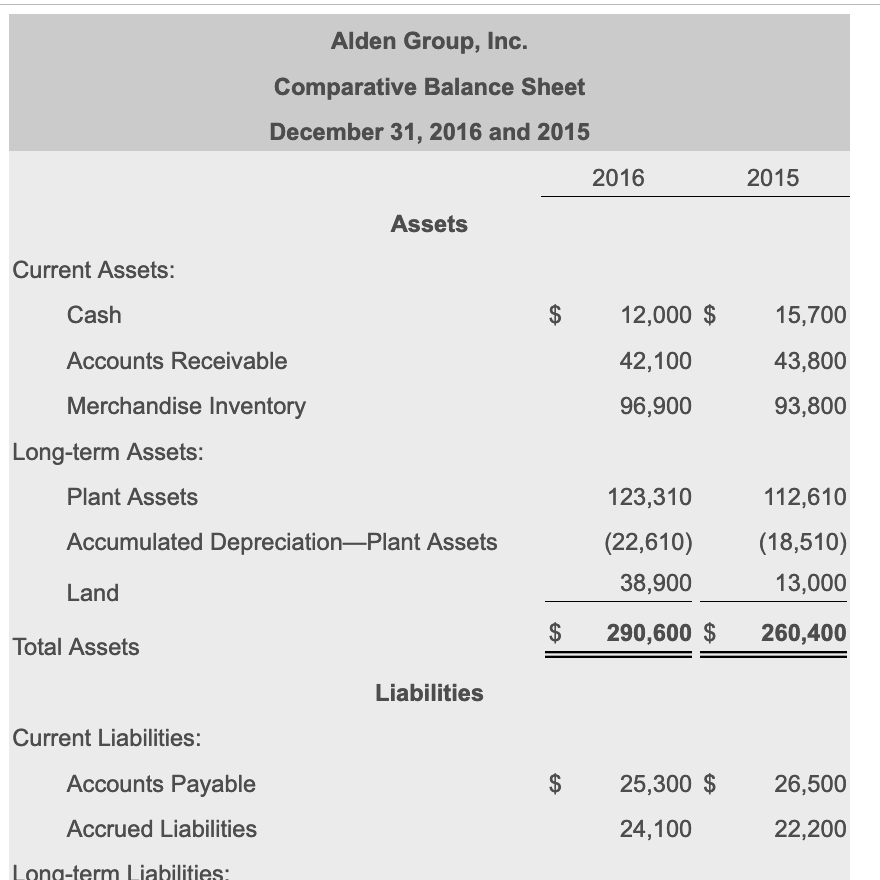

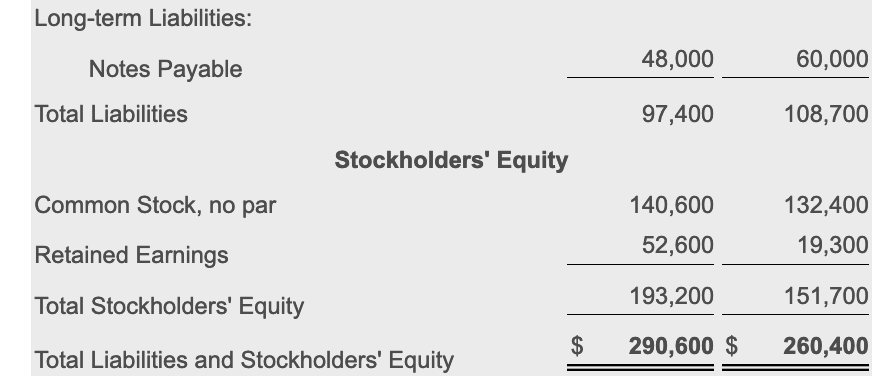

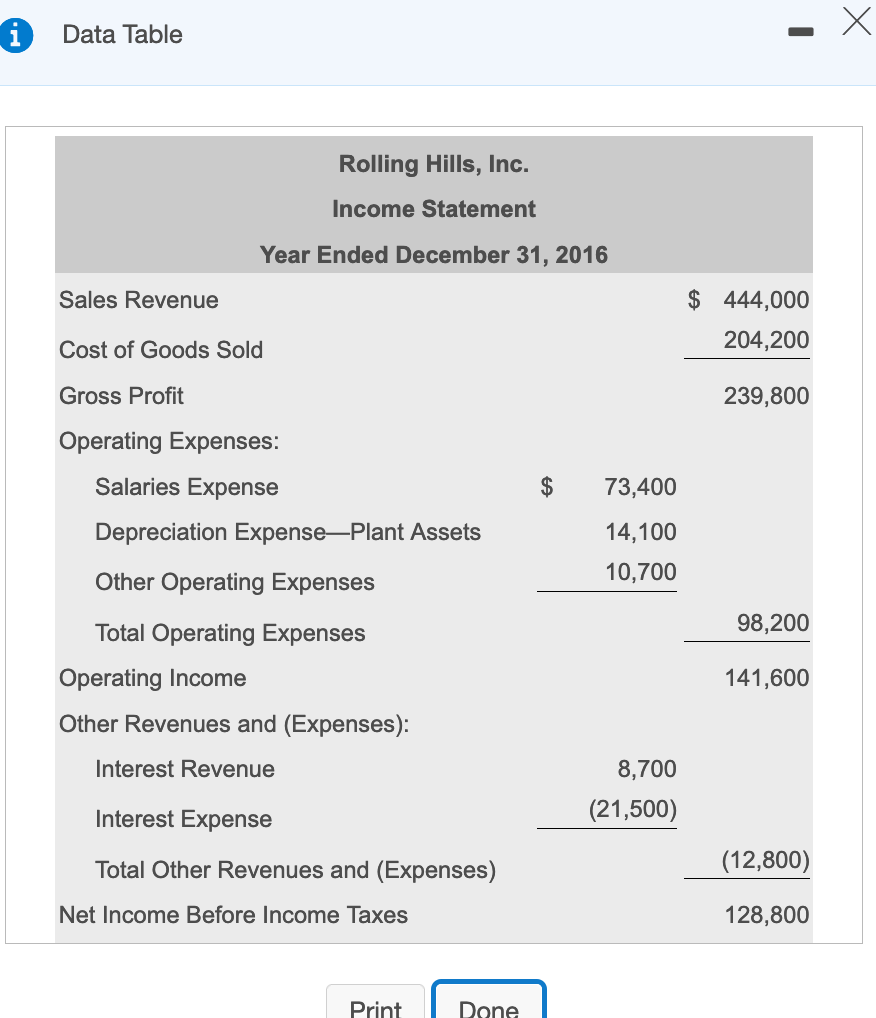

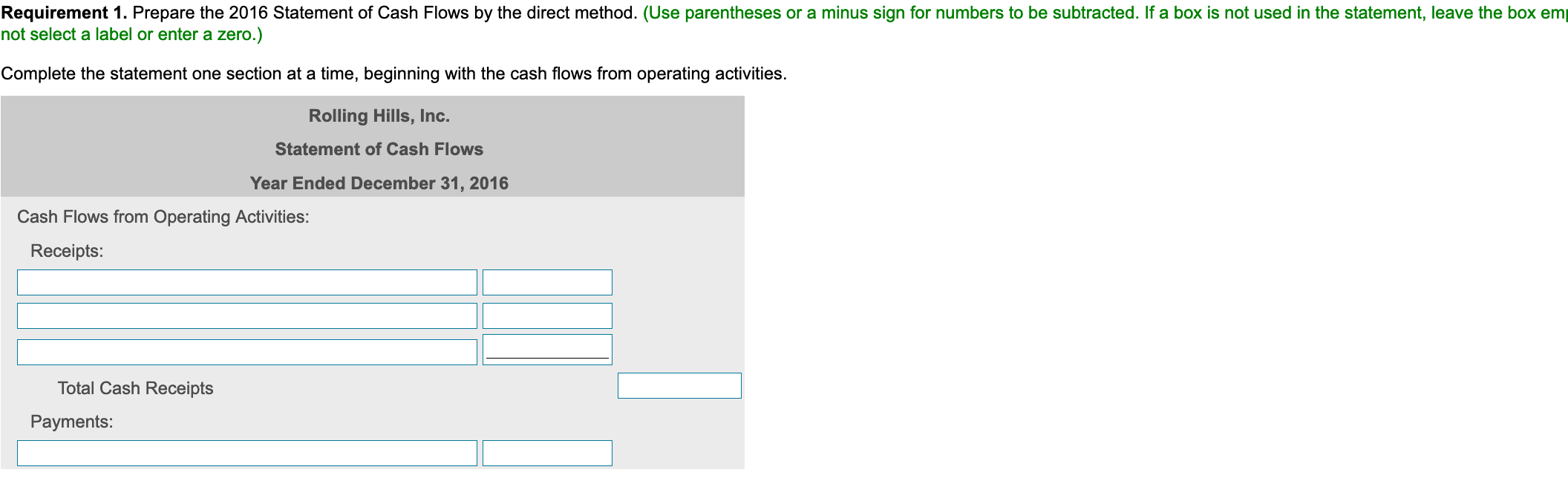

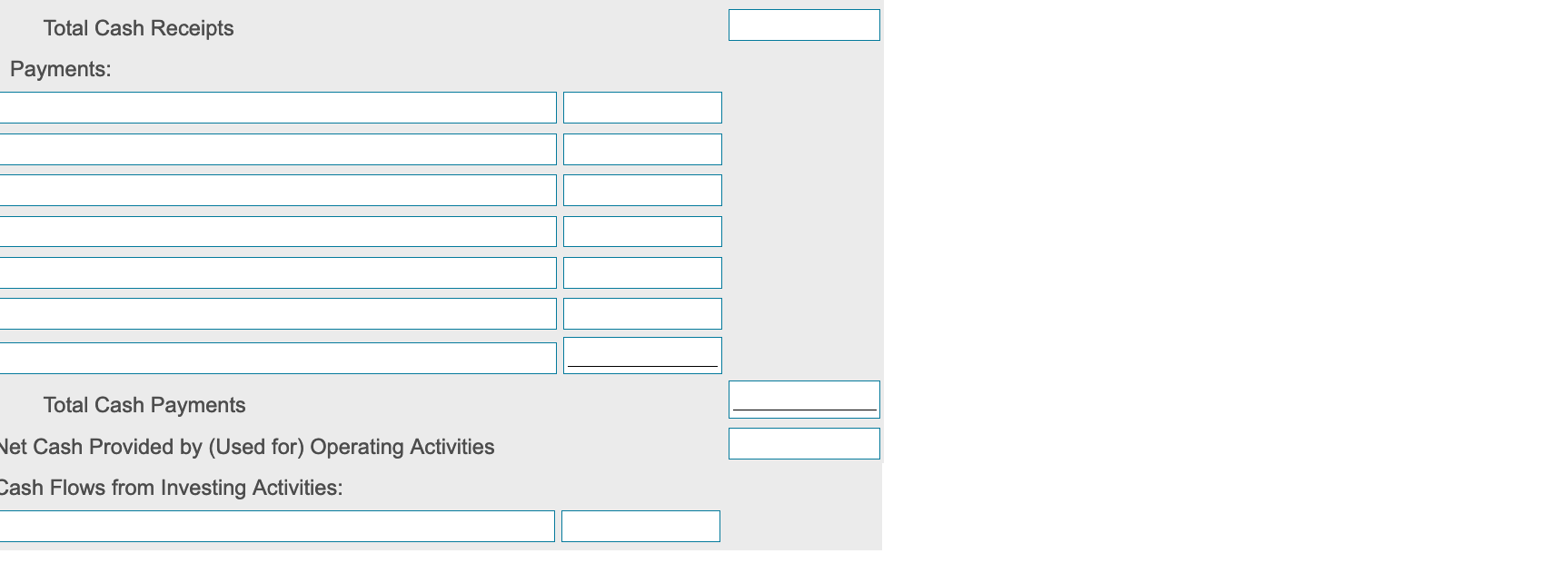

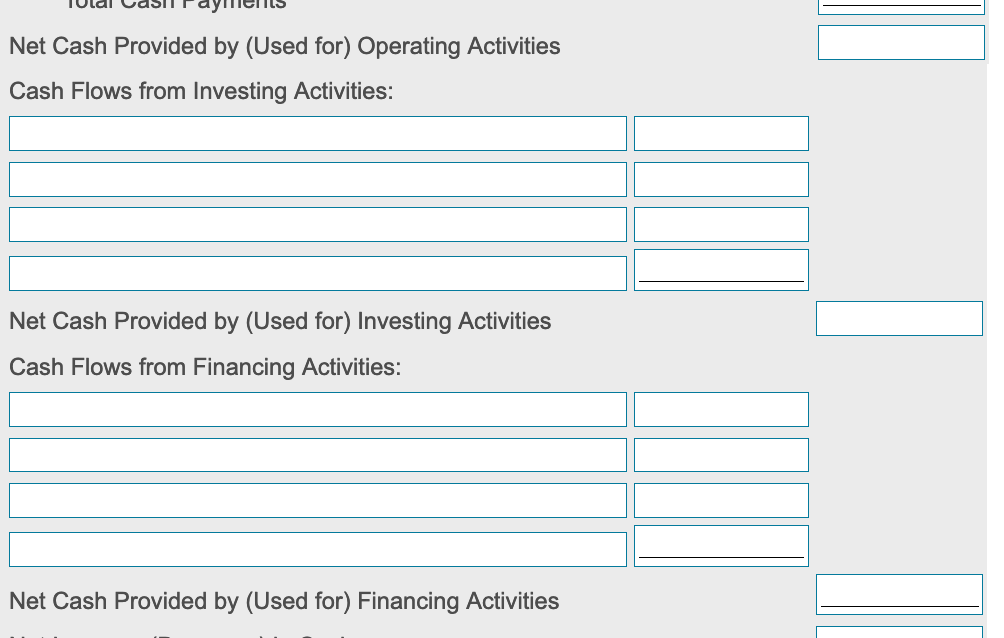

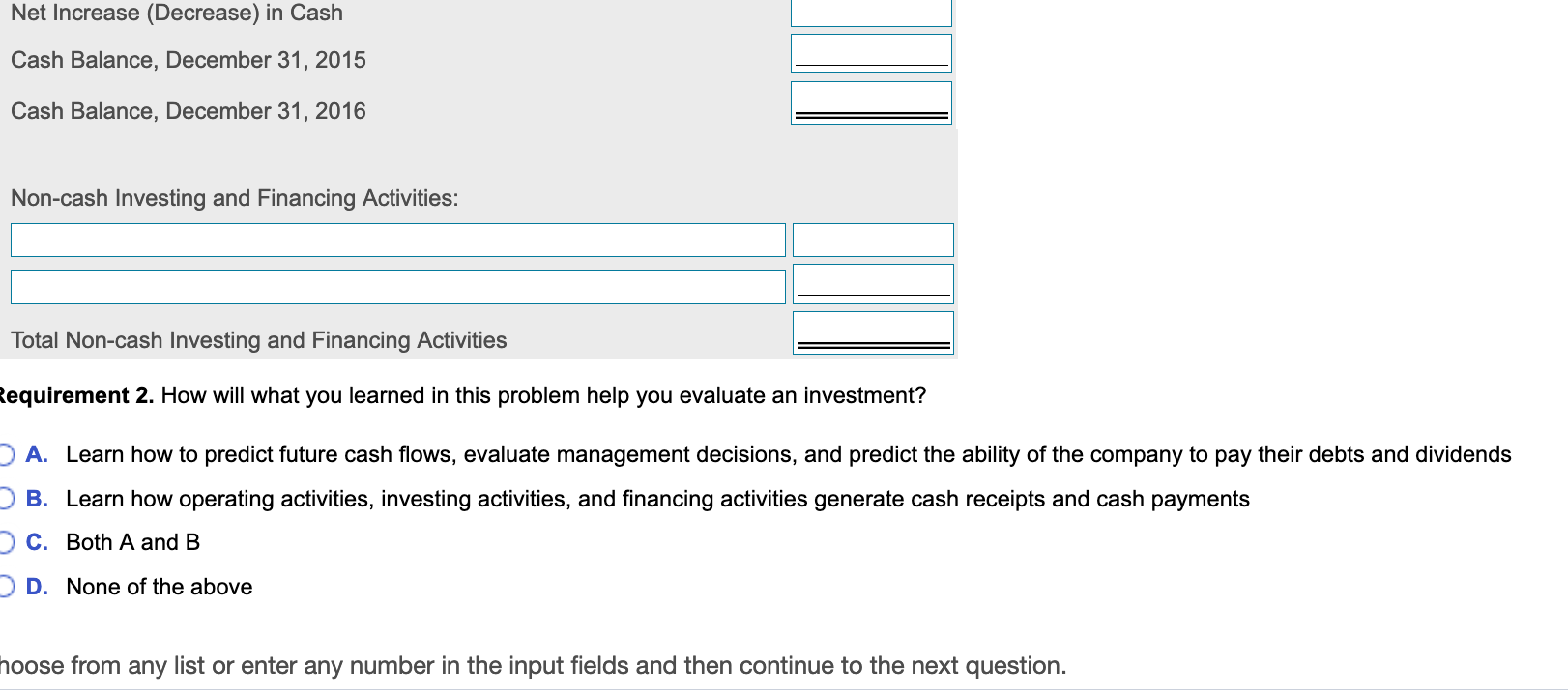

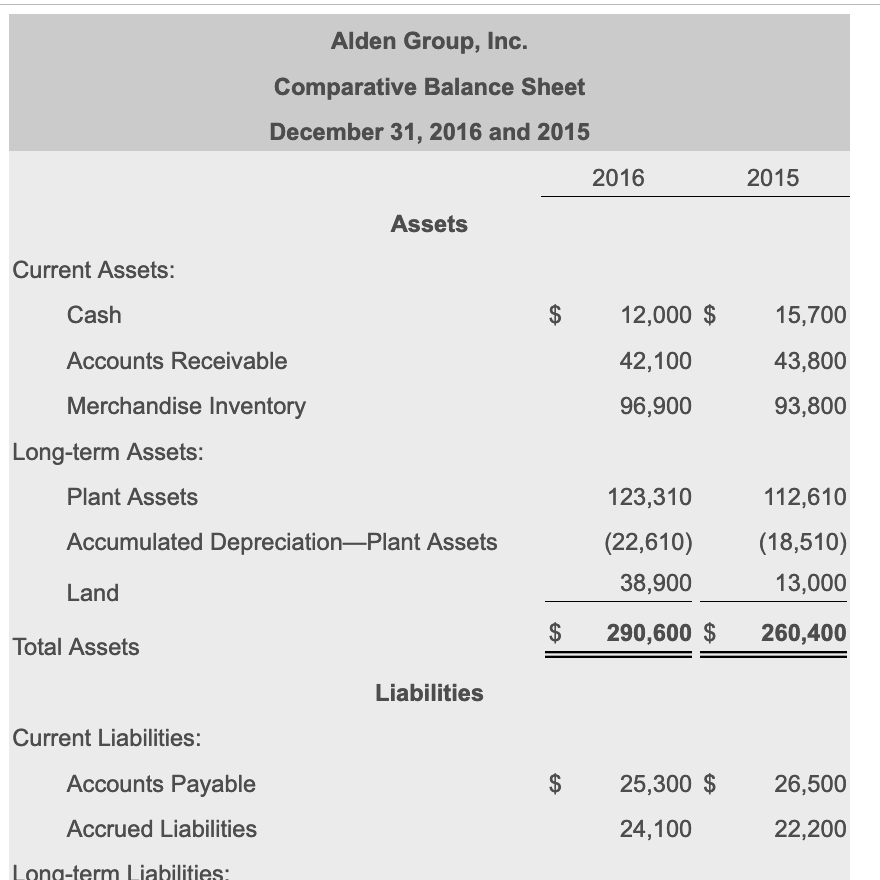

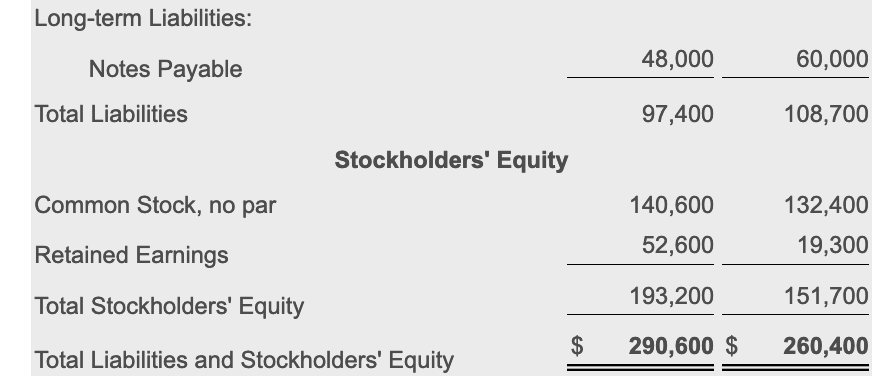

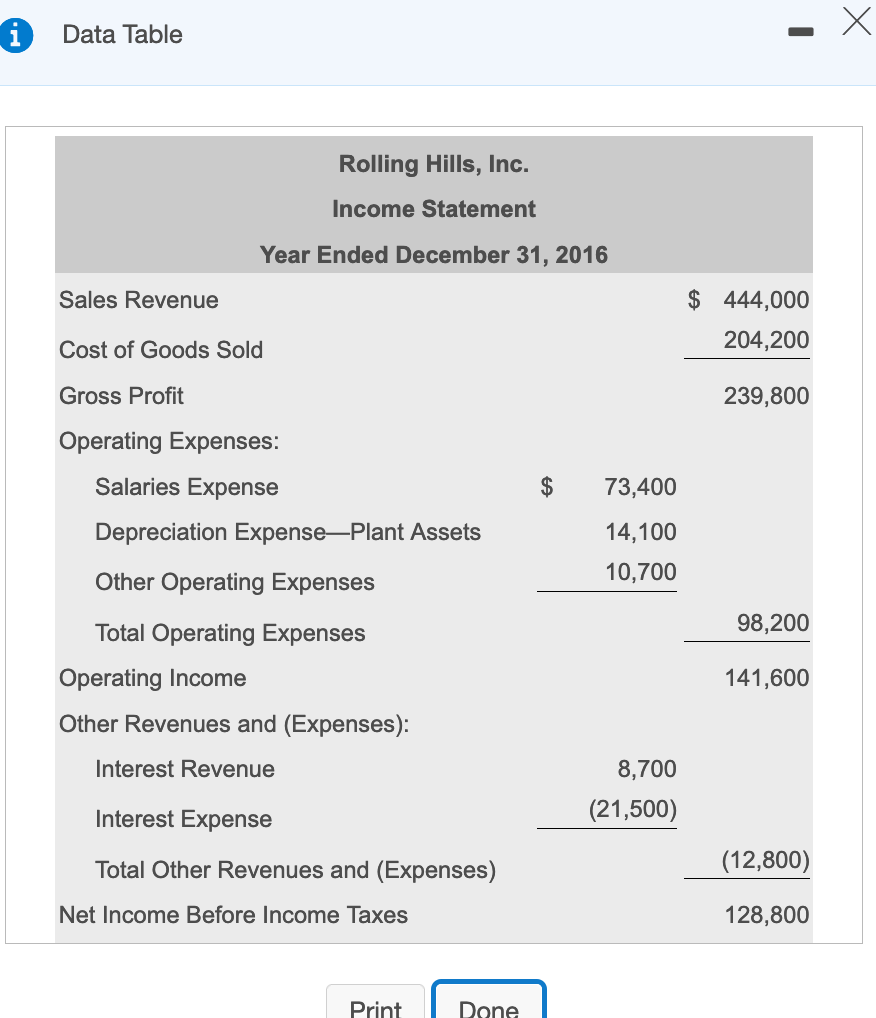

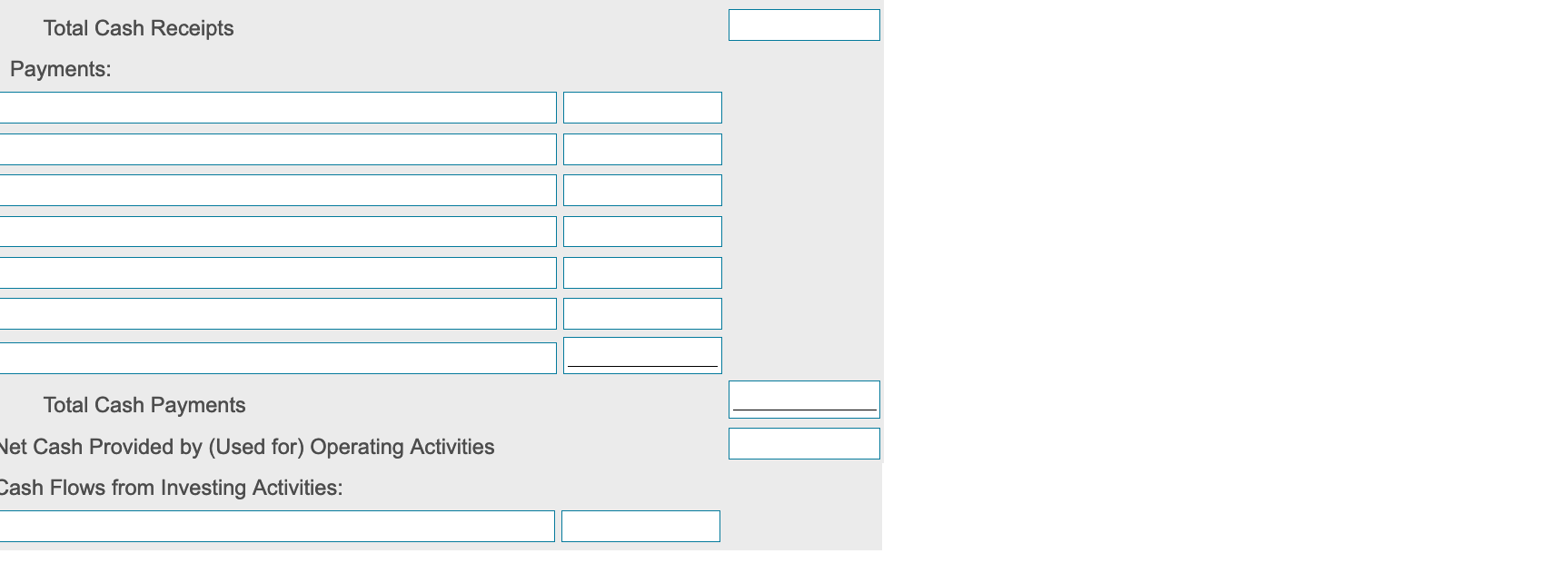

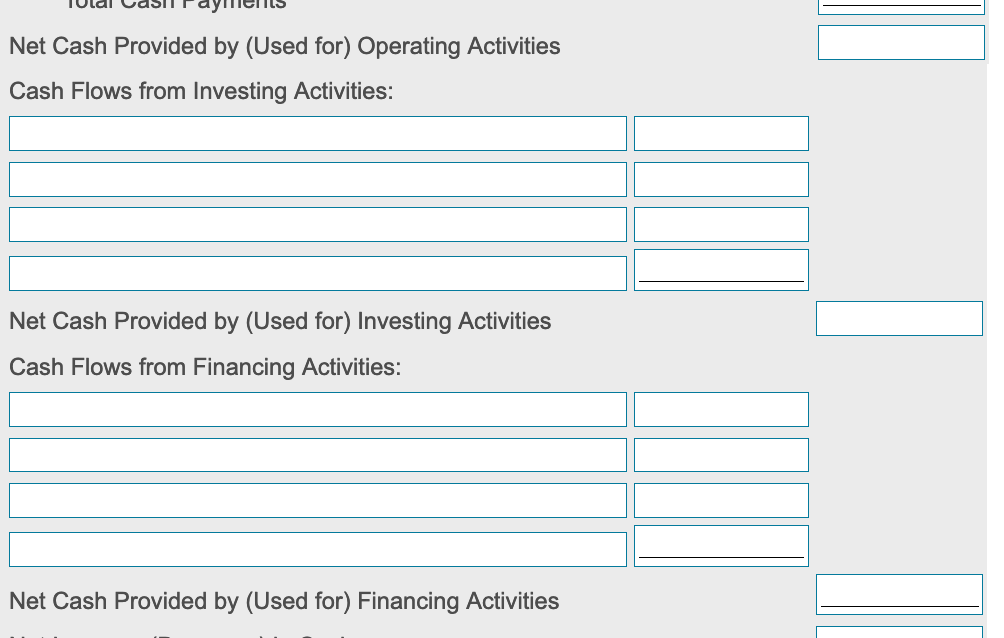

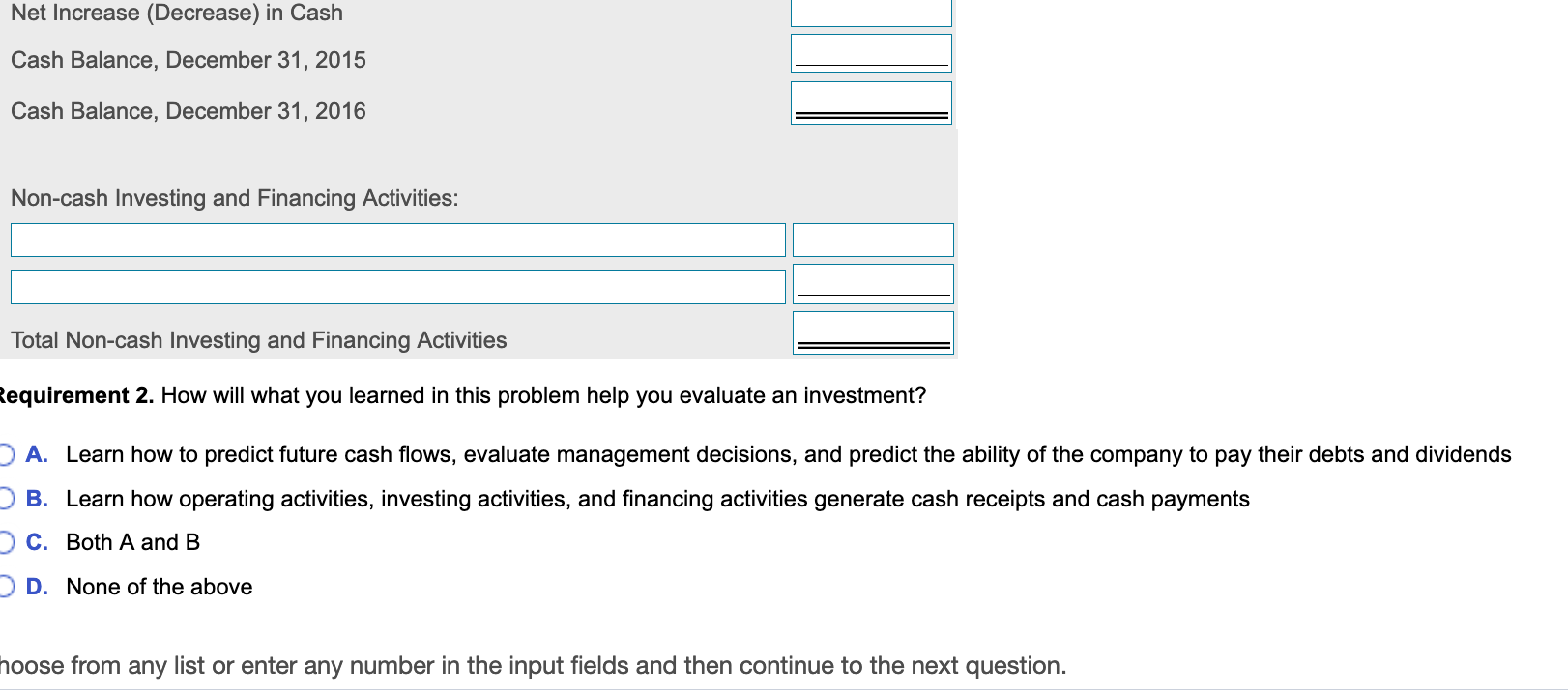

Alden Group, Inc. Comparative Balance Sheet December 31, 2016 and 2015 2016 2015 Assets Current Assets: Cash $ 12,000 $ 15,700 Accounts Receivable 42,100 43,800 96,900 93,800 Merchandise Inventory Long-term Assets: Plant Assets 123,310 112,610 Accumulated DepreciationPlant Assets (22,610) 38,900 (18,510) 13,000 Land $ 290,600 $ 260,400 Total Assets Liabilities Current Liabilities: Accounts Payable $ 25,300 $ 26,500 Accrued Liabilities 24,100 22,200 Long-term Liabilities: Long-term Liabilities: Notes Payable 48,000 60,000 Total Liabilities 97,400 108,700 Stockholders' Equity Common Stock, no par 140,600 52,600 132,400 19,300 Retained Earnings Total Stockholders' Equity 193,200 151,700 $ 290,600 $ 260,400 Total Liabilities and Stockholders' Equity i Data Table Rolling Hills, Inc. Income Statement Year Ended December 31, 2016 Sales Revenue $ 444,000 204,200 Cost of Goods Sold Gross Profit 239,800 $ 73,400 Operating Expenses: Salaries Expense Depreciation ExpensePlant Assets Other Operating Expenses 14,100 10,700 98,200 Total Operating Expenses Operating Income Other Revenues and (Expenses): 141,600 Interest Revenue 8,700 (21,500) Interest Expense Total Other Revenues and (Expenses) (12,800) Net Income Before Income Taxes 128,800 Print Done Total Cash Receipts Payments: Total Cash Payments Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: TILS Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2015 Cash Balance, December 31, 2016 Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activities Requirement 2. How will what you learned in this problem help you evaluate an investment? A. Learn how to predict future cash flows, evaluate management decisions, and predict the ability of the company to pay their debts and dividends B. Learn how operating activities, investing activities, and financing activities generate cash receipts and cash payments C. Both A and B D. None of the above hoose from any list or enter any number in the input fields and then continue to the next question. Alden Group, Inc. Comparative Balance Sheet December 31, 2016 and 2015 2016 2015 Assets Current Assets: Cash $ 12,000 $ 15,700 Accounts Receivable 42,100 43,800 96,900 93,800 Merchandise Inventory Long-term Assets: Plant Assets 123,310 112,610 Accumulated DepreciationPlant Assets (22,610) 38,900 (18,510) 13,000 Land $ 290,600 $ 260,400 Total Assets Liabilities Current Liabilities: Accounts Payable $ 25,300 $ 26,500 Accrued Liabilities 24,100 22,200 Long-term Liabilities: Long-term Liabilities: Notes Payable 48,000 60,000 Total Liabilities 97,400 108,700 Stockholders' Equity Common Stock, no par 140,600 52,600 132,400 19,300 Retained Earnings Total Stockholders' Equity 193,200 151,700 $ 290,600 $ 260,400 Total Liabilities and Stockholders' Equity i Data Table Rolling Hills, Inc. Income Statement Year Ended December 31, 2016 Sales Revenue $ 444,000 204,200 Cost of Goods Sold Gross Profit 239,800 $ 73,400 Operating Expenses: Salaries Expense Depreciation ExpensePlant Assets Other Operating Expenses 14,100 10,700 98,200 Total Operating Expenses Operating Income Other Revenues and (Expenses): 141,600 Interest Revenue 8,700 (21,500) Interest Expense Total Other Revenues and (Expenses) (12,800) Net Income Before Income Taxes 128,800 Print Done Total Cash Receipts Payments: Total Cash Payments Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: TILS Net Cash Provided by (Used for) Operating Activities Cash Flows from Investing Activities: Net Cash Provided by (Used for) Investing Activities Cash Flows from Financing Activities: Net Cash Provided by (Used for) Financing Activities Net Increase (Decrease) in Cash Cash Balance, December 31, 2015 Cash Balance, December 31, 2016 Non-cash Investing and Financing Activities: Total Non-cash Investing and Financing Activities Requirement 2. How will what you learned in this problem help you evaluate an investment? A. Learn how to predict future cash flows, evaluate management decisions, and predict the ability of the company to pay their debts and dividends B. Learn how operating activities, investing activities, and financing activities generate cash receipts and cash payments C. Both A and B D. None of the above hoose from any list or enter any number in the input fields and then continue to the next