to support the transfer pricing method that he prefers? Select the two arguments that Brock Jones could use to support the transfer pricing method that he prefers This transfer price method is the only one that will help top management evaluate the performance of individual subunits Setting transfer prices based on cost will cause Jones to pay no attention to controlling costs since all costs incurred will be recovered from the metals division at 110% of full costs Using market prices for transfers in these conditions leads to goal congruence Division managers acting in their own bost interests make decisions that are also in the best interests of the company as a whole Allow the two divisions to negotiate the transfer price between themselves every accounting period, then the division managers will continue to make decisions to benefit the company Enter any number in the edit nields and then continue to the next question nanufacturing cost per unit in the mining and metals divisions for 2014: e operating incomes for the mining and metals divisions for the 200,000 units of toldine transferred un mackat nice and h 1109 of full.manufacturina cost 1 Data Table 32a Mining Division Metals Division Direct material cost Direct manufacturing labor cost 16 Manufacturing overhead cost Total manufacturing cost per unit a Manufacturing overhead costs in the mining division are 25% fixed and 75% variable Manufacturing overhead costs in the metals division are 60% fixed and 40% variable $60 wava each 51 osit peth er wo efer Print Done d tha Print ument Done that Broek vores course to supporter transter-preg memor ethod is the only one that will help top management evaluate the performance of individual subunits es based on cost will cause Jones to pay no attention to controlling costs since all costs incurred will be recove Tull costs for transfers in these conditions leads to goal congruence Division managers acting in their own best interest best interests of the company as a whole og nenntitate division managers will