Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Ali depreciates his machinery at a rate of 20% p.a. on a reducing balance basis. He provides a full year's depreciation in the year

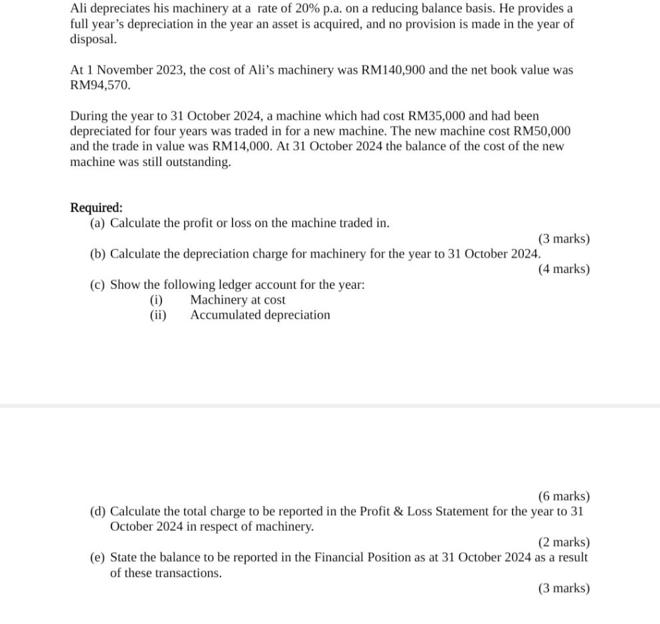

Ali depreciates his machinery at a rate of 20% p.a. on a reducing balance basis. He provides a full year's depreciation in the year an asset is acquired, and no provision is made in the year of disposal. At 1 November 2023, the cost of Ali's machinery was RM140,900 and the net book value was RM94,570. During the year to 31 October 2024, a machine which had cost RM35,000 and had been depreciated for four years was traded in for a new machine. The new machine cost RM50,000 and the trade in value was RM14,000. At 31 October 2024 the balance of the cost of the new machine was still outstanding. Required: (a) Calculate the profit or loss on the machine traded in. (b) Calculate the depreciation charge for machinery for the year to 31 October 2024. (c) Show the following ledger account for the year: Machinery at cost Accumulated depreciation (3 marks) (4 marks) (i) (ii) (6 marks) (d) Calculate the total charge to be reported in the Profit & Loss Statement for the year to 31 October 2024 in respect of machinery. (2 marks) (e) State the balance to be reported in the Financial Position as at 31 October 2024 as a result of these transactions. (3 marks)

Step by Step Solution

★★★★★

3.46 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started