Answered step by step

Verified Expert Solution

Question

1 Approved Answer

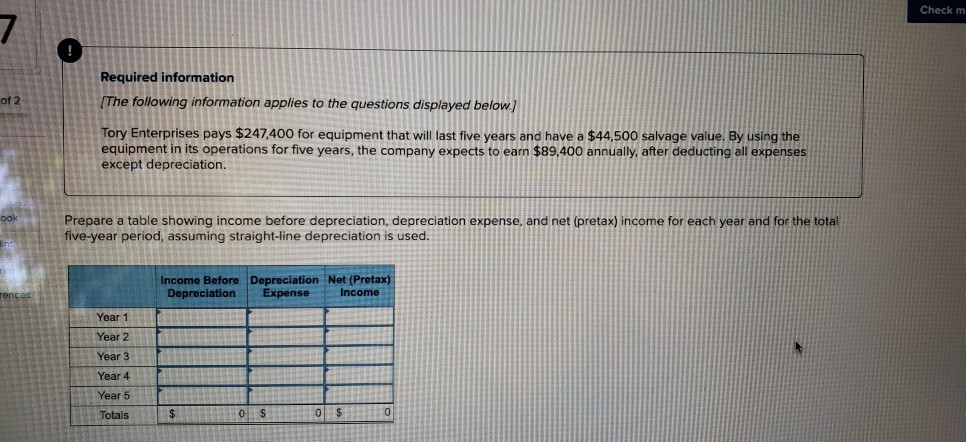

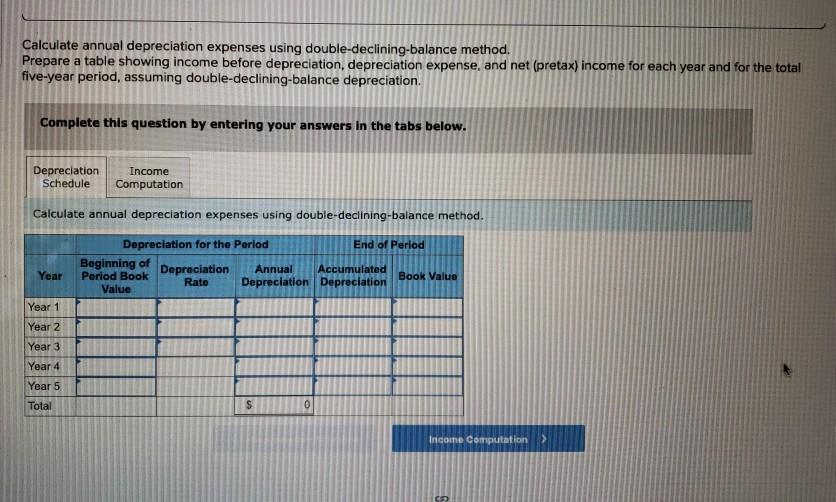

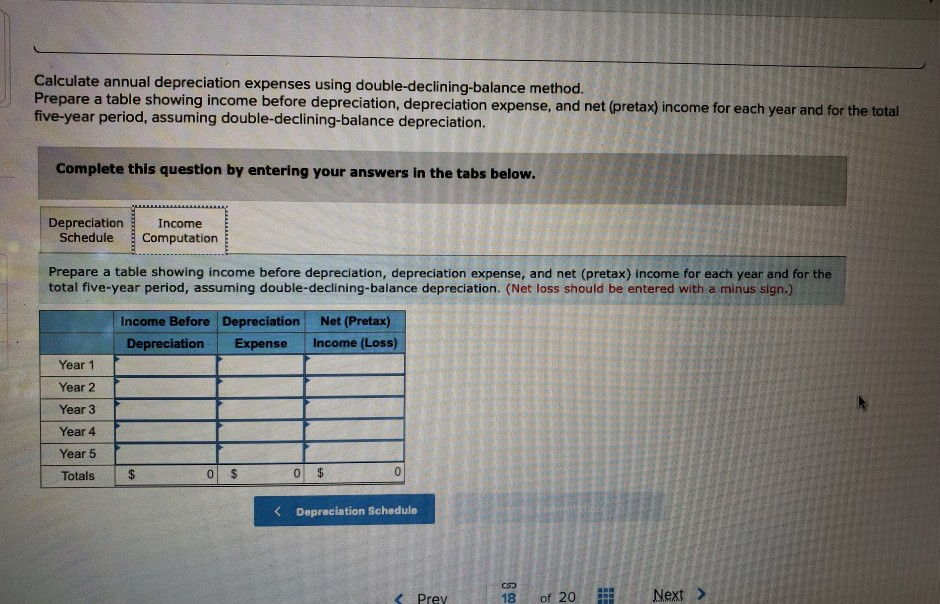

all 3 of these pictures go together. The first one shows the question to all 3. Check m 7 Required information (The following information applies

all 3 of these pictures go together. The first one shows the question to all 3.

Check m 7 Required information (The following information applies to the questions displayed below.) of 2 Tory Enterprises pays $247,400 for equipment that will last five years and have a $44,500 salvage value. By using the equipment in its operations for five years, the company expects to earn $89,400 annually, after deducting all expenses except depreciation. ook Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming straight-line depreciation is used. Income Before Depreciation Net (Pretax) Depreciation Expense Income rences Year 1 Year 2 Year 3 Year 4 Year 5 Totals $ 0 $ 0$ 0 Calculate annual depreciation expenses using double-declining-balance method. Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Depreciation Schedule Income Computation Calculate annual depreciation expenses using double-declining-balance method. Depreciation for the Period End of Period Beginning of Depreciation Annual Accumulated Period Book Book Value Rate Depreciation Depreciation Value Year Year 1 Year 2 Year 3 Year 4 Year 5 Total S 0 Income Computation > Calculate annual depreciation expenses using double-declining-balance method. Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-declining-balance depreciation. Complete this question by entering your answers in the tabs below. Depreciation Schedule Income Computation Prepare a table showing income before depreciation, depreciation expense, and net (pretax) income for each year and for the total five-year period, assuming double-declining-balance depreciation. (Net loss should be entered with a minus sign.) Income Before Depreciation Depreciation Expense Net (Pretax) Income (Loss) Year 1 Year 2 Year 3 Year 4 Year 5 Totals $ 0 0 $Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started