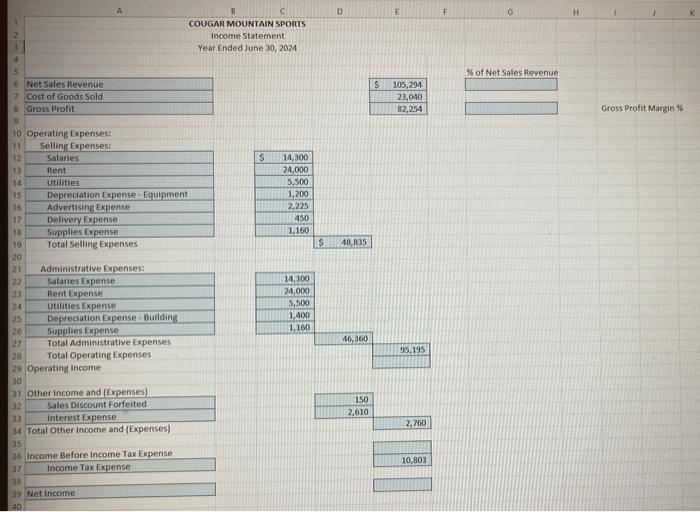

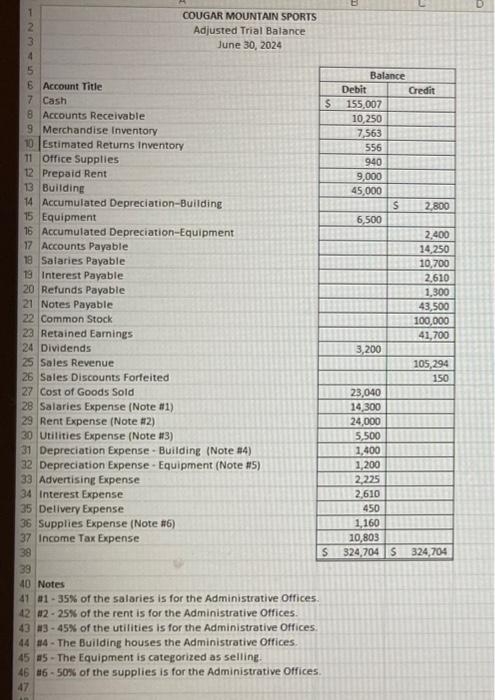

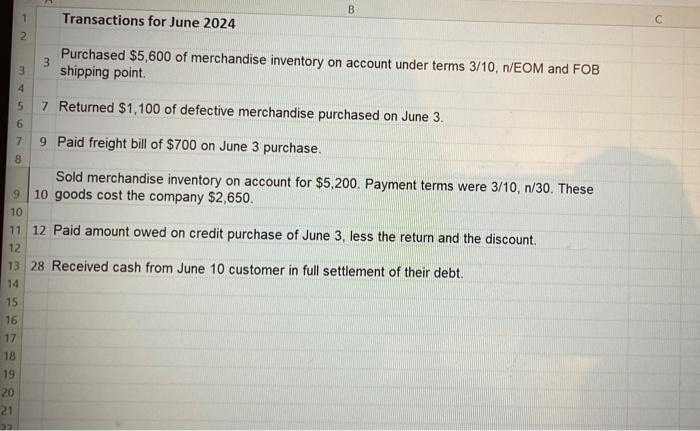

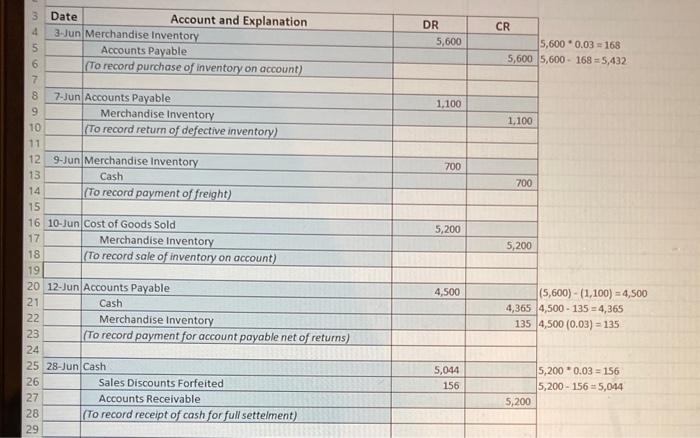

Wof Net Sales Revenue income Statement ear Ended Jane 30, 2024 to Operating Expenses: 11 Selling Expenses: \begin{tabular}{|l|l|} \hline 21 & Administrative Expenses: \\ \hline 27 & Salaries Expense \\ \hline 23 & Rent Expense \\ \hline 24 & Utilities Expense \\ \hline 26 & Depreciation Expense - Building \\ \hline 27 & 5upplies Expense \\ \hline & Total Adiministrative Expenses \\ \hline \end{tabular} Gross Profit Margin % Gross Prolit Margin % 27 Total Administrative Expenses 29 Operating income 30 31 Other income and (Expenses) 12 5ales Discount Forfeited 34 Total Other income and (Expenses) \begin{tabular}{|r|r|} \hline 150 & \\ \hline 2,610 & \\ \hline & 2,760 \\ \hline \end{tabular} 35 36 Income Before income Tax Experise 37 Income Tax Expense. 39 Net income Notes a1 - 35\% of the salaries is for the Administrative Offices. 122-25s of the rent is for the Administrative Offices. 133-45\% of the utilities is for the Administrative Offices. 184 - The Building houses the Administrative Offices. 185 - The Equipment is categorized as selling. 46 - 50 s. of the supplies is for the Administrative Offices. Purchased $5,600 of merchandise inventory on account under terms 3/10,n/EOM and FOB shipping point. 7 Returned $1,100 of defective merchandise purchased on June 3. 9 Paid freight bill of $700 on June 3 purchase. Sold merchandise inventory on account for $5,200. Payment terms were 3/10,n/30. These 10 goods cost the company $2,650. 12 Paid amount owed on credit purchase of June 3 , less the return and the discount. 28 Received cash from June 10 customer in full settlement of their debt. Wof Net Sales Revenue income Statement ear Ended Jane 30, 2024 to Operating Expenses: 11 Selling Expenses: \begin{tabular}{|l|l|} \hline 21 & Administrative Expenses: \\ \hline 27 & Salaries Expense \\ \hline 23 & Rent Expense \\ \hline 24 & Utilities Expense \\ \hline 26 & Depreciation Expense - Building \\ \hline 27 & 5upplies Expense \\ \hline & Total Adiministrative Expenses \\ \hline \end{tabular} Gross Profit Margin % Gross Prolit Margin % 27 Total Administrative Expenses 29 Operating income 30 31 Other income and (Expenses) 12 5ales Discount Forfeited 34 Total Other income and (Expenses) \begin{tabular}{|r|r|} \hline 150 & \\ \hline 2,610 & \\ \hline & 2,760 \\ \hline \end{tabular} 35 36 Income Before income Tax Experise 37 Income Tax Expense. 39 Net income Notes a1 - 35\% of the salaries is for the Administrative Offices. 122-25s of the rent is for the Administrative Offices. 133-45\% of the utilities is for the Administrative Offices. 184 - The Building houses the Administrative Offices. 185 - The Equipment is categorized as selling. 46 - 50 s. of the supplies is for the Administrative Offices. Purchased $5,600 of merchandise inventory on account under terms 3/10,n/EOM and FOB shipping point. 7 Returned $1,100 of defective merchandise purchased on June 3. 9 Paid freight bill of $700 on June 3 purchase. Sold merchandise inventory on account for $5,200. Payment terms were 3/10,n/30. These 10 goods cost the company $2,650. 12 Paid amount owed on credit purchase of June 3 , less the return and the discount. 28 Received cash from June 10 customer in full settlement of their debt