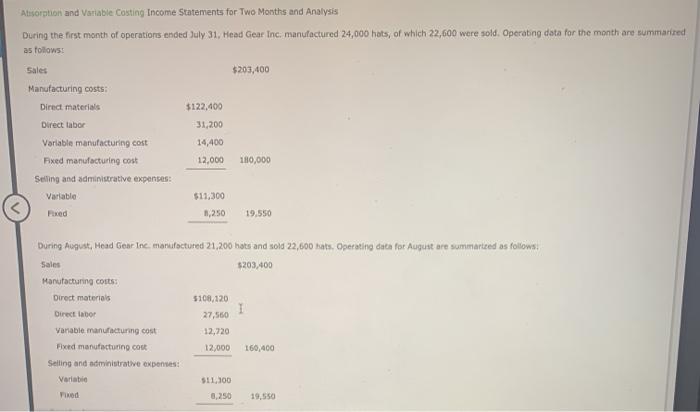

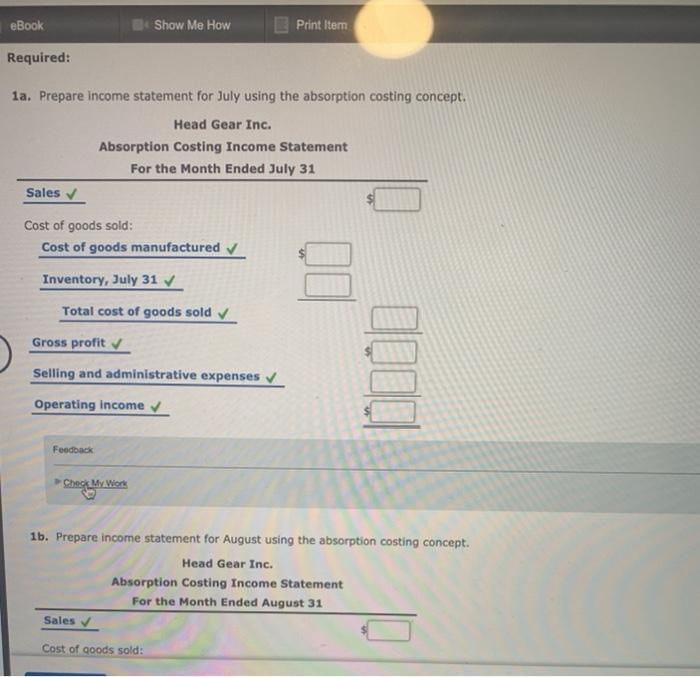

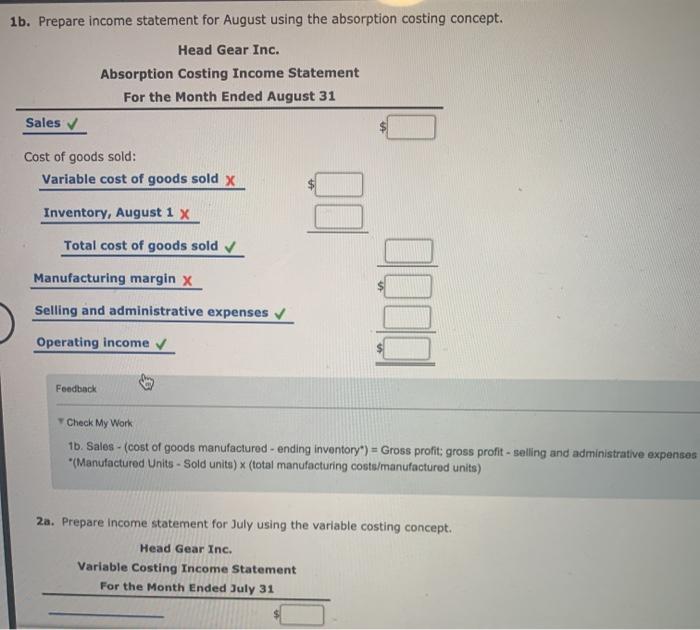

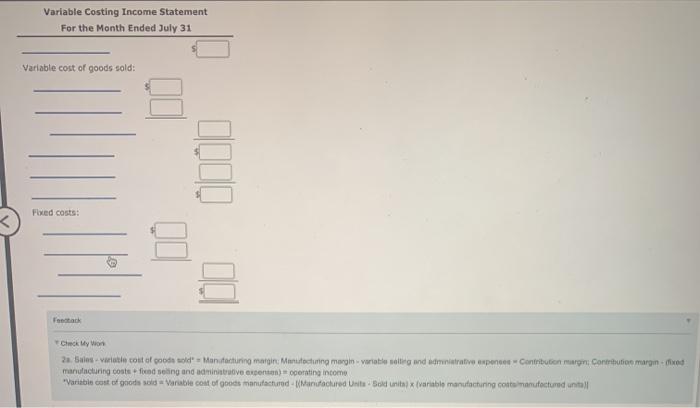

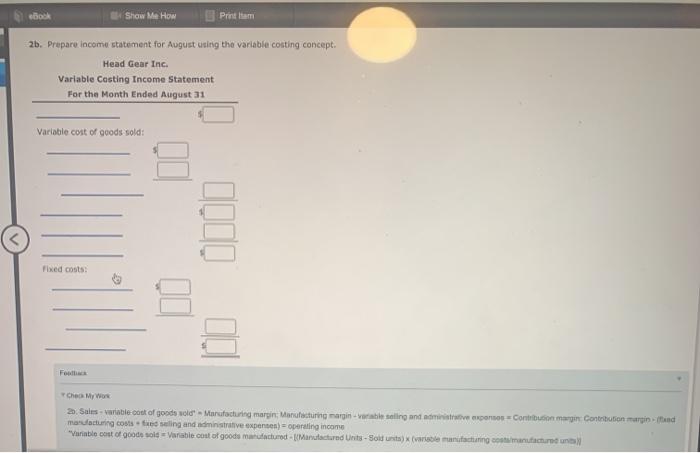

Alisorption and Variable Costing Income Statements for Two Months and Analysis During the first month of operations ended July 31, Head Gear Inc, manufactured 24,000 hats, of which 22,600 were sold. Operating data for the month are summarired as follows: $203,400 $122,400 31,200 Sales Manufacturing costs: Direct materials Direct labor Variable manufacturing cost Fixed manufacturing cost Selling and administrative expenses: Variable 14,400 12,000 180,000 $11,300 1,250 Fixed 19.550 During August, Head Gear Tec mariloctured 21,200 hots and sold 22,600 hats. Operating data for August are summarteed as follows Sales 5203,400 Manufacturing costs Direct materials Direct labor Vanable manufacturing cost Find manufacturing cost Selling and administrative expenses Variable 5108,120 27,560 12,720 1 12,000 160,400 511,300 Fixed 0,250 19.550 eBook Show Me How Print Item Required: 1a. Prepare income statement for July using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended July 31 Sales Cost of goods sold: Cost of goods manufactured Inventory, July 31 Total cost of goods sold Gross profit Selling and administrative expenses Operating income Feedback Check My Wor 1b. Prepare income statement for August using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales Cost of goods sold: 1b. Prepare income statement for August using the absorption costing concept. Head Gear Inc. Absorption Costing Income Statement For the Month Ended August 31 Sales Cost of goods sold: Variable cost of goods sold x Inventory, August 1 x Total cost of goods sold Manufacturing margin x Selling and administrative expenses Operating income Feedback Check My Work 16. Sales - (cost of goods manufactured - ending inventory") = Gross profit; gross profit - selling and administrative expenses "(Manufactured Units - Sold units) (total manufacturing costs/manufactured units) 2a. Prepare income statement for July using the variable costing concept. Head Gear Inc. Variable Costing Income Statement For the Month Ended July 31 Variable Costing Income Statement For the Month Ended July 31 Variable cost of goods sold: Fixed costs: DO Peach Check my w 2. Sains variatie cost of goods sold Man aturing margin: Manufacturing marginvariable selling and administrative expenses Contribution Contribution margin- manufacturing costs feeding and advent) cerating income Variable cost of goods sold Varble cost of goods manufactured - Manufactured UniteSed units x (variable manufacturing cost manufactured antall Show Me How Print bar 2b. Preparo income statement for August using the variable colting concept. Head Gear Inc. Variable Casting Income Statement For the Month Ended August 31 Variable cost of goods sold: Fixed costs HH MT 4 2. Sales variable cost of goods sold arufacturing margin: Manufacturing margin-variable selling and more contribution margin Contribution upin ind manufacturing costs sailing and administrative expennen) = operating income "Varmble cost of goods sold Variable cost of goods manufactured - Manufactured Units - Sold usta variable manufacturing manufactured