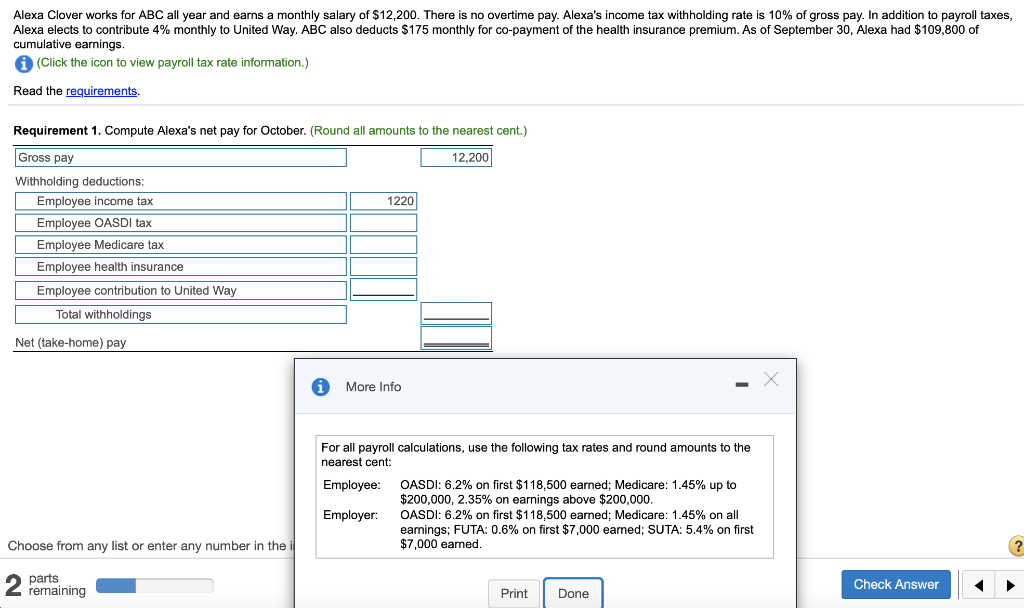

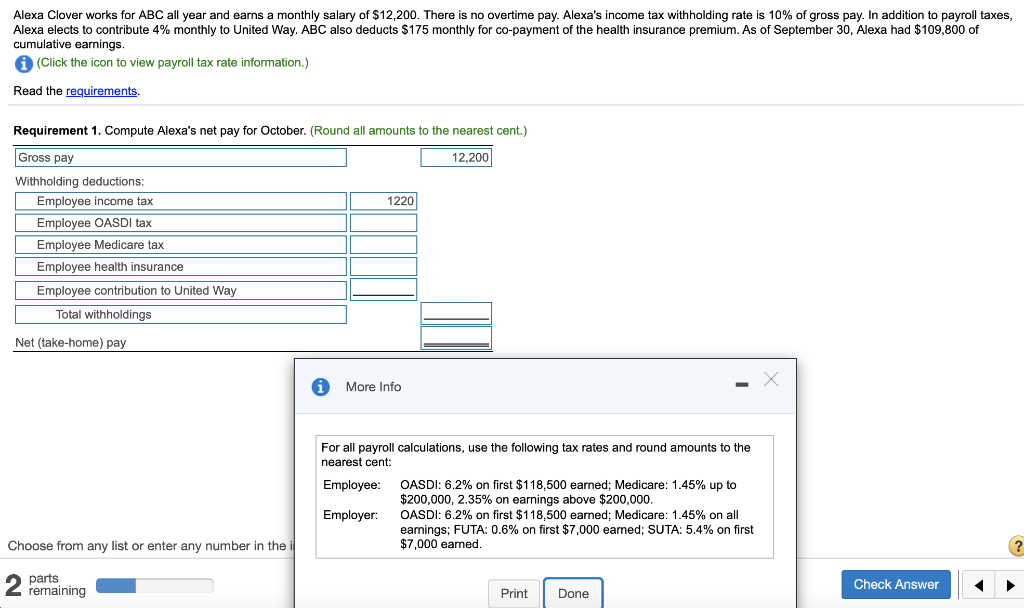

Alexa Clover works for ABC all year and earns a monthly salary of $12,200. There is no overtime pay. Alexa's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Alexa elects to contribute 4% monthly to United Way. ABC also deducts $175 monthly for co-payment of the health insurance premium. As of September 30, Alexa had $109,800 of cumulative earnings. (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Compute Alexa's net pay for October. (Round all amounts to the nearest cent.) 12,200 1220 Gross pay Withholding deductions: Employee income tax Employee OASDI tax Employee Medicare tax Employee health insurance Employee contribution to United Way Total withholdings Net (take-home) pay More Info For all payroll calculations, use the following tax rates and round amounts to the neare: cent: Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 eamed; SUTA: 5.4% on first $7,000 earned Choose from any list or enter any number in the i ? 2 parts remaining Check Answer Done 1 Print Done Alexa Clover works for ABC all year and earns a monthly salary of $12,200. There is no overtime pay. Alexa's income tax withholding rate is 10% of gross pay. In addition to payroll taxes, Alexa elects to contribute 4% monthly to United Way. ABC also deducts $175 monthly for co-payment of the health insurance premium. As of September 30, Alexa had $109,800 of cumulative earnings. (Click the icon to view payroll tax rate information.) Read the requirements. Requirement 1. Compute Alexa's net pay for October. (Round all amounts to the nearest cent.) 12,200 1220 Gross pay Withholding deductions: Employee income tax Employee OASDI tax Employee Medicare tax Employee health insurance Employee contribution to United Way Total withholdings Net (take-home) pay More Info For all payroll calculations, use the following tax rates and round amounts to the neare: cent: Employee: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% up to $200,000, 2.35% on earnings above $200,000. Employer: OASDI: 6.2% on first $118,500 earned; Medicare: 1.45% on all earnings; FUTA: 0.6% on first $7,000 eamed; SUTA: 5.4% on first $7,000 earned Choose from any list or enter any number in the i ? 2 parts remaining Check Answer Done 1 Print Done