Answered step by step

Verified Expert Solution

Question

1 Approved Answer

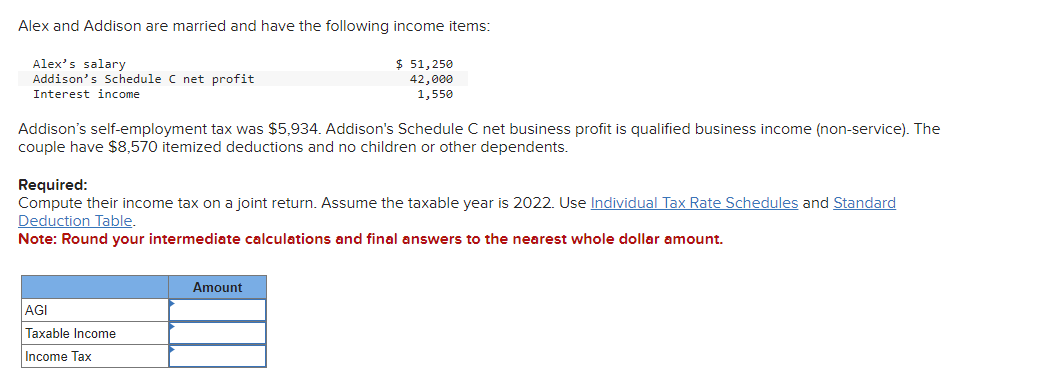

Alex and Addison are married and have the following income items: Addison's self-employment tax was $5,934. Addison's Schedule C net business profit is qualified business

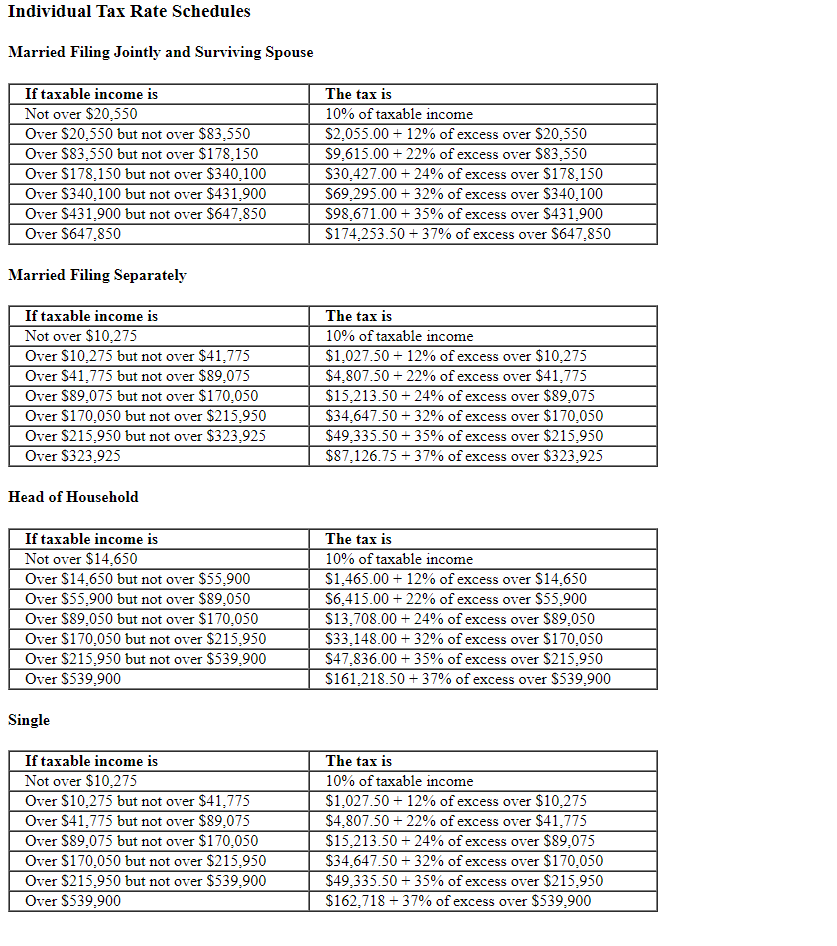

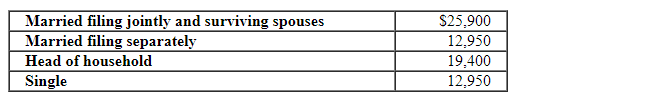

Alex and Addison are married and have the following income items: Addison's self-employment tax was $5,934. Addison's Schedule C net business profit is qualified business income (non-service). The couple have $8,570 itemized deductions and no children or other dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022 . Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules \begin{tabular}{|l|c|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular} Alex and Addison are married and have the following income items: Addison's self-employment tax was $5,934. Addison's Schedule C net business profit is qualified business income (non-service). The couple have $8,570 itemized deductions and no children or other dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022 . Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules \begin{tabular}{|l|c|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular}

Alex and Addison are married and have the following income items: Addison's self-employment tax was $5,934. Addison's Schedule C net business profit is qualified business income (non-service). The couple have $8,570 itemized deductions and no children or other dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022 . Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules \begin{tabular}{|l|c|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular} Alex and Addison are married and have the following income items: Addison's self-employment tax was $5,934. Addison's Schedule C net business profit is qualified business income (non-service). The couple have $8,570 itemized deductions and no children or other dependents. Required: Compute their income tax on a joint return. Assume the taxable year is 2022 . Use Individual Tax Rate Schedules and Standard Deduction Table. Note: Round your intermediate calculations and final answers to the nearest whole dollar amount. Individual Tax Rate Schedules \begin{tabular}{|l|c|} \hline Married filing jointly and surviving spouses & $25,900 \\ \hline Married filing separately & 12,950 \\ \hline Head of household & 19,400 \\ \hline Single & 12,950 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started